Bitcoin’s “scaling solution” for fast payments, the Lightning Network, is becoming increasingly popular around the globe. According to a fresh research report (pdf) by Arcane Research, Lightning payments are growing fast, even more so than what can be measured by looking at “imperfect” public metrics.

Though Satoshi Nakamoto titled the now-famous whitepaper “A Peer-to-Peer Electronic Cash System”, clearly aiming at creating a digital equivalent of cash for everyday use at scale, Bitcoin’s decentralized and secure design, with a small block size and relatively long block time, does not have the transaction capacity to facilitate payments in the same way people use cash, whether physical or digital, in their everyday lives.

The Lightning Network is designed to be a solution to Bitcoin’s slow throughput without compromising the security of the Bitcoin (BTC) network. By using the Lightning Network, millions of people can send fractions of a bitcoin at instant speed, all at the same time. Use of the Lightning Network has increased significantly over the last year, and there’s still plenty of room for growth.

Almost 50% is payments between individuals

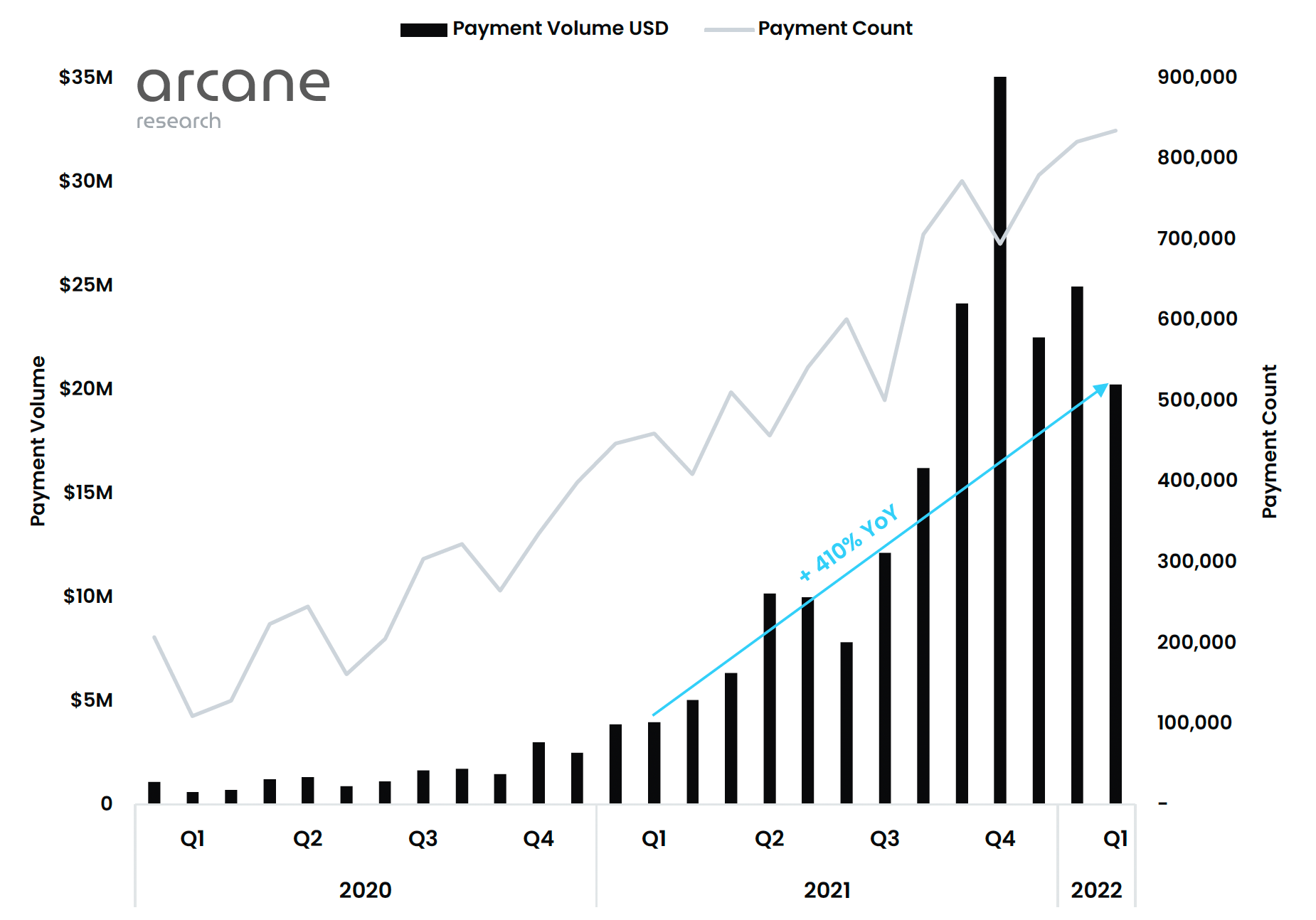

By gathering actual transaction data to estimate the use of the Lightning Network, Arcane Research has observed that adoption is rising, and quickly so. According to Arcane, the number of payments has roughly doubled over the last year, at the same time as the value of the payments has increased by more than 400%, measured in U.S. dollars.

Breaking down and looking at the total payment volume in the first two months of 2022, Arcane found that almost 50 percent of the value of payments was direct payments between individuals, for instance remittance payments or for buying things from other individuals.

Of the other just over 50% of the payments, 20% came from purchases of goods or services handled through a payment processor or bought indirectly through gift cards, and a third came from deposits and withdrawals to and from exchanges.

Arcane estimates that by the summer of 2021 just over 100,000 users had access, through an installed application, to Lightning payments globally, but in March 2022 that figure had increased to more than 80 million people – an increase by a staggering 800 times. However, having access to Lightning capable apps does not mean people actually use the functionality, but if nothing else it shows how quickly the adoption of Bitcoin and/or Lightning apps grows.

The use of Lightning Network is a black box

However, as reported by CryptoSlate, the total USD value locked (TVL) in the Lightning Network hit a high of $216 million in November 2021. Since then, TVL has decreased significantly, coming in at $140 million today. This, of course, ties in with bitcoin’s falling USD price, as evidenced by the amount of Bitcoin locked (currently 3.338k) peaking and holding steady throughout the downturn period since November 2021.

The use of the Lightning Network is somewhat of a black box, Arcane writes in the report. Therefore, most observers are left to look at imperfect public metrics to gauge the growth in Lightning Network usage. According to Arcane, by gathering actual transaction data to estimate the use of the Lightning Network, Arcane has been able to gather more accurate data.

Arcane’s report shows that Lightning Network payment volume peaked in November and has since retracted somewhat. This development does not, however, fairly depict the underlying adoption trend. In November, a high volume of deposits and withdrawals to exchanges during a period of “super hot” bitcoin markets blurs the statistics. If one excludes deposits and withdrawals from trading services from the payment volume, one can see that all other payments actually dipped in November but have since grown to new highs.

“Comparing payment volume growth with the increase in widely cited public metrics shows a striking insight. Actual usage of the Lightning Network has risen significantly more than any of the public metrics,” the report reads.

The ecosystem is expanding and better funded

Compared with the public capacity indicators, the increase in payment volume shows that one should be wary of using the public indicators as a proxy for growth in Lightning Network usage.

“The reasons for being careful in doing this are many. For one, the public indicators underestimate the size of the network due to private channels and invisible nodes. Second, these metrics say nothing explicit about Lightning Network usage. The Lightning Network will become more capacity efficient as infrastructure solutions develop, and public metrics will likely underestimate growth in the future,” the report reads.

According to the report, a thriving ecosystem is pushing the Lightning Network forward, both technically and for increased adoption. The Lightning Ecosystem is expanding and becoming better funded. With increased Lightning Network adoption, more and more big companies are entering the ecosystem. As showcased by recent funding rounds, companies working on the Lightning Network are fast becoming more attractive to investors.

As a couple of examples of recent funding, OpenNode raised $20 million at a $220 million valuation in February 2022 and Lightning Labs raised $70 million in April this year. According to Arcane, the record for funding rounds in the Lightning Network ecosystem has been beaten twice in just the last couple of months.

Use cases beyond remittances

The excitement surrounding Bitcoin and the Lightning Network is mainly due to the positive changes it can bring to the world. The potential for positive impact is especially high in the developing world. Bitcoin and the Lightning Network can provide financial inclusion for the unbanked and more effective remittance payments. And the effect will be enormous, Arcane says. According to statistics from the World Bank, more than 2 billion people worldwide are unbanked.

“The unbanked are generally poor and have low- or no-income jobs. By enabling financial inclusion, Bitcoin and the Lightning Network create new possibilities for these people to enhance their lives, likely compounding to a significant increase in living standards for possibly billions over time,” the report reads.

However important and significant for the Lightning payment volumes today, remittances and traditional types of payments are not the only interesting use cases for the Lightning Network. To this point, Arcane points to examples such as “value-for-value” payments where content creators leave it to the users to decide what value the content gives them and trust them to compensate accordingly. Stacker.news is an example of the value-for-value model put into life on the Lightning Network.

Another example of an up-and-coming use case mentioned in the report is the Zion social media app which allows users to share content without trusting their data with a central intermediary. The content is shared in the form of a minuscule Lightning payment with the content added in an encrypted message. Only the intended receiver can decrypt the message to show the sent content, and the Zion protocol automatically sends the minuscule payment amount back to the sender.

Jack Mallers’ relentless grinding

The Zion app actually constitutes the lion’s share of new nodes added to the Lightning Network as each Zion user runs the social app via a node on the Lightning Network. Since the launch in the fall of 2021, 3500 new nodes have been set up to use Zion. Given that the number of nodes on the Lightning Network increased by about 5,000 in the same period, it means Zion accounted for approximately 75% of the increase in nodes since its launch.

To date, most use of the Lightning Network has been by Bitcoin enthusiasts, Arcane’s report says, but their share of payment activity is falling. Kick-started by El Salvador’s bitcoin adoption in September 2021, the user base has expanded well beyond the die-hard Bitcoin proponents.

There’s no doubt that Jack Mallers’ relentless work through his peer-to-peer payments company Strike has contributed greatly to the adoption and growth of the Lightning Network, not the least in El Salvador. But in recent times the adoption of Lightning payments has spread far beyond the Latin American country.

Major cryptocurrency payment service provider BitPay added support for the Lightning Network, as reported by CryptoSlate only last week, April 6th. Added to this, Cash App is bringing the Bitcoin Lightning Network to its 36 million users. Bitcoin itself has been available on Cash App since late 2017, but now the mobile payment provider is set to roll out the Lightning Network to its users.

Integration with e-commerce giant Shopify

Following the integration with BitPay’s Payment Processing Platform, merchants can now receive transactions from crypto wallets that support the Lightning Network, including CashApp and Strike. In their turn, consumers now have a “low-cost alternative” when they make payments at BitPay-enabled dealers.

Also, at the Bitcoin 2022 conference in Miami on April 7th, Jack Mallers announced an integration with e-commerce giant Shopify that would allow merchants to receive faster and cheaper Bitcoin transactions via the Lightning network.

According to an accompanying press release, the new integration will unlock “the ability for eligible U.S. Shopify merchants to receive Bitcoin payments from customers globally as U.S. dollars” via Lightning Network.

Furthermore, as reported by CryptoSlate on the same date, Mallers also announced a partnership with NCR and Blackhawk. During Maller’s presentation, a slide appeared listing some of the biggest retailers in America, including McDonald’s, Walmart, Home Depot, and Best Buy. According to their websites, Blackhawk and NCR also serve Starbucks, Chipotle, El Corte Inglés, Lowe’s, Staples, Woolworths, and thousands of other global retailers.

We will have to wait for more details to understand exactly when and how some of these retailers will start accepting Bitcoin. However, Mallers claims that over 400,000 storefronts will now accept Bitcoin via the Lightning Network. If or when this comes through, it will be a massive boon for Lightning adoption.

Finally, as per Arcane Research’s report, “there is great potential for Lightning Network adoption to continue the explosive growth, both through users deliberately using bitcoin on the Lightning Network and as a payment rail for fiat currency transactions.”