Vice President Kamala Harris has announced her running mate for the 2024 presidential election. Pennsylvania Governor Josh Shapiro lost out to Minnesota Governor Tim Walz among the front-runners.

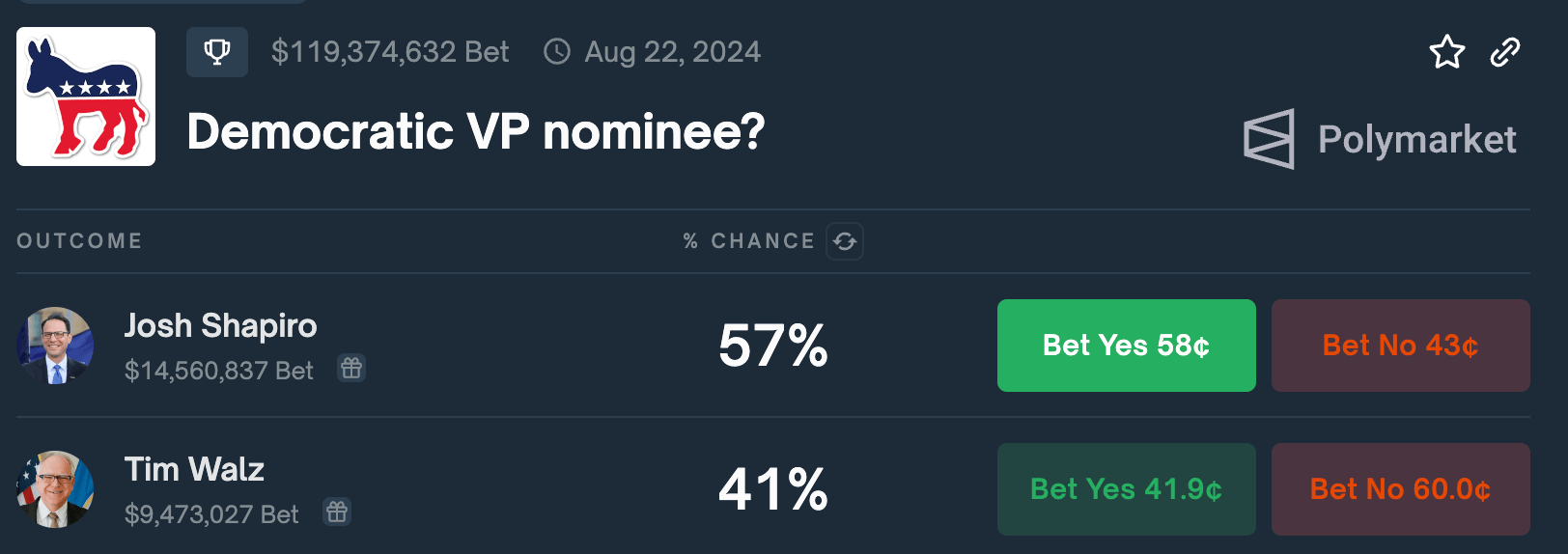

According to the earlier data, the crypto prediction market Polymarket had Shapiro ahead by 7%, with $119 million wagered. However, Walz came from behind to take the nomination. Given the lack of clear evidence of Harris’ position on crypto or Bitcoin, eyes were all on her VP pick to give an insight into her potential position.

Harris’s decision coincides with the start of her campaign tour across seven critical battleground states. Both Shapiro and Walz bring distinct political profiles to the table, each reflecting different priorities and approaches to crypto.

While neither candidate’s crypto position is listed on the Stand With Crypto database, Shapiro has demonstrated a supportive stance towards the Bitcoin mining industry, evidenced by substantial financial backing. Stronghold Digital Mining, a company involved in Bitcoin mining, received over $29 million in tax credits from the state over the last two years. This financial support illustrates Shapiro’s favorable position in the Bitcoin mining sector.

However, this support has not been without controversy. Stronghold Digital Mining, which operates the Panther Creek Electric Generating Facility, has faced lawsuits from environmental groups for alleged pollution. The facility has also been cited for numerous air quality violations, raising concerns among local residents and environmental advocates. Despite these issues, Shapiro’s administration backs the industry, showing resolve in backing Bitcoin.

In contrast, Governor Tim Walz of Minnesota has taken a more regulatory-focused approach to cryptocurrencies. Walz advocates for stricter regulations to ensure the financial system’s security and stability and protect consumers from potential fraud and abuse in the crypto market. His stance emphasizes the need for government oversight to maintain economic stability and ensure market transparency. Walz’s approach reflects a cautious and protective stance towards digital assets, prioritizing consumer protection and regulatory oversight over industry support.

Parts of the Democrat Party have been adversarial toward crypto. However, Shapiro has taken a notably different stance on digital assets than this group, including Senator Elizabeth Warren and SEC Chair Gary Gensler. Along with his support for Bitcoin mining, Shapiro’s regulatory changes in Pennsylvania have not aligned with the stringent anti-money laundering and consumer protection measures advocated by Warren and Gensler.

Senator Elizabeth Warren has been a vocal critic of cryptocurrencies, emphasizing the need for strong anti-money laundering protections and regulations to prevent illicit activities and protect consumers. Warren’s stance is highlighted by her advocacy for the Digital Asset Anti-Money Laundering Act, which aims to subject digital currencies to the same regulations as traditional financial transactions. SEC Chair Gary Gensler has similarly been aggressive in enforcing regulations on the crypto industry, viewing many cryptocurrencies as securities that need to comply with existing laws. Gensler has criticized the crypto sector for inadequate disclosures and noncompliance with securities laws.

In contrast to Shapiro, Walz’s stance aligns more closely with Warren and Gensler’s regulatory perspectives. Both Warren and Gensler prioritize regulatory measures to address the risks associated with the crypto market. Walz’s advocacy for government oversight to safeguard consumers is consistent with its focus on protecting investors and maintaining market integrity.

In summary, Tim Walz’s stance on cryptocurrencies aligns more closely with the outdated views of Senator Warren’s and SEC Chair Gary Gensler’s regulatory and consumer protection priorities. In contrast, Josh Shapiro’s support for the crypto mining industry and less stringent regulatory approach indicates a divergence from their positions.

As neither of the candidates is currently in the Senate or Congress, their investment holdings are not publicly available. However, estimates indicate that Shapiro is worth around $35 million, while Walz is said to have a net worth around $19 million. Shapiro’s wealth is mostly in cash and real estate, whereas Walz allegedly holds substantial US equities.

[Updated following VP announcement]