El Salvador made history on Tuesday as the Bitcoin Law came into effect, sanctioning the leading cryptocurrency as legal tender in the Central American country.

However, since President Bukele first introduced the bill, rumblings of discontent among Salvadorians have been brewing.

Following Tuesday’s passing of the law, this discontent has been getting noticeably more charged, both in the number of protestors and their actions of protest.

With that in mind, is it time to concede that the world at large still isn’t ready for Bitcoin?

Cracks appear in President Bukele’s plans

President Bukele shocked the world at the Bitcoin Conference in Miami, in June, by announcing plans to make El Salvador the first sovereign country to adopt Bitcoin as the legal lender.

During his video message, President Bukele spoke about helping the unbanked, which make up 70% of the population. As well as easing remittance flow from Salvadorians abroad sending money home.

In the three months since then, having been voted in by Congress, President Bukele’s plans have faced severe criticism causing a splinter of opinion.

At first, protests consisted of small numbers with (seemingly older) protestors voicing concerns that Bitcoin is not for ordinary folk on minimum wage.

In particular, they spoke of their unease over price volatility, and how that exposes people to loss as a result.

“For people who earn minimum wage, one moment you can have $300 in Bitcoin and the next day the $300 can become $50. Today we have seen how the price of cryptocurrency is falling.”

Bitcoin is not being forced on anybody

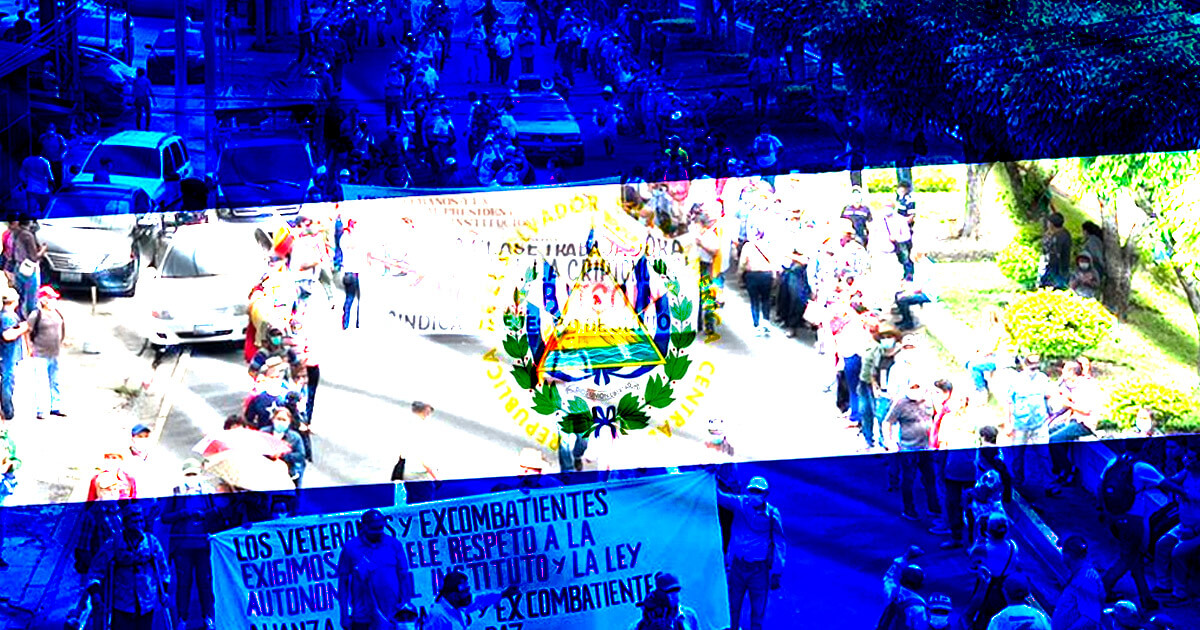

With no let-up in the strength of feeling, the protests have been getting progressively larger in scale and intensity.

As reported by Al Jazeera, Salvadorians marched in the capital, San Salvador on the day of the Bitcoin law passing. Protestors burned tires and set off fireworks in front of government buildings.

Such was the scale of protest that heavily armed riot police were deployed, suggesting a menacing factor that wasn’t present during previous protests.

One protestor echoed earlier concerns, of Bitcoin not being for everyday people, by saying:

“This is a currency that’s ideal for big investors who want to speculate with their economic resources.”

Jack Maller, the CEO of Strike, the firm behind El Salvador’s wallet infrastructure, made clear that the legislation does not force Bitcoin on anyone.

Instead, Maller said El Salvador is operating a dual currency system with people having the option of switching between dollars and Bitcoin, and vice versa, within the Chivo wallet. This leaves people the option to transact however they wish.

“We allow dollars, like a traditional U.S bank account to be interoperable with this open monetary network. So you can send and make Bitcoin payments in dollars, and receive Bitcoin payments in dollars.”