Brendan Blumer, one of the executives behind EOS, criticized Bitcoin’s slow transaction times, low transactions per second, and high costs per transaction (when inflation is considered).

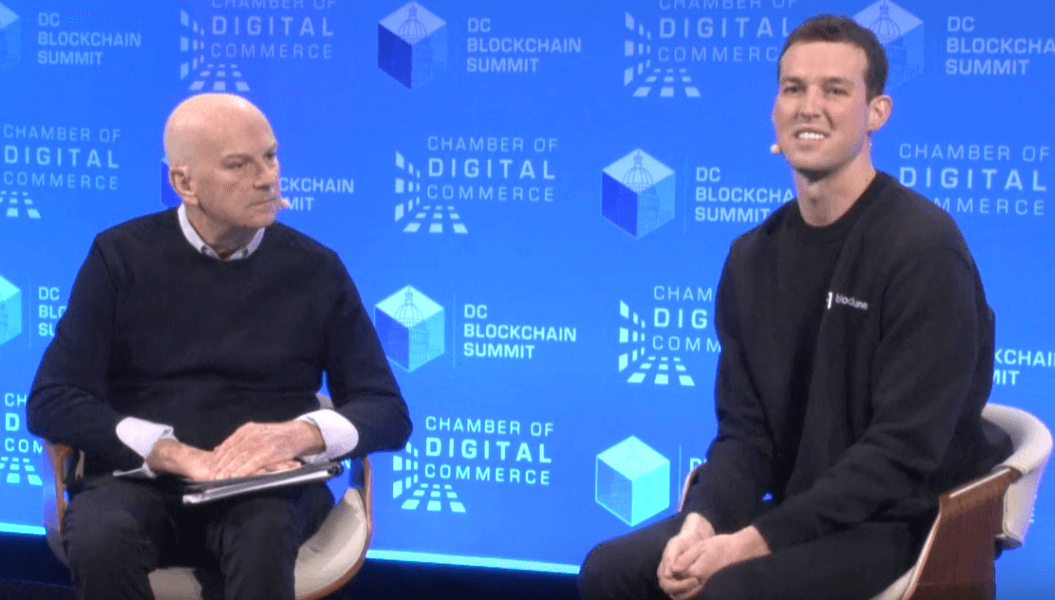

Brendan Blumer, the 32-year-old CEO of Block.one—a Cayman Islands-registered firm that developed EOS, one of the largest platforms for building and deploying decentralized applications (dApps)—called Bitcoin “fundamentally transformative” in terms of how financial transactions between two parties will be processed in the world’s future economy, while at the same time scrutinizing it for its limitations.

Bitcoin’s Limitations

According to Blumer, transacting in bitcoin is expensive if annual inflation from block rewards is considered. On average, the crypto entrepreneur estimated that users are paying an extra $50-$100 per transaction. Furthermore, he asserts the Bitcoin network is constrained because it can only process about 3 transactions per second (TPS). These factors represent “huge scaling limitations,” said Blumer.

In response to Blumer’s comments, which came last month during the 4th annual DC Blockchain Summit (held on Mar. 6th-7th, 2019), Twitter user vake (@vakeraj) emphasized the importance of having “technically knowledgeable interviewers.” The user also accused Blumer of “spewing lie after lie” in order to indirectly promote EOS, which vake considers to be a scam.

Let me say that this is why it’s important to have technically knowledgeable interviewers. This moderator provided no pushback as Brendan spewed lie after lie in service of his scam, EOS.

The Chamber of Digital Commerce is a joke of an organization.

— Vake (@vakeraj) April 6, 2019

Optimized For Different Use Cases

Responding to the statements made by vake, Blumer clarified that he loves Bitcoin, however that’s not going to help it become “fast or cheap.” Notably, Blumer believes that in the long-term Bitcoin has what it takes to succeed in terms of achieving mass adoption:

I love #Bitcoin too, but that won’t make it fast or cheap

Bitcoin has everything it needs to succeed, and I think in time it will become the largest store of value in the world#EOS isn’t designed to compete with Bitcoin, it’s optimized for different use cases

— Brendan Blumer (@BrendanBlumer) April 7, 2019

He added that EOS was not designed to directly compete with Bitcoin as both cryptocurrency networks have been “optimized for different use cases.”