The biggest news in the cryptoverse for Dec. 9 includes a Twitter sparring between Binance CEO Changpeng Zhao and former FTX CEO Sam Bankman-Fried, and Hut8, Riot, and Marathon are emerging as the only public miners that increased their BTC holdings in November.

CryptoSlate Top Stories

The Artificial Intelligence (AI) cryptocurrency sector grew 12.3% over the last 24 hours, making it the second biggest gaining sector after cannabis.

Notable top 10 AI cryptocurrency performers were Cortex, which develops machine learning models on blockchain, up 93.7%, and Fetch, which leverages AI and automation for dApp and peer-to-peer applications, gaining 33.7%.

The drama surrounding FTX and Binance continues to unfold as new text messages emerge that show what went on behind the scenes as the exchange crumbled.

The New York Times obtained text messages from a group chat with Sam Bankman-Fried, Changpeng Zhao, and various other cryptocurrency executives that were exchanged on Nov. 10 — the day before FTX filed for bankruptcy.

The series of around a dozen texts showed that all crypto executives feared the situation could worsen. Moreover, the worried exchanges reportedly became increasingly tense as CZ accused SBF of trying to manipulate the price of Tether (USDT).

In the texts, CZ said that SBF used Alameda Research to depeg the stablecoin. Binance’s CEO pointed out a $250,000 trade and said Alameda specifically placed it to destabilize USDT.

Sam Bankman-Fried (SBF) has spoken out following Binance founder Changpeng Zhao’s (CZ) public thread referring to Kevin O’Leary’s defense of FTX and referring to SBF as “a fraudster.”

The feud continued following CZ’s recent allegations that CZ accused SBF of trying to depeg USDT through Alameda.

CZ alleged that SBF “launched a series of offensive tirades at multiple Binance team members” in his Twitter thread.

In rebuttal, SBF announced that CZ had “won” and alleged that CZ had lied regarding the details surrounding Binance’s buyout of FTX.

FTX former CEO Sam Bankman-Fried supports restarting the bankrupt exchange by issuing new FTT tokens to creditors and giving 100% profits to token holders.

Crypto Trader host Ran Neuner first proposed the idea on Dec. 9, adding that it would make the new exchange the “biggest exchange in the world.”

In response, SBF tweeted that he thinks “that this would be a productive path for parties to explore.”

Research Highlight

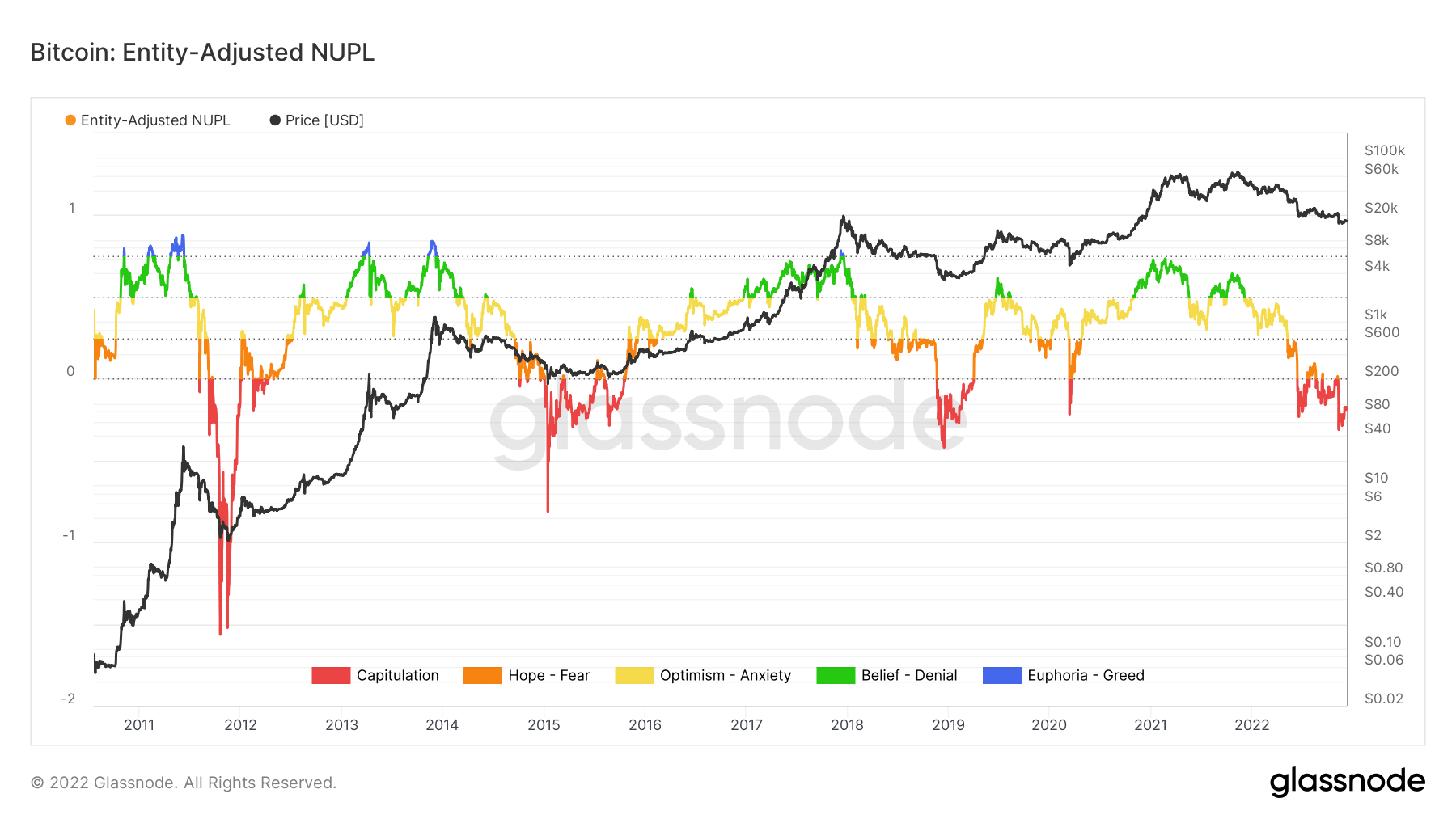

Since June, Bitcoin (BTC) – and the general market subsequently – has been in capitulation, other than a handful of rallies seen in the summer of this ongoing bear market, according to on-chain data provided by Glassnode and analyzed by CryptoSlate.

Both bull and bear markets reveal on-chain sentiment data, ranging from ‘Capitulation’ to ‘Euphoria – Greed. In the height of a bull market, the top is historically indicated when Euphoria grips tightly. On the other hand, capitulation usually signals the bottom.

The chart below shows that BTC has firmly sunk into the Capitulation sentiment as the Net Unrealized Profit/Loss (NUPL) on-chain data displays a descent into red territory seen previously only in 2012, 2015, and 2019.

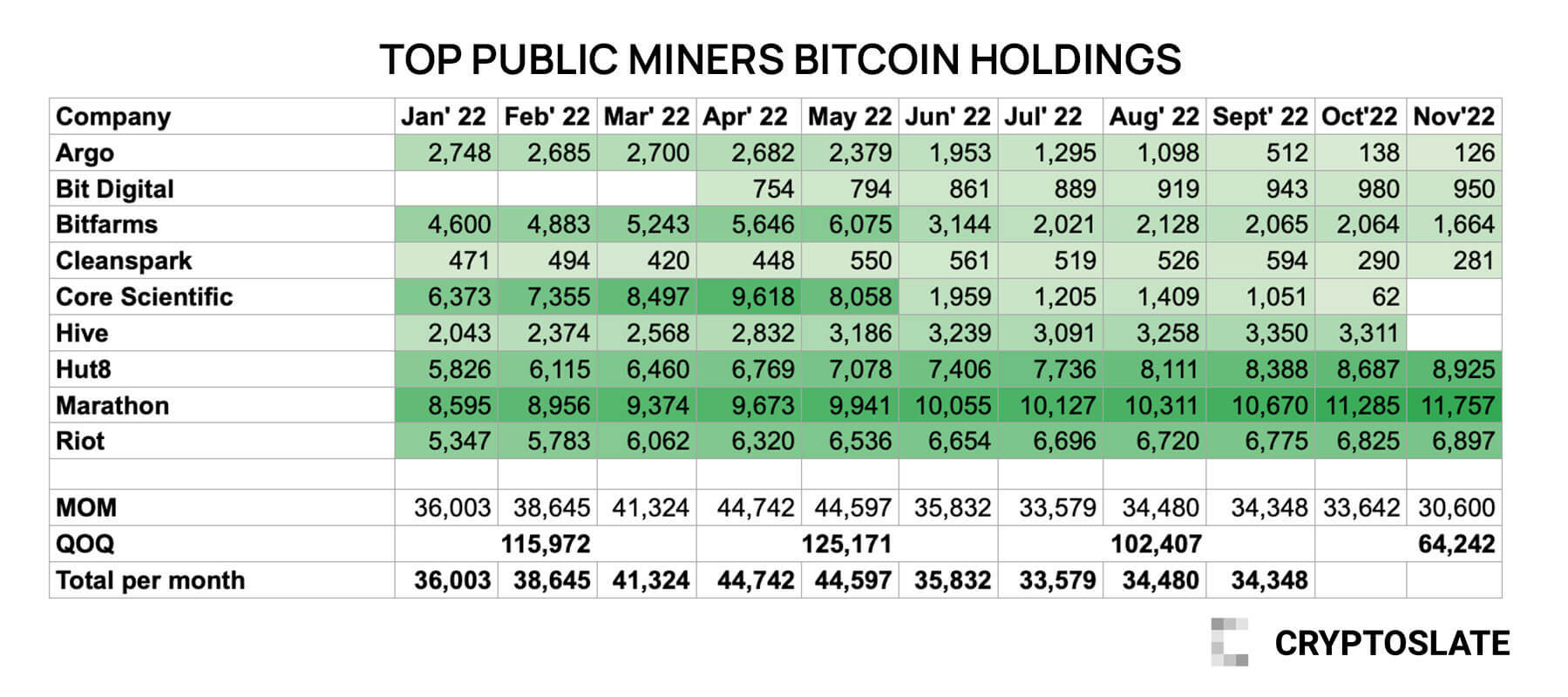

Mining companies have been releasing their November production rates throughout the week. CryptoSlate analysts brought the numbers together and revealed that Hut8, Riot, and Marathon are the only ones who increased their BTC holdings in November.

The chart above includes the top nine BTC miners’ monthly reserves starting from January 2022. The numbers show that Hut 8, Riot, and Marathon added 238, 472, and 72 BTC to their reserves in November, respectively.

On the other hand, Argo, Bit Digital, Bitfarms, and Cleanspark shrank by losing 12, 30, 400, and 9 BTC in the same month.

Crypto Market

In the last 24 hours, Bitcoin (BTC) increased by 0.75% to trade at $17,147.91, while Ethereum (ETH) increased by 1.16% to trade at $1,270.72.

Biggest Gainers (24h)

- Mass Vehicle Ledger (MVL): +30.26%

- Ampleforth (AMPL): +26.01%

- Fetch (FET): +21.52%

Biggest Losers (24h)

- Radix (XRD): -10.64%

- Neutrino USD (USDN): -7.14%

- Celsius (CEL): -6.73%