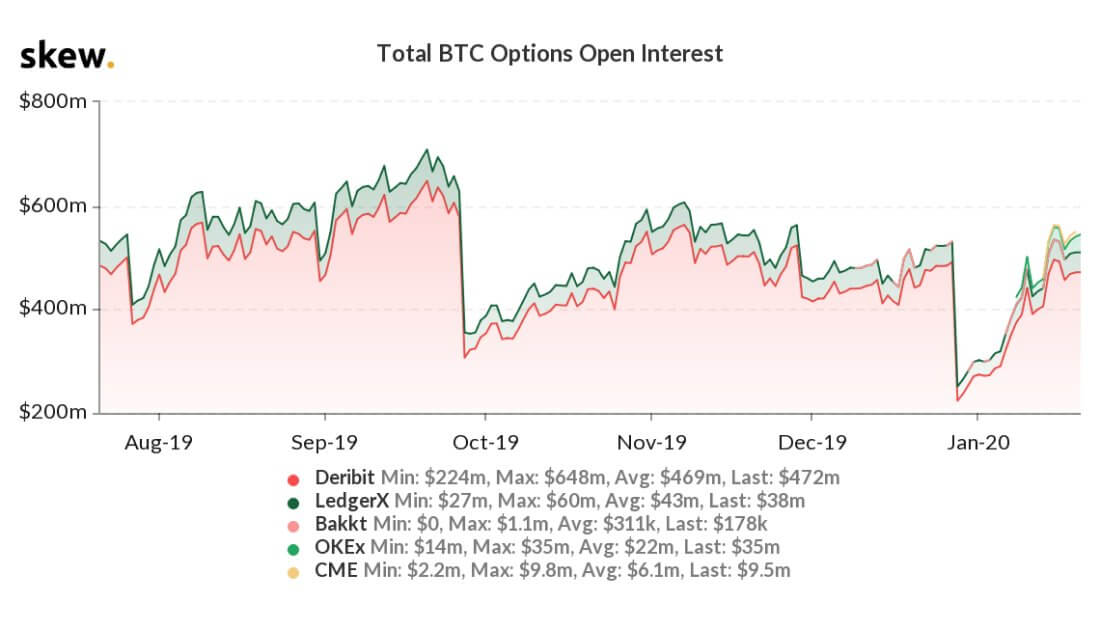

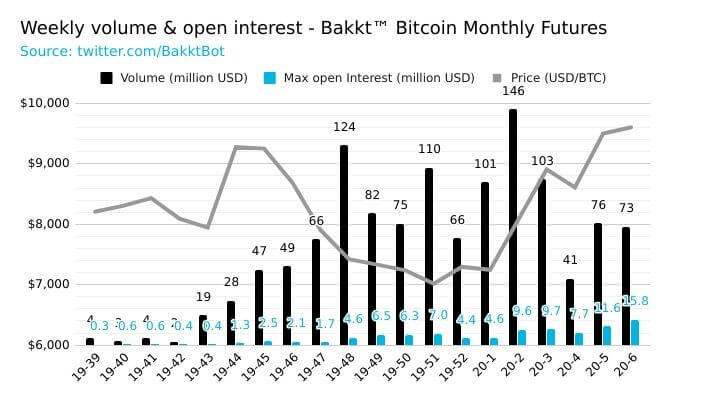

Despite its hype in the latter half of 2019, the performance of Bakkt has been lackluster to say the least. Compared to competitors in the bitcoin futures and options markets like CME Group and Deribit, it has seen substantially low numbers in the last several months.

Bakkt’s options market has particularly seen a significantly lower daily volume than Deribit, OKEx, CME, and LedgerX, falling behind its peers in both the U.S. and international markets.

Is there a lack of institutional interest in bitcoin, or is it only Bakkt?

Throughout January, despite the 50 percent upsurge of Bitcoin, the options volume of Bakkt was virtually non-existent. It stayed close to zero for an entire week, raising questions on the involvement of institutions in the rally.

However, given the high volume of Bakkt’s competitors, an argument can be made that Bakkt is simply not appealing to accredited investors and institutions in the market.

Su Zhu, the CEO of Three Arrows Capital, said that the largest shareholder of ICE asked about the low market share of Bakkt over the Bitcoin options and futures markets.

ICE, the parent company of the New York Stock Exchange, also operates Bakkt.

Zhu said:

“Had lunch with the largest shareholder of ICE last week. He asked why Bakkt isn’t gaining more market share vs Bitmex, Deribit, etc. I said: 1) over-reliant on clearing brokers 2) can’t margin in BTC 3) can’t trade 24/7 4) can’t trade infinitesimal sizes 5) 10x more expensive.”

For a good portion of 2019, Bakkt was one of the main narratives around the cryptocurrency market. It was often referred to as a key catalyst for the next upsurge of bitcoin as investors predicted it would serve as an important infrastructure for institutions.

Yet, Bakkt has struggled to meet the expectations of investors and has been unable to catch up to CME Group in the futures market in terms of volume.

Still nowhere enough

According to Bakkt Volume Bot, which tracks both the daily and weekly volume of the Bakkt bitcoin futures market, the company processed around $75 million worth of bitcoin futures contracts on a weekly basis in January and February.

In sharp contrast, CME has been processing around $500 million on a daily basis in the last two weeks, surpassing Bakkt with ease.

Given the high volume of CME and the consistent inflow of capital into platforms like Coinbase Custody and Grayscale Bitcoin Trust (GBTC), it would be premature to claim that there is a lack of institutional demand for bitcoin.

But, Bakkt is falling behind its fellow futures platforms and exchanges, which suggest that rather than the institutional demand for crypto being low, the issue may be exclusive to Bakkt.