Dan Tepiero, the 10T Holdings co-founder, believes MicroStrategy’s $425 million Bitcoin bet could be worth $10 billion in a decade.

On September 14, less than two months ago, MicroStrategy CEO Michael Saylor confirmed the purchase of $425 million in Bitcoin. He said at the time:

“MicroStrategy completed its acquisition of 16,796 additional bitcoins at an aggregate purchase price of $175 million. To date, we have purchased a total of 38,250 bitcoins at an aggregate purchase price of $425 million, inclusive of fees and expenses.”

Since then, Square and Stone Ridge both confirmed the purchase of $50 million and $110 million worth of Bitcoin, respectively.

Why $425 million in Bitcoin to $10 billion?

For MicroStrategy’s $425 million Bitcoin investment to turn into $10 billion, BTC would have to rise by 23.5-fold.

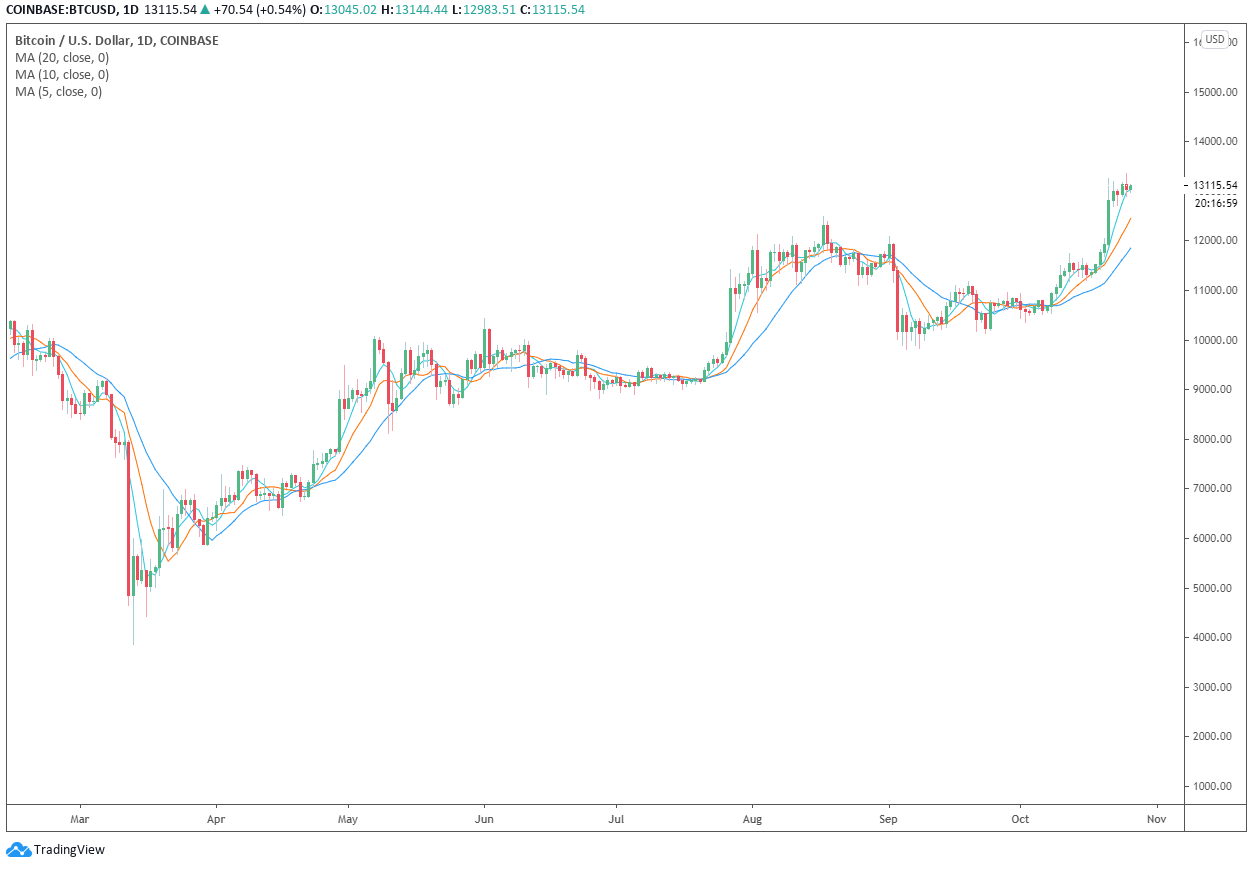

As of October 26, Bitcoin is trading at around $13,100. If BTC hits $308,000 in the next 10 years, then MicroStrategy’s investment could become $10 billion.

Tepiero, who praised Saylor as one of the great global macro investors, said:

“Nails it again. Michael Saylor to go down as one of the great global macro investors of all time (and I have worked with a few of the greats.) Massive $425m Bitcoin bet going to $10 billion within 10yrs. Reasoning and thought process impeccable.”

There are several compelling long-term investment theses that support BTC to rise above $100,000.

The go-to thesis from institutional investors is the argument that Bitcoin would evolve into a safe-haven asset. If so, it would compete against gold, which has a $9 trillion valuation.

At a price point of $308,000, the market capitalization of Bitcoin would be around $6.46 trillion. That would still be less than the market cap of gold.

The primary advantage of Bitcoin is that institutions perceive it as an inflation trade. Often, institutions purchase hedges or inflation trades because they protect their portfolios.

But, BTC is still at a nascent stage where it could serve as a hedge against inflation but also potentially result in exponential gains over the long term.

Saylor confident in BTC as an inflation trade

According to Saylor, the fix to the growing concerns of inflation would be to short the dollar. But, the more interesting trade would be to long BTC, which MicroStrategy has taken. He said:

“In theory, the cash flows of a risk-free equity asset would need to grow faster than the rate of monetary expansion for it to serve as a good store of value. Absent that, the fix would be to either short USD (by leveraging up with debt) or go long #BTC.”

For BTC to continuously evolve into a safe-haven asset, it would need to show that it can compete against the likes of gold over a long period. For now, based on the demand, institutions remain confident that BTC could close the gap.