The Bitcoin (BTC) price reached as high as $10,060 on Coinbase, rising by more than 160 percent in 56 days. After such an extended rally, BTC is typically at risk of a severe correction. This time, it is showing signs of actual accumulation and strong buyer demand, which reduces the probability of a large pullback.

Bitcoin showed all five factors for a sustainable uptrend: record-high options volume, futures open interest, institutional demand, healthy spot market, and rise in developer activity.

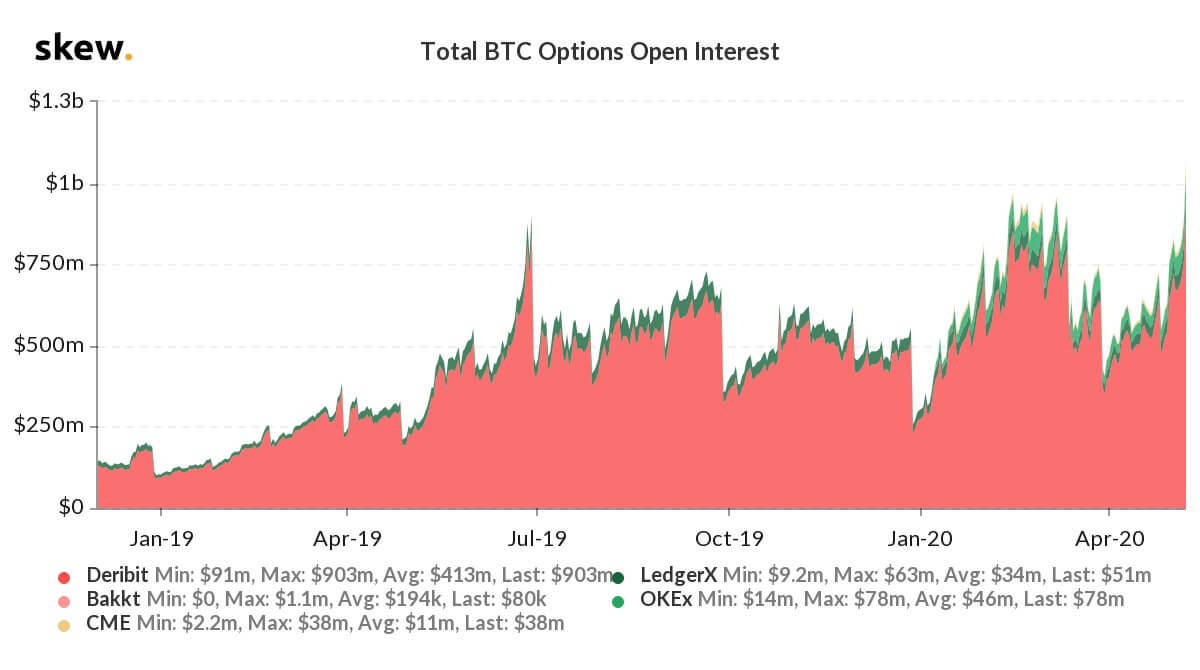

Factor #1 and #2: record-breaking Bitcoin options and futures trading activity

In the past week, Bitcoin options volume on Deribit and total open interest on CME futures exchange rose to all-time highs.

Both Deribit and CME are widely utilized by professional traders, investment firms, and accredited investors. Options are a relatively difficult trading instrument for retail investors to navigate, and CME’s maximum cap of 2x leverage makes the two platforms unfavorable for the typical casual investor.

Record high trading activity on Deribit and CME Group indicates that the demand for Bitcoin among professional traders is rapidly increasing.

Unlike previous Bitcoin cycles that were kickstarted by spoof orders primarily on BitMEX, the recent price movement indicates that it is organic buying demand supplementing the upsurge.

Factor #3: Rising institutional demand

On May 8, esteemed billionaire investor Paul Tudor Jones said that he invested in Bitcoin as a hedge against inflation.

From January to March, institutional investors invested hundreds of millions of dollars in Bitcoin through Grayscale. The entrance of Tudor Jones into the cryptocurrency market may trigger a fear of missing out (FOMO) among institutional investors, after having invested record amounts in BTC last month.

Factor #4: Strong spot market

Binance, Coinbase, Kraken, and other leading spot exchanges that facilitate fiat-to-crypto or stable-to-crypto trades recorded a significant increase in user activity since mid-March.

The recent uptrend of Bitcoin was primarily triggered by a combination or spot, derivatives, institutional, and futures demand. But, previous rallies were mostly led by whales on BitMEX and Bitfinex, causing massive volatility to both the upside and the downside.

The strength of the spot market explains limited downside movements Bitcoin recorded throughout the past three weeks, as it made its move above $10,000.

Dips in the Bitcoin price are being bought fast with relative volume, suggesting that accumulation is still ongoing.

Factor #5: Bitcoin developer activity is on the rise

Since early 2020, developer activity on top of the Bitcoin blockchain network increased noticeably.

Bitcoin is a currency, but it is foremost a blockchain protocol and a piece of software. High developer activity typically indicates an optimistic sign of long-term growth.

Rising levels of developer activity throughout a prolonged period suggest that a growing number of developers are working on optimizing the blockchain protocol.

A confluence of all-time high trading, developer, and institutional activity is backing the current rally of Bitcoin, which makes a deep correction below $7,000 unlikely.