Bitcoin dipped to over $28,000 yesterday, sending other altcoins in a downward spiral and chalking up one of the biggest crypto ‘liquidation’ days in a few weeks.

Several large-cap cryptos like Solana, XRP, and Polkadot saw double-digit percentage declines. Their corresponding futures products did, too, see falling prices, causing a long line of liquidations in their wake.

Crypto liquidations and what really happened

‘Liquidations’ occur when traders borrow excess capital from brokerages/exchanges (i.e., ‘margin’ or trading futures) to place bigger bets on the assets they trade.

They pay a fixed fee for doing so, while exchanges close out these positions at a predetermined price—when the trader’s collateral is equal to the loss on that position. Such a trade is then said to be liquidated.

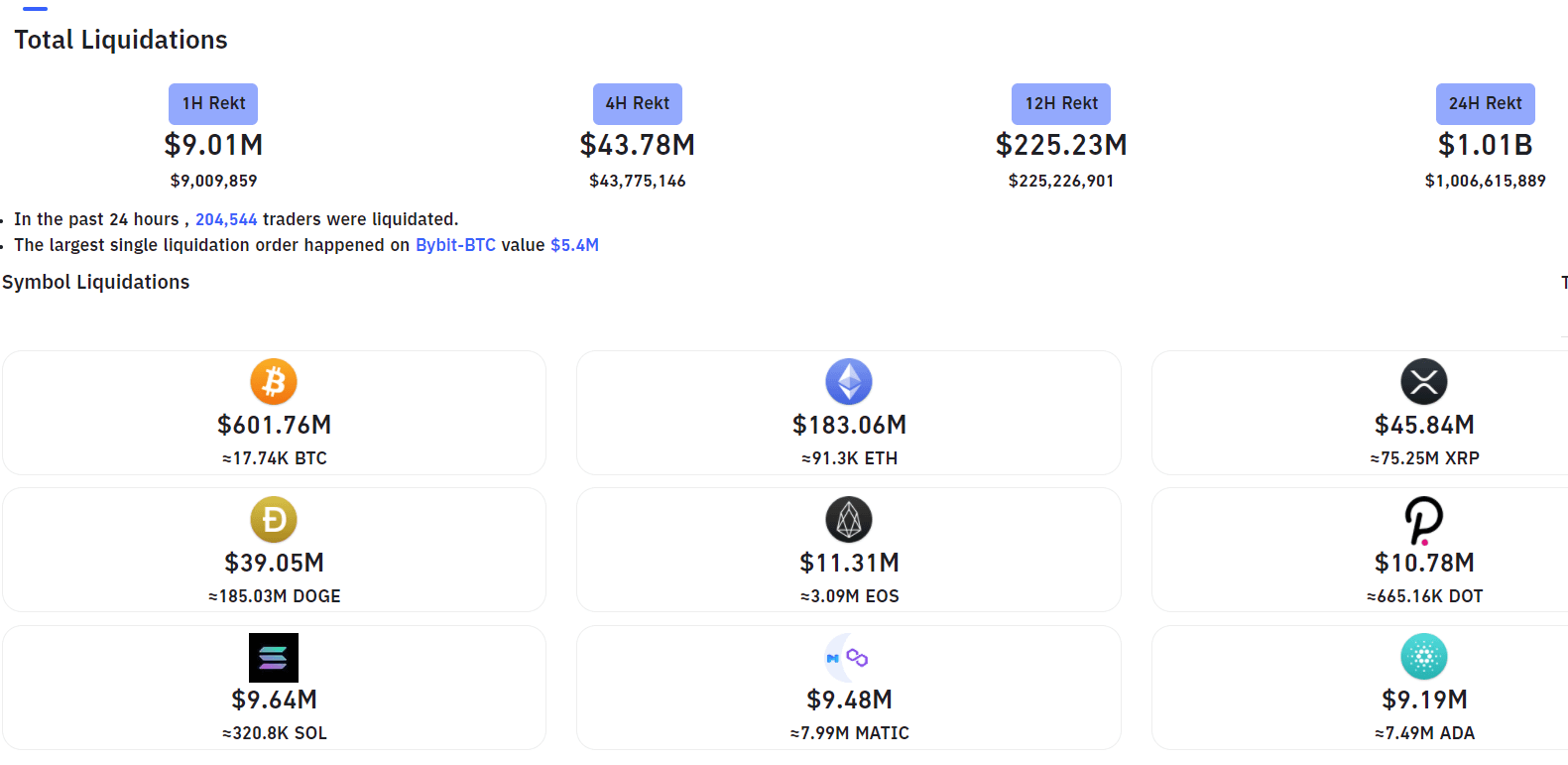

Data from analytics tool Bybt shows over $1 billion was lost to such liquidations yesterday. Leading that chart was Bitcoin with over $600 million in liquidations, followed by Ethereum with a relatively tamer $183 million in liquidations.

On the altcoin side, XRP saw $45 million in liquidations, Dogecoin saw $39 million in liquidations, while EOS, Polkadot, and Solana saw $11 million, $10 million, and $9 million in liquidations respectively.

Where do most ‘degens’ trade?

54% of all liquidated traders were long the market, meaning they bet on higher prices but got caught in the unwinding. The others, despite being short, still got liquidated as the market pumped higher this morning (or because they used higher leverage and had a close liquidation price).

Futures exchange Bybit saw the most liquidations, with over $389 million getting rekt on that exchange (interestingly, most Bybit traders were short the market—the only ones majorly shorting compared to other exchanges).

Meanwhile, the crypto market saw a green bump this morning. Data from CryptoSlate shows Bitcoin and Ethereum rose by a few percent today, with other cryptocurrencies like Uniswap and Solana rose up 8%.