Bitcoin has been moving to break its tight correlation with the traditional markets seen throughout the past few months.

Although on shorter time frames it does appear to have fully decoupled from traditional assets like equities, it is important to note that BTC’s “V-shaped” recovery from its March lows is strikingly similar to that seen by the S&P 500 and other benchmark indices.

Data does show, however, that BTC’s decoupling from traditional assets started gaining some major momentum throughout the month of May.

This could backfire on the crypto’s buyers in the near-term, as analysts believe that the stock market is now entering another full-fledged bull trend.

Data: Bitcoin largely breaking its correlation with traditional assets

According to a newly released research report from cryptocurrency exchange Kraken, Bitcoin’s correlation with the traditional markets saw accelerated rates of decline throughout the month of May.

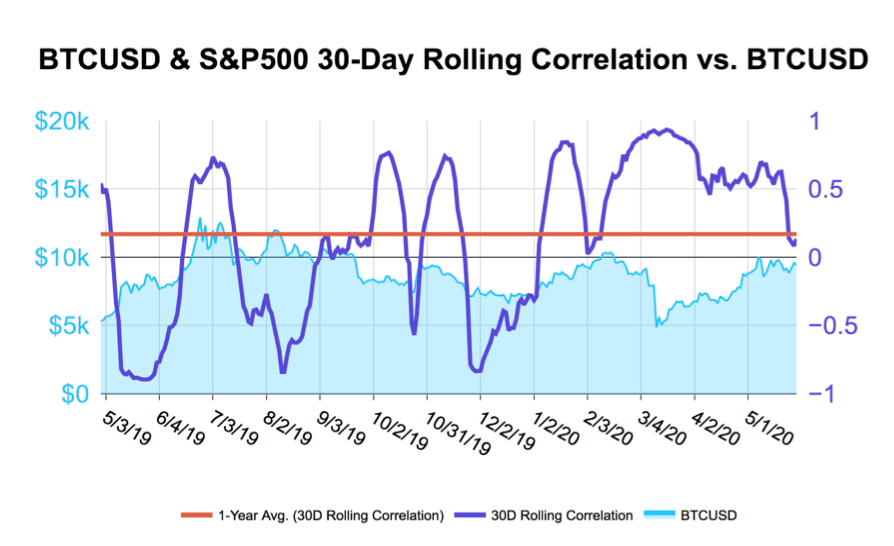

While looking towards BTC’s 30-day rolling correlation with the S&P 500, Kraken notes that it fell to its lowest levels seen since February in late-May.

“Since soaring to a 1-year high of 0.93 on March 18, bitcoin’s rolling 30- day correlation with the S&P500 continued falling through May. In late-May, the correlation fell to its lowest level since February 5th (0.08) before finishing the month below its 1-year average of 0.17 at 0.13.”

They also explain that a similar trend can be seen while looking towards Bitcoin’s correlation with gold, which has also shown signs of degrading after recently setting a 9-month high.

Kraken does note that they still anticipate Bitcoin to be exposed to any of the traditional market’s downside, with another downtrend potentially proving to be grave for the benchmark cryptocurrency.

“We believe that if traditional markets fail to hold their ground, correlations among all assets, including bitcoin, will rise as markets fall back into bear market territory.”

Here’s why this trend could hurt BTC’s bull case

This decoupling could ultimately damage Bitcoin, as it may stop it from catching all of the potential short-term upside seen by the stock market in the days and weeks ahead.

The stock market’s intense rebound from its recent lows has sent many equities up to fresh all-time highs, with this move being driven by hopes regarding a sharp economic recovery as many states begin easing their pandemic-related lockdown restrictions.

Per a recent report from MarketWatch, BTIG strategist Julian Emanuel stated that the “cyclical rip” seen by the stock market since late-March has made it safe to say that equities have entered a new bull market.

“The cyclical rip since Mar. 23 has been so conclusive as to say that stocks are in a new bull market,” he noted.

If Bitcoin is not able to recapture its correlation with the stock market as it enters a new bull cycle, it may underperform equities in the weeks and months ahead.