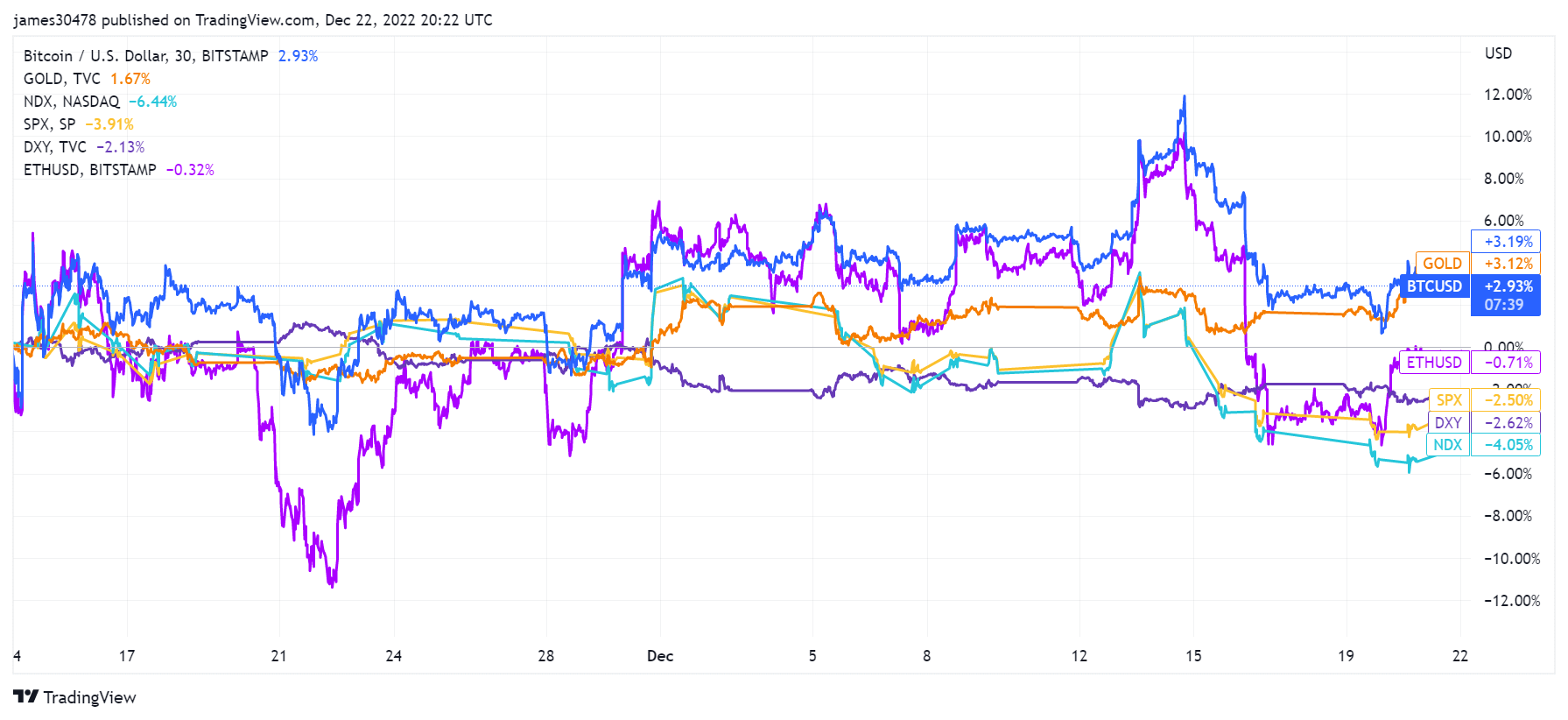

Bitcoin’s (BTC) value has risen by roughly 3% since FTX filed for bankruptcy on Nov. 11, according to CryptoSlate data.

Bitcoin, gold up 3%

Bitcoin traded at a low of $15,742 on Nov. 10, when FTX was dealing with a bank run that eventually led to its collapse.

During this period, retail traders withdrew their coins en masse from centralized exchanges pushing BTC’s reserves on these platforms to 2018 levels. In addition, leading crypto platforms like Binance and Coinbase recorded withdrawals from their platforms as investors favored self-custody.

Despite this, Bitcoin’s price mostly traded above $17,000, with the flagship digital asset touching a high of $18,320 on Dec. 14. However, in the last seven days, BTC has declined by 2.8% and is currently trading for $16,865 as of press time.

Similarly, the gold price has increased by 3% since FTX’s implosion. As of Nov. 11, the precious metal was trading at around $1,760 before rising to as high as $1,817 on Dec. 19.

Meanwhile, its value has slightly decreased to $1,796 as of press time.

ETH down

While Bitcoin and gold’s value increased following FTX’s implosion, Ethereum’s (ETH) price, alongside other assets like the US dollar, S&P 500, and NASDAQ, has declined.

According to CryptoSlate data, Ethereum hit a trading bottom of $1,095 on Nov. 10 before recovering to $1,301 on Nov. 11. Since then, the second-largest digital asset by market cap’s value has declined by 0.71% to its current level of $1,218.

During this period, ETH briefly traded at a high of $1,343 on Dec. 14, but its value has declined by over 3% in the last seven days.

Following FTX’s collapse, other assets, like the US Dollar, S&P 500, and NASDAQ, dropped by 2.62%, 2.50%, and 4.05%, respectively.

Meanwhile, the S&P and Nasdaq indexes’ poor performance is fueled by the fears of a recession. Reuters reported that the biggest US banks predicted that the economy would worsen. As a result, according to the report, some banks have begun culling their workforce.

The better-than-expected monthly data on jobs and economic performance has also fueled concerns that the Fed will keep increasing interest rates which are already very close to a record high. The Fed recently raised interest rates by half a point to reach the highest levels in 15 years.