Bitcoin (BTC) miner Bitfarms sold 414 BTC, representing 90.19%, of its mined 459 BTC in May, according to a June 1 statement.

According to the statement, the miner generated $11.3 million from the sold assets, reducing its debt by $1.8 million, leaving a balance of $17.4 million as of May 31.

BTC production

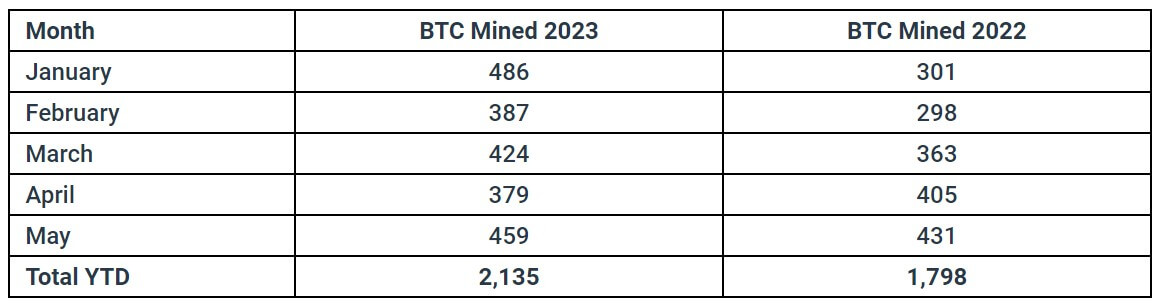

When Bitfarms BTC production is viewed on the month-on-month metrics, its production rose 21% from the 379 BTC recorded in April.

On the year-to-date metric, its Bitcoin production stands at 2,135 BTC, representing an 18.74% increase from the 1798 BTC recorded during the same period last year.

Speaking on the increased production, Ben Gagnon, the chief mining officer of the firm, pointed out that the increased production was “largely due to a temporary spike in BTC transaction fees.”

In May, CryptoSlate reported that Bitcoin network recorded a sharp spike in transaction fees thanks to the introduction of the Ordinals Protocol.

Additionally, Bitfarms added 45 BTC to its treasury in May— bringing its total to 510 BTC, worth $13.8 million.

The miner noted that its energy curtailment activity in Quebec fully subsided during the previous month.

Delivery of 2900 mining machines

The BTC mining company further revealed that it took delivery of 2900 mining machines in Argentina. The miner said the machines were part of the 6200 machines ordered in April, and the remaining 3300 machines would be delivered and installed in June.

Bitfarms CEO Geoff Morphy said the machine deliveries aided the company’s organic growth target of 6.0 EH/s from the end of Q4 2023 to the end of Q3 2023. Morphy added:

“We are focused on organic and other growth opportunities that bring value and accretive cash flow to us ahead of the Halving expected in April 2024.”

Following news of its improved production and plans for further growth, Bitfarms’ BITF stock is up 0.30% to $1.20 as of press time, according to Google Finance data.