Dan Morehead, the CEO of Pantera, believes that Bitcoin is “cheap” when compared to the price trend over the last 11 years according to their June investor report.

Bitcoin is under it’s 11-year trend

Bitcoin’s price has had varying deviations from the 11-year “exponential trend” over the past couple of years. In 2018, Bitcoin was trading over 200% above the trend while in 2020, it traded over 50% under the trend. Currently, BTC is trading at 36% under the trend, and the asset has only traded under the trend 20.3% of its history which seems to indicate that now is a good time to buy.

For new investors, it’s best to buy when the market is well below trend. Now is one of those times.#Bitcoin has only been this “cheap” relative to its trend 20.3% of the past 11 years.

More perspectives on market timing in our June investor letter: https://t.co/AOvhFyxBJh pic.twitter.com/2bsxbw5Iay

— Dan Morehead (@dan_pantera) June 16, 2021

The June investor report also comments on China and YoY growth

According to the report, investors should not be overly concerned with China banning crypto. China also “banned crypto” during the 2013 and 2017 “mid-market cycles” and it has not had a long-term effect on Bitcoin’s value. Morehead also pointed out that China banning companies has not been a good reason to sell for investors.

Investors who sell on China “bans” usually end up bummed… pic.twitter.com/OKlBe9yU9q

— Dan Morehead (@dan_pantera) May 26, 2021

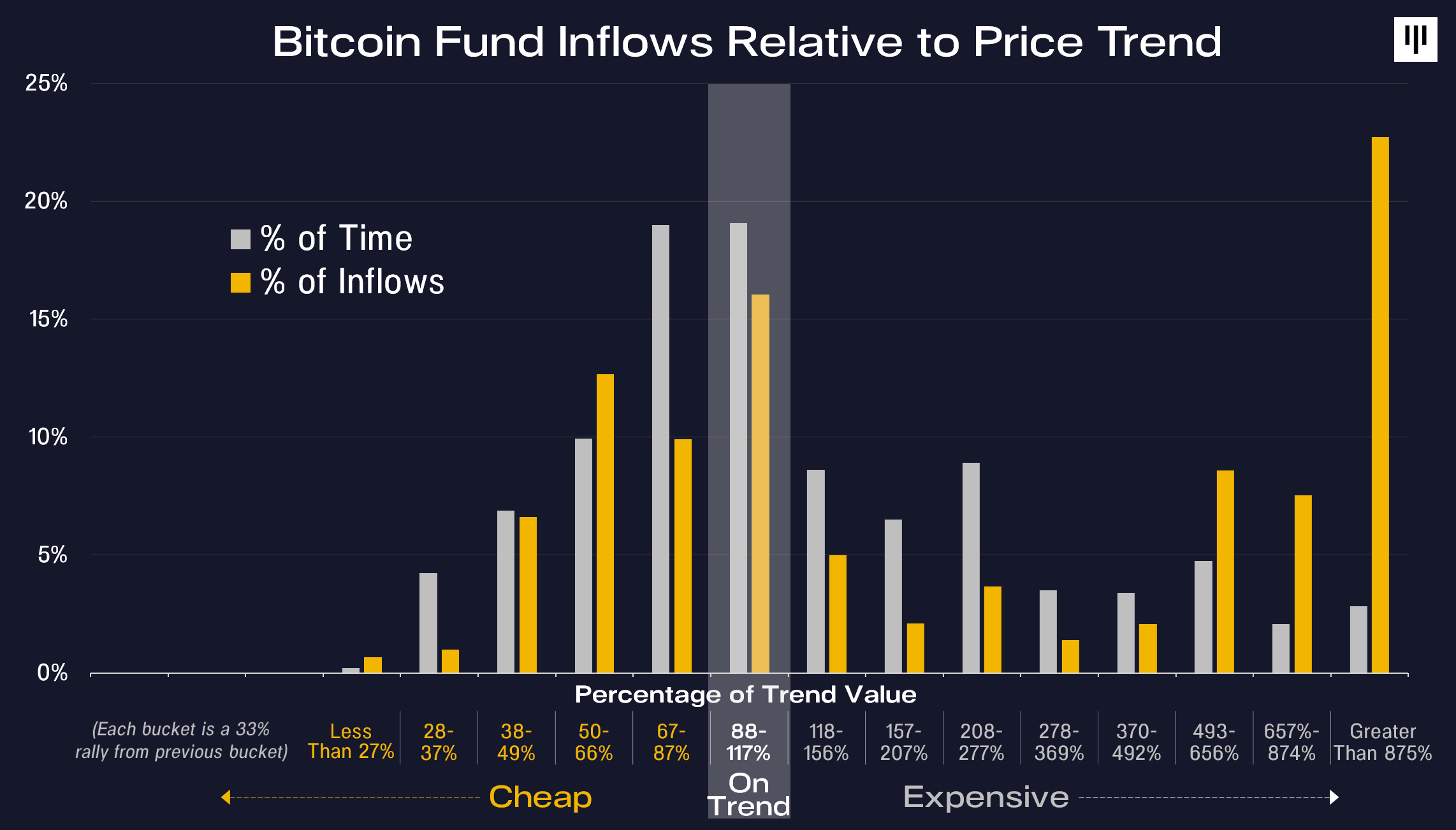

Furthermore, the report points out that people tend to buy when the market is up and tend to sell when the market is down. This point is illustrated by the histogram which shows “the percentage of time that the price of bitcoin was in each price bucket.”

The buckets are “a logarithmic progression” and “each bucket is a 33% rally from the lower bucket.” The percent of time follows the trend with most of the time spent at or near the trend.

However, inflows are highest in the highest bucket and lowest in the smallest bucket. This indicates the phenomenon that investors buy when price growth is high and sell when the price growth is slow. This led Pantera to recommend that investors should “resist the urge to close down positions.”

Bitcoin is trading at 281% year-over-year but that is not as pronounced as previous peaks. The four-year-over-year return is also “at the lower end of its historical return”. These numbers along with the 11-year exponential trend lead Pantera leadership to say that the asset is not overvalued.