Bitcoin and Ethereum both continue to show an unclear direction as both fail to break major resistances and fall back on their ‘support’ price levels.

However, the number of Bitcoin ‘shorts’ continues to rise and touch an all-time high on crypto exchange Bitfinex, which suggests that traders are leaning on the bearish side as of now.

For the uninitiated, a “short,” or a short position, is created when a trader sells an asset (borrowing it from an exchange or brokerage at a fixed interest rate) with the intention of repurchasing it or covering it later at a lower price.

Such positions bet on lower prices for any asset, meaning the large short built on Bitfinex could mean a big trader is preparing for even further downside in the market.

However, the short may be a ‘hedge’ against other positions, such as spot, options, or a ‘long’ futures.

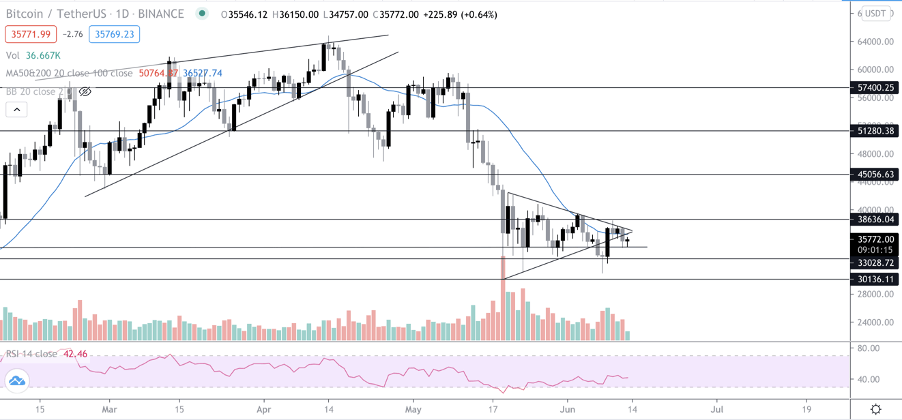

So what’s next for Bitcoin?

Sunday saw Bitcoin having a relatively quiet day as the price continues to be stuck in the $34,500-$38,000 range.

Many technical indicators still continue to show a bearish trend. The price is still under the higher time frame moving averages (a tool that uses past market movement and prices to determine the trend of the market). The price action however has been flat and there has been very little volatility.

$33,000 should hold well in case of another dip. Ideally, the price needs to close above the 20MA and the $36,600 resistance to show some strength.

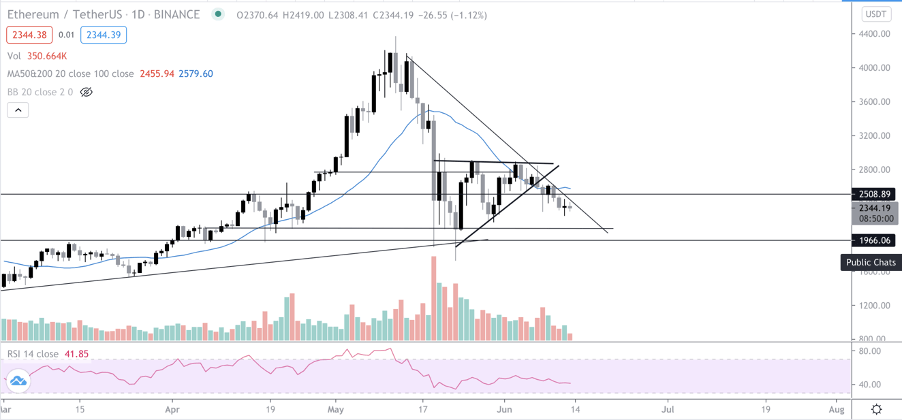

What’s next for Ethereum?

As the chart below shows, Ethereum (ETH) is facing a rough diagonal resistance and is still looking bearish.

The price has now similarly to Bitcoin fallen below the 100 MA—which is a bearish signal for many traders.

It still looks like $2,150 still continues to be a good price to put spot buys in, as there is a high chance of going down to that range unless the upcoming week brings in a volume surge.