The crypto market has been caught in the throes of a firm uptrend in the time following the capitulatory downtrend seen in mid-March that erased virtually all the gains incurred throughout the early part of the year.

The rebound from these lows, however, has allowed most major cryptos to recapture some of the gains from January and February, with Bitcoin climbing back up towards $8,000 as Ethereum fast approaches $200.

There are several fundamental factors that suggest market participants are preparing for the market to see some serious near-term downside. One analyst is noting that from a contrarian perspective, this could be a super bullish sign.

Crypto market participants gear up for near-term downside

Today has been a rather boring day for the nascent market, as Bitcoin and most other cryptocurrencies are currently trading up or down marginally as investors patiently await a trend-defining movement.

This lackluster price action today comes close on the heels of a volatile weekend that led Bitcoin to post multiple firm rejections at $7,800 – a level that bulls are once again retesting.

How the benchmark crypto responds to this level could be the event that sparks the next market-wide trend.

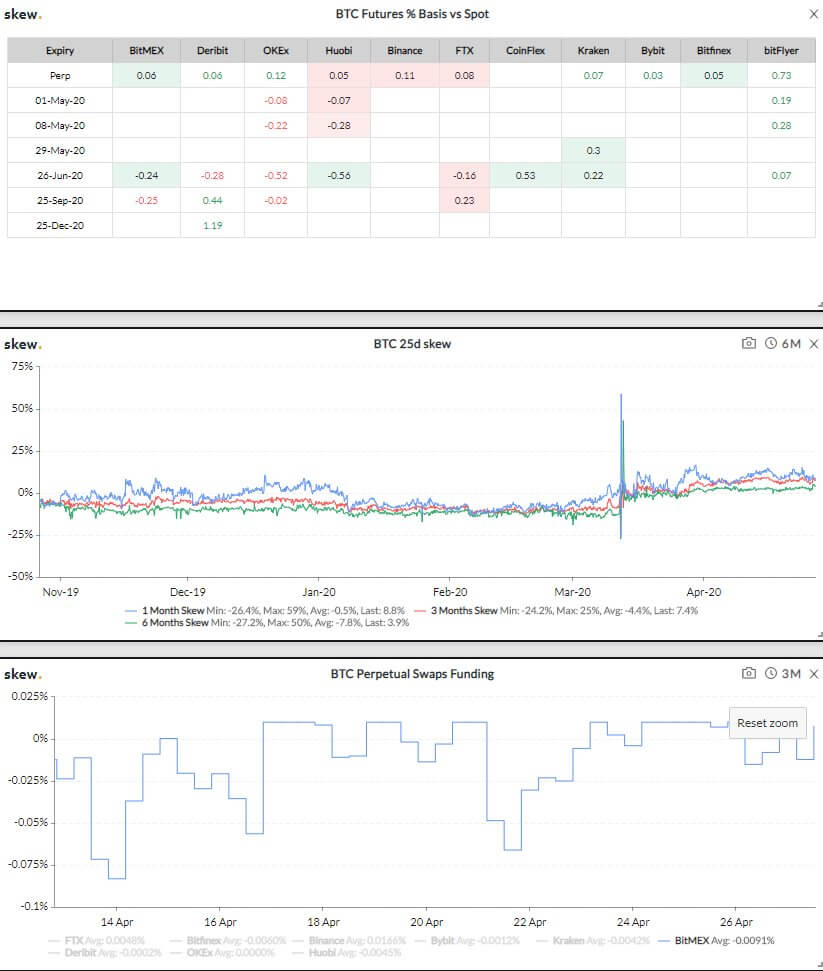

Data seems to suggest that traders are anticipating a bearish resolution to this ongoing consolidation within the upper-$7,000 region, as both skew and futures are in backwardation – meaning that the current spot price of BTC is higher than its future’s price.

Popular cryptocurrency trader and analyst Cantering Clark broke down what this data means for the crypto, explaining that it suggests traders are expecting downside.

“I am all for a healthy correction eventually, but you cannot trade on that. Right now it seems that in the long and short term the market is positioning for more downside. Skew and Futs term structure in backwardation. Is the market ever this right in advance? No.”

Contrarian perspective coupled with low implied volume could mean upside is imminent

The contrarian perspective offered by Clark is underpinned by the notion that the markets will not reward the majority of participants.

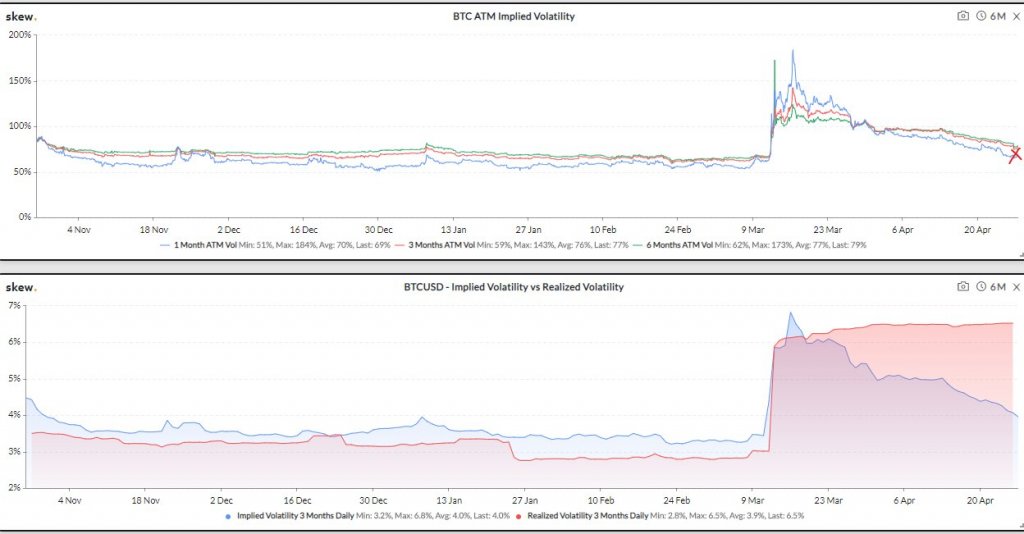

There are some technical occurrences that also support the idea that upside is imminent, including rapidly declining implied volume.

Clark also spoke about this in a tweet, concluding that the difference between the crypto’s implied volume and realized volume signals that now could be a good time to buy.

“Now might be one of the better times to buy vol considering how low ATM iv is, especially when compared to realized vol,” he noted.

If these factors do push Bitcoin past $7,800, the entire crypto market will likely follow suit and see some notable near-term upside.