The state of Bitcoin’s market structure has been incredibly unclear as of late. Despite currently being up 150 percent from its March lows, the cryptocurrency has been struggling to break into the five-figure price region.

These mixed signals have led there to be a clear divide between the sentiment amongst institutional investors and retail traders.

At the moment, BTC’s technical weakness appears to have led retail traders to generally hold a bearish sentiment, whereas institutions trading the benchmark crypto on the CME still remain bullish.

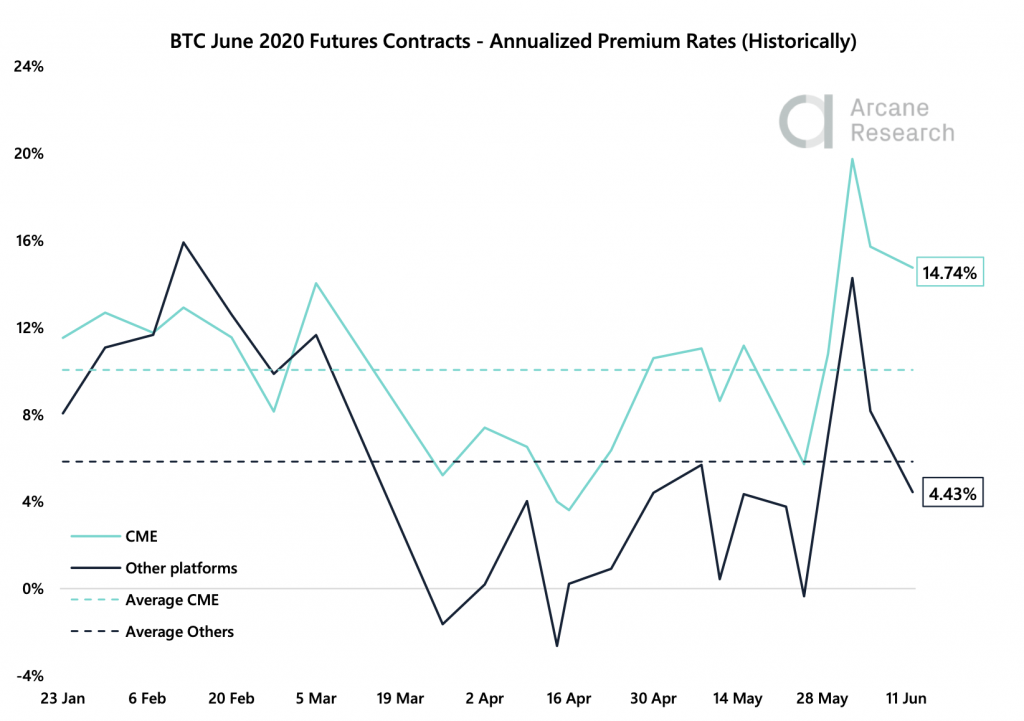

The futures premium seen on the CME shows that institutional bias still remains firmly bullish despite the price decline seen yesterday – a sign that they still view BTC has a hedge against the imminent inflation many currencies are likely to see in the near future.

Institutions remain more bullish on Bitcoin than retail investors

Ever since Bitcoin plummeted on March 12th, the entire crypto market has seen a massive inflow of institutional activity.

The crypto’s recovery from these lows far outpaced that seen by the stock market – drawing a spotlight to BTC and rekindling the narratives regarding it being a safe haven asset.

According to a recent survey conducted by Fidelity Investments, roughly one third of big-name institutions in the US and Europe have long exposure to either Bitcoin or Ethereum.

This data elucidates that Bitcoin is rapidly shifting away from being a purely retail-driven market.

Fidelity Digital Assets President Tom Jessop spoke about the result of this survey, saying:

“These results confirm a trend we are seeing in the market towards greater interest in and acceptance of digital assets as a new investable asset class.”

Institutions’ bullish outlook on BTC is also illuminated by the premium seen while looking towards the crypto’s CME futures.

Arcane Research spoke about this in a recent report, pointing to a chart showing just how clear this premium is.

“After a strong rise in BTC futures premium rates over the last couple of weeks, we got a pullback this week… Traders on retail-focused are still less bullish than CME traders, and in now back below the average level since January.”

Here are the motives driving the divide between these two group’s sentiments

The motive of these two investor groups is likely the primary factor driving this divide.

Many institutional traders have been drawn to Bitcoin by its potential to be a hedge against the inflation caused by global money printing.

Retail investors, on the other hand, may be more focused on the cryptocurrency from a technical perspective – with their sentiment being guided by how it responds to the key support and resistance levels it is currently trading around.

Because BTC has faced multiple harsh rejections at $10,000, this may be the primary factor behind them being less bullish than institutional traders are.