MicroStrategy’s Bitcoin (BTC) investment is now in the green, boasting over $110 million in unrealized profits after the flagship asset jumped above $30,000 earlier today, according to CryptoSlate’s data.

Saylortracker, a dedicated platform for monitoring MicroStrategy’s BTC holdings, confirms that BTC’s current value surpasses the firm’s average purchase price.

Data from the website shows that MicroStrategy had acquired its 158,245 Bitcoin bag at an aggregate purchase price of $4.83 billion and an average of $29,870.14 per coin.

With the top cryptocurrency trading for $30,493 as of press time, the company is profiting more than $600 on each BTC as its holdings are now worth $4.84 billion.

Over the years, MicroStrategy has consistently expanded its holdings, with its most recent purchase being the acquisition of 5,455 units between Aug. 1 and Sept. 24. The company holds 14 times more BTC than the closest public company, Marathon Digital, according to data from Bitcoin Treasuries.

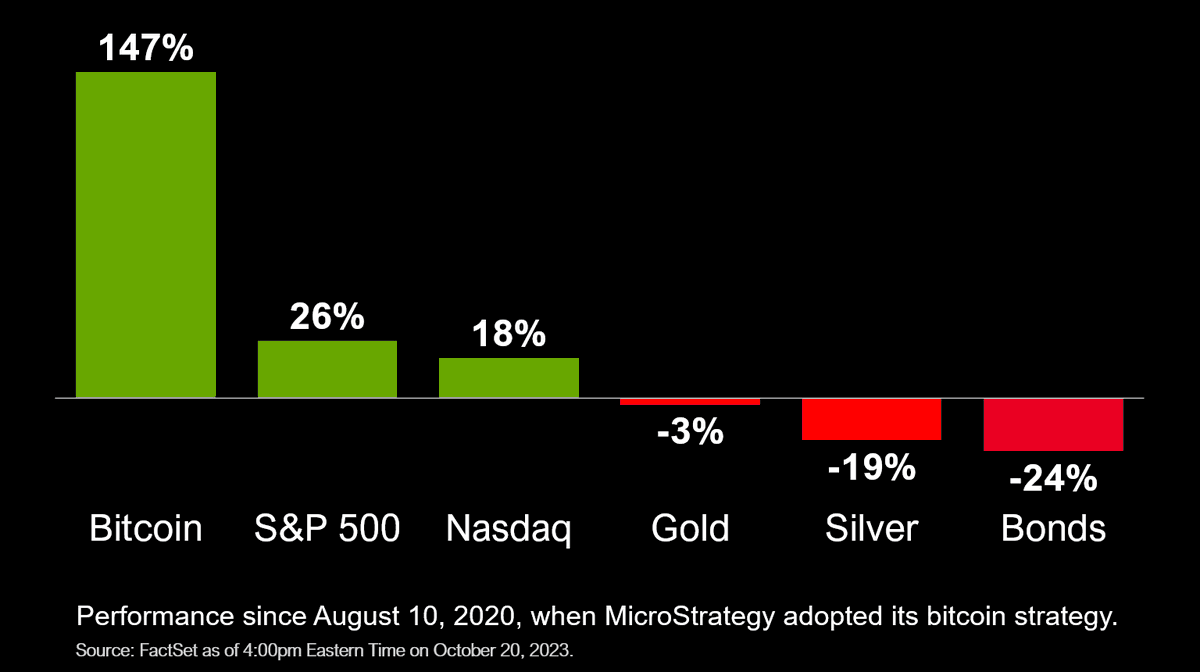

Michael Saylor, the business intelligence company’s chairman, remains a vocal proponent of BTC. On Oct. 21, he shared data showing that BTC has outperformed traditional assets like gold, Nasdaq, Silver, and bonds since MicroStrategy adopted the Bitcoin strategy in 2020.

Meanwhile, MicroStrategy’s MSTR stock is also performing well, rising by 1.62% to $353.67 at pre-market trading, according to Tradingview data. The asset has recorded an impressive year-to-date increase of 138.92%.

ETF buzz keeps BTC rising

Bitcoin’s recent price surge is closely tied to growing interest in spot-based Exchange-Traded Funds (ETFs) in the United States.

The leading cryptocurrency rallied past $30,000 just last week following erroneous reports that the Securities and Exchange Commission (SEC) had given the green light to BlackRock’s ETF proposal.

Market analysts view this reaction as a clear indication of investor optimism for ETF approval. According to insights from crypto research firm Matrixport, Bitcoin’s value could surpass $50,000 if the SEC approves an ETF application.