Market sentiment is strongly bullish, since the start of October its price has gained more than 50% without taking a single correction yet. At IntoTheBlock we have analyzed three key indicators that provide interesting insights into how the crypto market could be positioned for the next move.

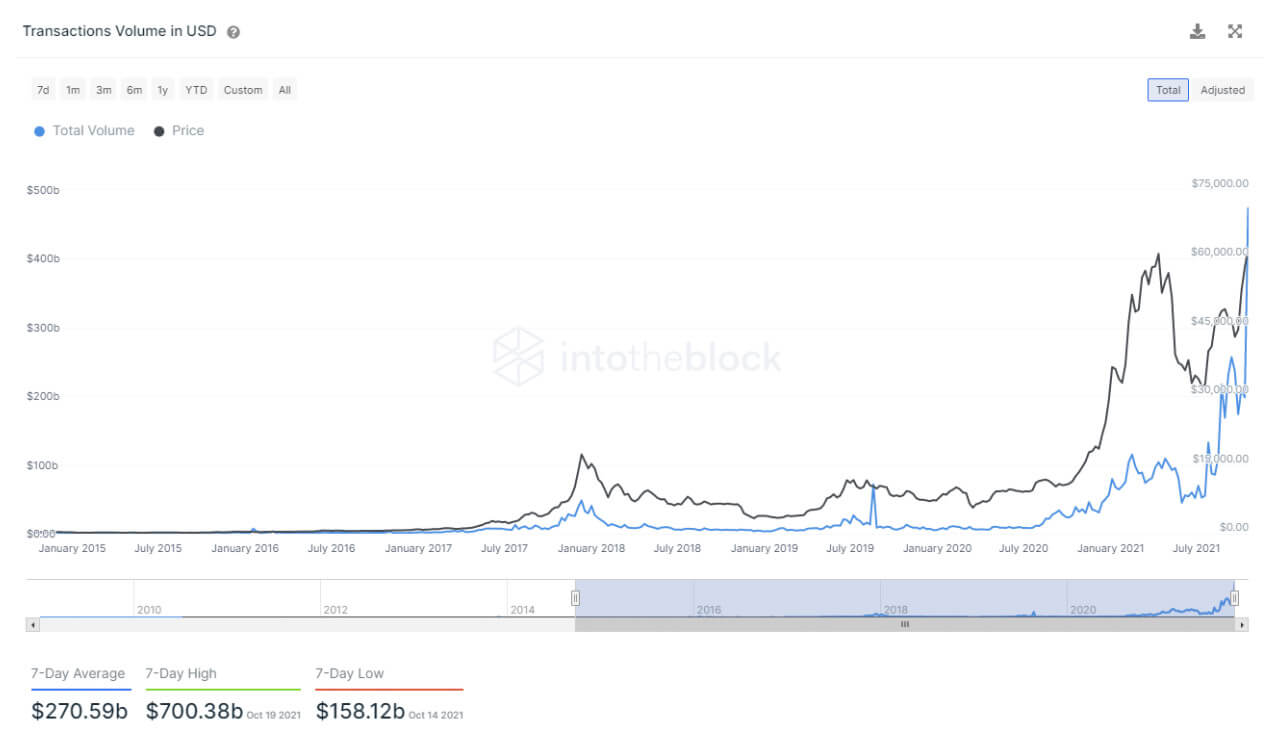

Transactions volume up 7x since previous ATH

Since the last time Bitcoin was at $60,000 transaction volume on its blockchain has grown by a factor of seven. This growth is a phenomenal proxy of the institutional clients that have been adopting Bitcoin this year, thus significantly growing its volume.

Part of that institutional adoption has been reflected in the recent ETF launch. This new product, called ProShares Bitcoin futures ETF (BITO) was welcomed with great acceptance trading over 1 billion on its first day, positioning itself as the second most traded ETF on launch day. At the end of the session, it finished with $570 million in assets.

This ETF does not directly invest in Bitcoin but tracks the price of the cash-settled front-month Bitcoin futures on the Chicago-based CME, the world’s largest derivatives exchange. As the prospect page of ProShares claims, around 25% of its total assets will be invested in the underlying CME futures contract.

On a similar note, Grayscale announced it aims to convert its Bitcoin trust GBTC into the first physically-backed US Bitcoin ETF and take the BTC ticker with it. Even though there are doubts about the custody setup, this would be very positive news for investors, who could get direct exposure to the spot price of BTC without having to deal with cryptocurrency exchanges or custody risks. This would certainly give the confidence for more institutional investors to get their feet wet with investing in Bitcoin.

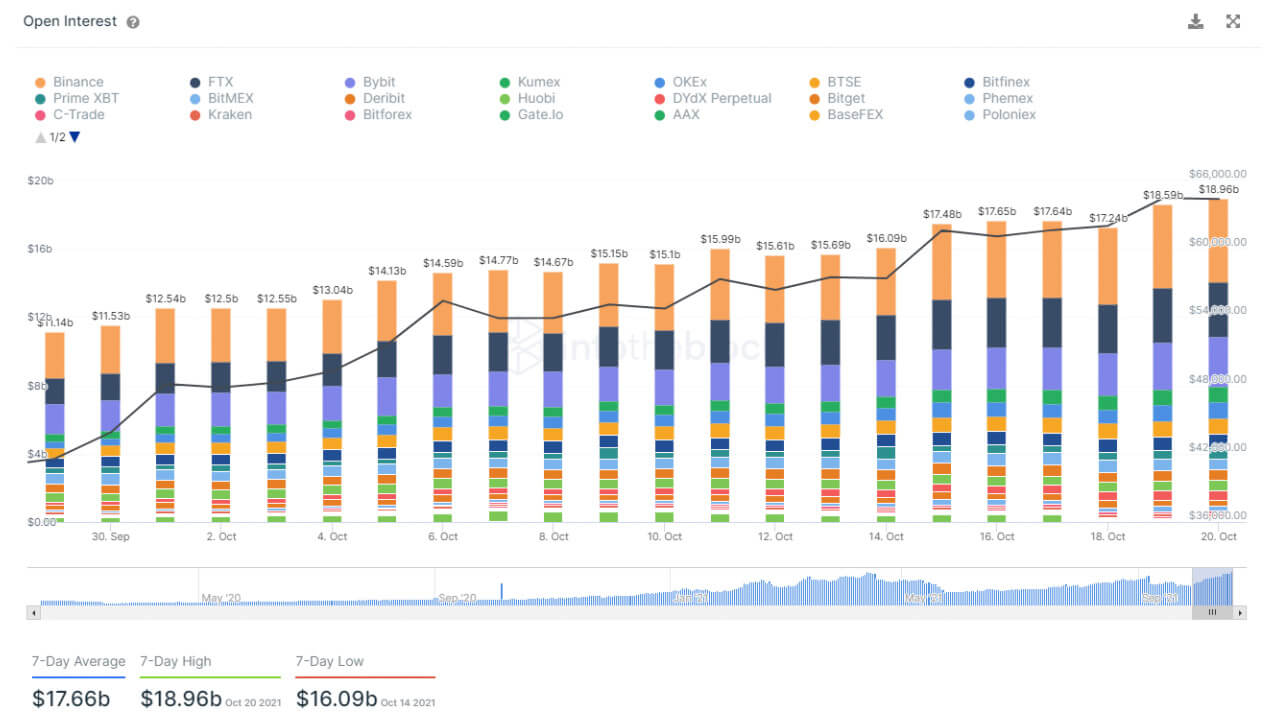

Perpetual futures open interest is at all-time highs

Perpetual swaps quickly became the most popular derivative in the crypto space. Recently, it achieved an aggregate open interest of almost $19bn on the 20th of October, surpassing the previous all-time high figures seen in April. Open Interest shows the total notional value in dollars that currently stand as open positions, either long or short. The last month progression of both price and open interest has been positive:

The steady increase in open interest is following the increasing prices, which points to strong conviction by traders in following the bullish trend with long positions, even when prices have corrected slightly. This also hints at the chance that part of these positions are leveraged, which could have a negative impact in the event of a fast price drop.

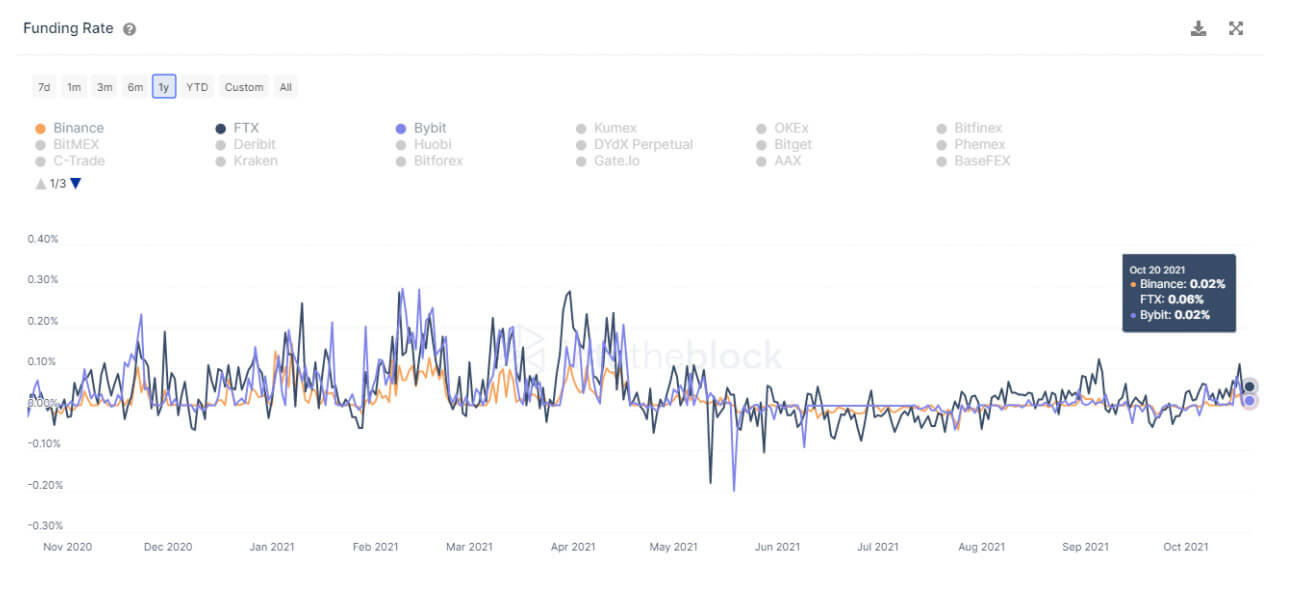

Perpetual funding rates are not overheated yet

Funding rates are one of the best indicators to measure the current market positioning across exchanges. Positive funding rates point at a majority amount of long over short positions. In that case, long positions pay a variable rate to the short positions willing to bet short on the price. This mechanism allows the contracts’ price to remain pegged to the spot price. Likewise, the opposite happens when funding rates turn negative

This last month had most days of funding rates staying above 0.00%, which can be understood as a sign because this would mean that the majority of open positions on the perpetual markets are betting long on Bitcoin and have to pay the funding fee to the short positions willing to bet bearishly on the Bitcoin price. To put into perspective the current rates, here is the chart showing the values of the most traded exchanges over the last 365 days:

As can be appreciated, the current levels of funding rates are staying just shy over the 0.0% level. This is significantly lower than the massive positive funding rates of spring that were consistently around 0.2% and 0.3%, which was unusually high and incentivized traders to take advantage by opening short positions.

These three indicators hint at a possible room for growth in the medium term for Bitcoin price. Plus the current macro situation with growing cryptocurrency adoption and an inflationary perspective are also bullish indicators that can be taken into account. At IntoTheBlock we would not be surprised if Bitcoin’s price continues to rise to new highs along the fourth quarter of this year.