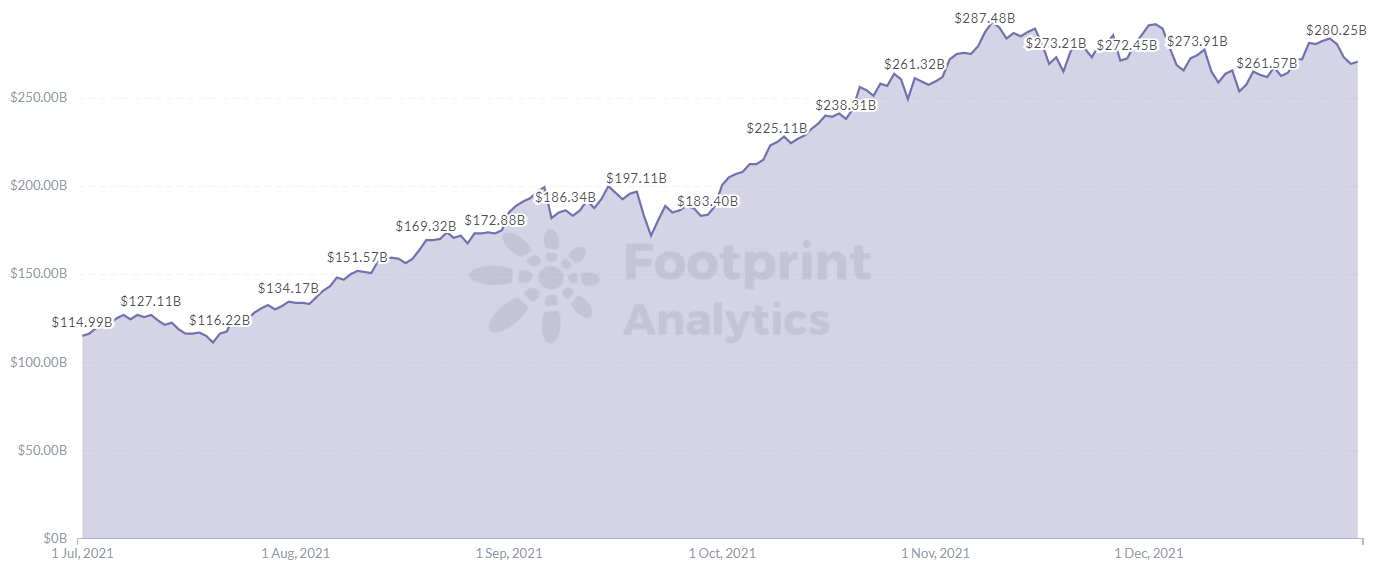

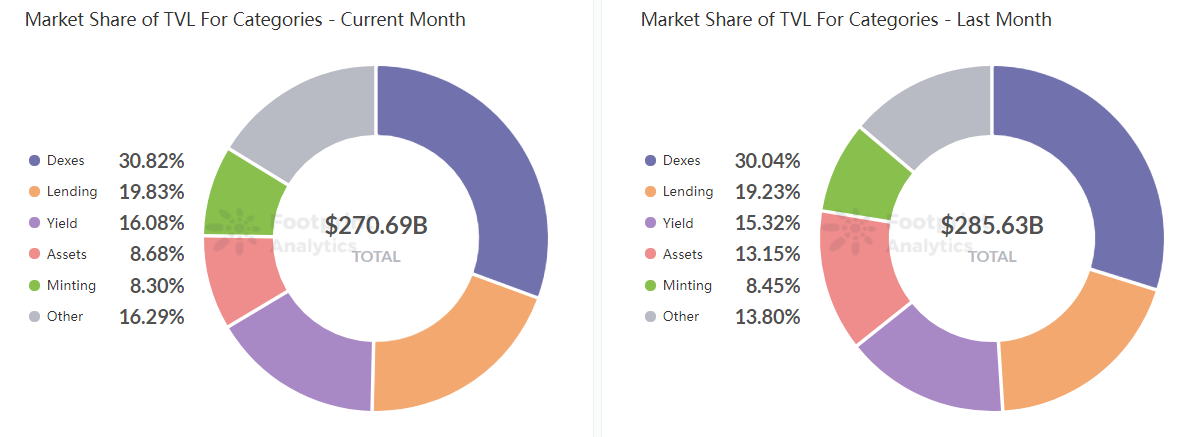

Growth in the crypto market slowed in December, with DeFi‘s TVL falling to $270.69 billion, down 5.23% MoM, and failing to exceed $300 billion. BTC and ETH had a flash crash and NFT trading market growth returned to a modest positive.

Next, we take a closer look at the overall crypto market in December with data from Footprint Analytics.

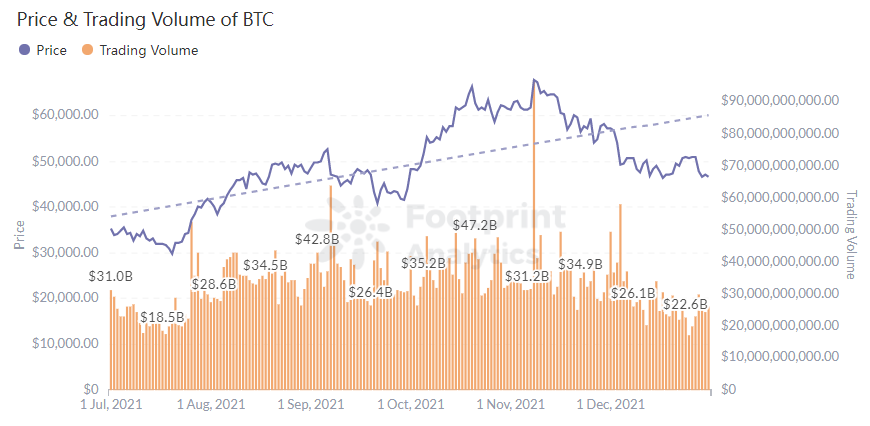

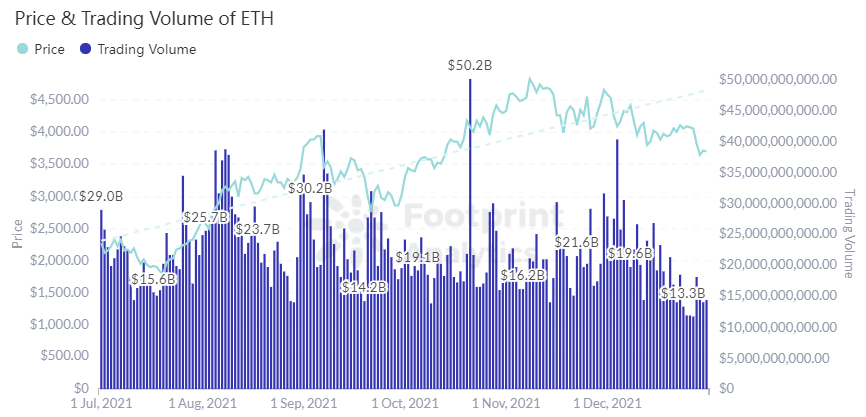

BTC, ETH have flash crashes, down over 20%

Footprint Analytics data shows that in December the price of BTC fell from $57,179 to $46,472, a drop of 23%. The highest daily trading volume during the month was $57.7 billion. As of 31-Dec, BTC’s Market Cap was US$8.8 trillion.

The price of ETH fell 24.2% from US$4,592.82 to US$3,695.60. The highest daily trading volume during the month was $40.3 billion. As of 31-Dec, ETH’s Market Cap was US$4.4 trillion.

The price dive of BTC and ETH was perhaps the result of a combination of multiple market factors.

- Excessive leverage and large open positions for the future.

- Sluggish growth in the number of active addresses and a lack of liquidity.

- Tightening of the Federal Reserve’s monetary policy.

- In addition, the completion of the liquidation of Chinese users by cryptocurrency exchanges this month, such as Huobi Global, also had a partial impact.

DeFi TVL down 5.23% MoM

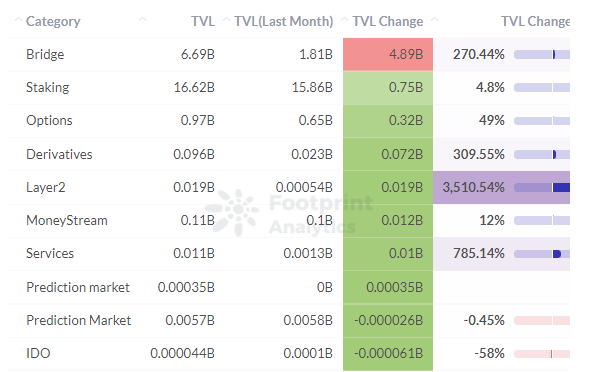

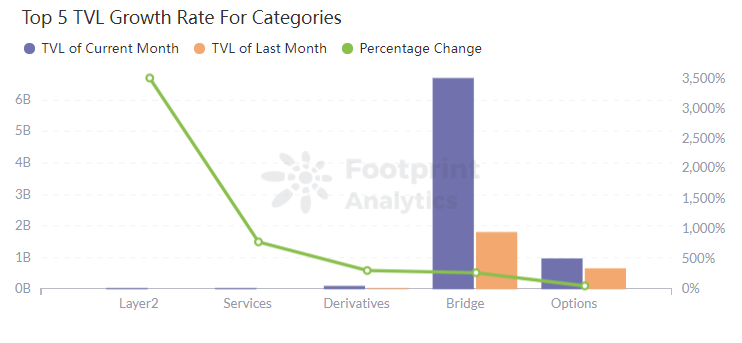

The Assets segment saw the largest decline in December, down 60% MoM, due to the negative performance of the cryptocurrency market. The Layer2 and cross-chain bridge TVL increased by 3,510.54% and 270.44% respectively, however, the TVL share was not high and thus did not contribute much to the growth of the overall DeFi TVL in total. As of 31-Dec, DeFi’s TVL was US$270.69 billion, down 5.23% MoM.

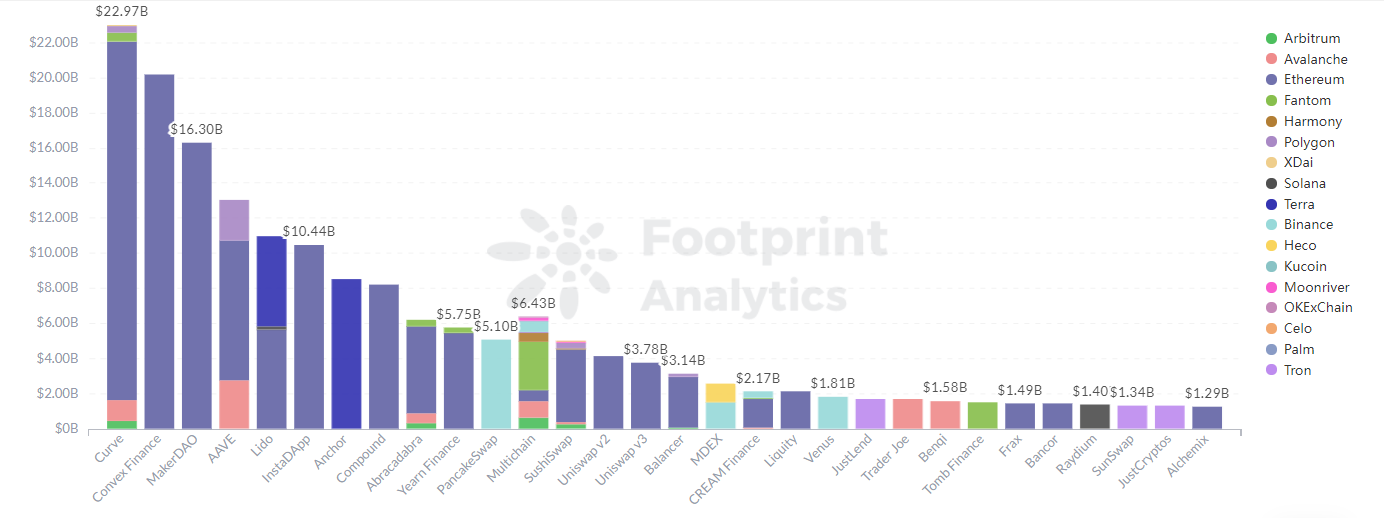

Curve continued to dominate this month, leading the DEX race for the fourth consecutive month. Curve Financial’s TVL for the month was US$20.81 billion, up 27.9% MoM.

Public chains compete fiercely, each with its own way of capturing the market

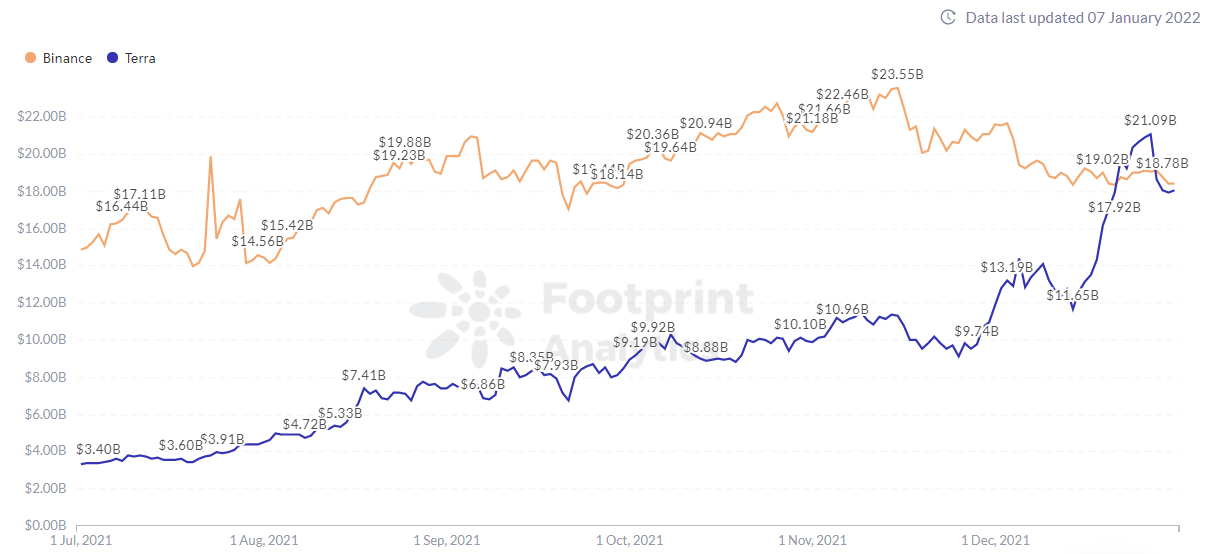

Terra set a record high, capturing 6.67% of the market with a 65.05% growth rate and $18.04 billion TVL, overtaking Avalanche ($12.84 billion TVL, 4.74% market share) and Solana ($11.2 billion TVL, 4.14% market share) to rank third behind Ether ($167.88 6.02% market share) and Binance ($18.4 billion TVL, 6.80% market share) in third place.

Footprint Analytics – Market Share of TVL For Chains

On 20-27 Dec, Terra surpassed Binance as the second-largest public chain in terms of TVL, and on 28th, Binance overtook it. Terra can buck the trend of declining TVL on mainstream public chains, helped by the presence of Lending’s Anchor and Staking’s Lido on its chain. For more information on Terra, see “Will Terra crack the Top 3 in Q4?”

In addition to the major public chains, the fastest-growing TVL in the last 31 days was Aurora, which rose 456.88% from $100 million to $590 million, helped by Trisolaris. Which is a decentralized exchange within the NEAR ecosystem, deployed on the Aurora chain. It is worth noting that NEAR had previously announced an $800 million Ecosystem Foundation, of which $350 million is focused on the development of the DeFi business.

NFT volume growth was positive for the first time since August, up 0.78%.

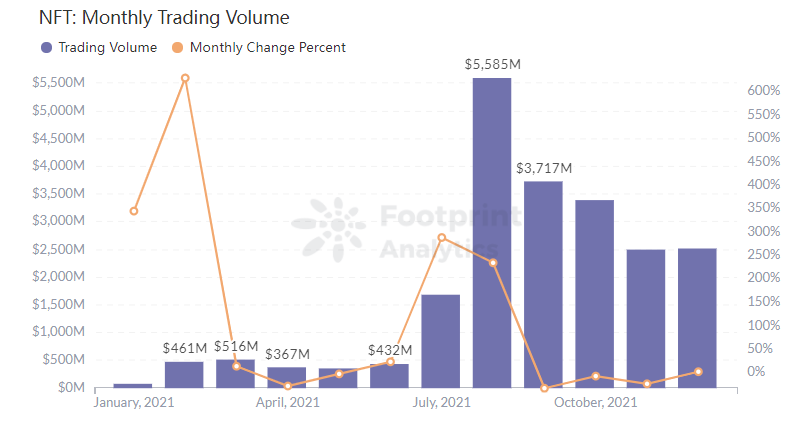

Since July, the NFT market has become blisteringly hot, with a lot of trading and a lot of high-priced NFTs, but the monthly change in NFT trading volume shows that only the July to August period was a period of increased trading, with a gradual decline after August.

It seems to be a process of overheating and then calming down. The NFT market, which is gradually passing through a period of calm, saw positive volume growth of 0.78% to US$2.51 billion in December.

This growth was largely driven by a number of NFT collectibles and Metaverse land sales on Ethereum. When looking at Footprint Analytics’ NFT trading volume over the past 7 days, Doodles, which has attracted a large number of users with its public offering, is up 84%, Mutant Bored Ape Yacht Club is up 39%, and virtual land The Sandbox is up 17%. Notably, Capsule is up 3014.86% to rank fifth with $4.8 million.

Investors invest in DeFi & NFT as well as in Web3

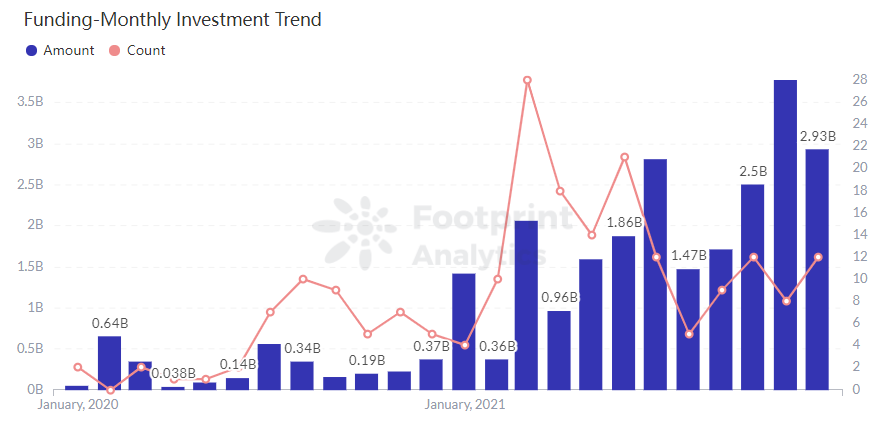

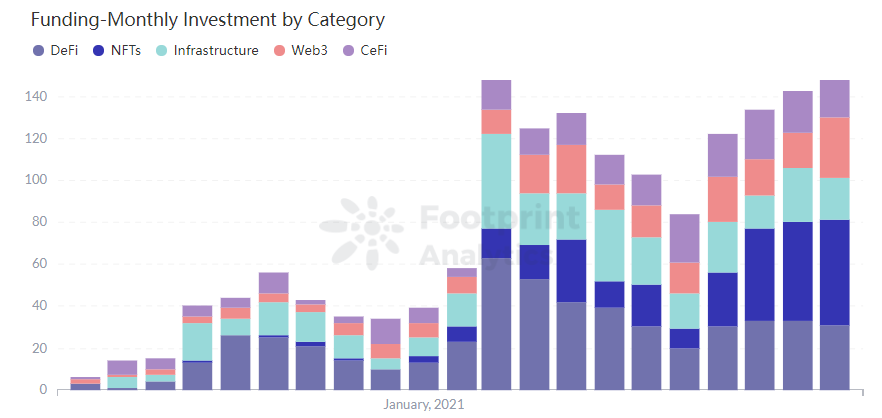

The number of Investments made by major investors increased by 6.3% in December, but the amount invested decreased by 25%. In terms of investment sectors, investors remained deeply invested in the DeFi and NFT sectors, with little difference in the amount of money invested compared to November. Meanwhile, with the development of blockchain technology, more and more investment funds were pumped into Web3 , with the number of investments increasing by 70.6%.

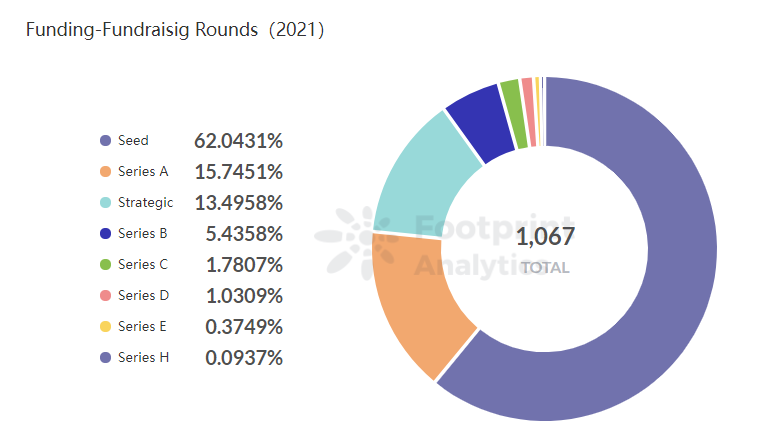

Financing is still in the early stages, mostly seed rounds

In December, the cryptocurrency market was still dominated by seed rounds at 64.04%, followed by Series A funding at 15.75%, strategic funding at 13.50% and Series B and above at less than 7%. This reflects the fact that the cryptocurrency market is still in a budding development phase for new projects.

Summary

December saw a slowdown in the cryptocurrency market, with major cryptocurrency prices falling and BTC prices fluctuating between $40,000-$50,000 and ETH prices fluctuating between $3,000-$4,000.

DeFi’s TVL of $270.69 billion was slightly lower than November’s TVL. NFT volumes grew slightly with Mutant Ape Yacht Club, Capsule and The Sandbox all adding to the growth in volumes.

Public chains Terra and Binance are battling it out for the 2nd position in the public chain. Investor interest in the DeFi and NFT space remains span, while more funds are being injected into the Web3 space.

Let’s wait and see if Web3 will drive new developments in the cryptocurrency market in 2022, and who will take 2nd place in the public chain.

December Events Review

Nations Current Affairs:

- South Korean Crypto Exchanges to Follow Coinone in Verifying Private Wallets

- Several Chinese Courts Rule That Contracts for Transactions Related to Bitcoin and Other Virtual Currencies Are Invalid

- Turkey’s central bank to ban cryptocurrencies for buying goods, services

- Dubai World Trade Center Will Become a Comprehensive Regional and Regulatory Agency for Cryptocurrencies

- U.S. Federal Regulator Says Credit Unions Can Partner with Crypto Providers

Fundraising:

- Blockchain startup TRM Labs raises $60M in Tiger Global-led round

- Loot Squad announced $5 million initial round

- Astra Protocol Completes 9 Million USD Financing

- Colony Raises $18.5 Million To Fuel Next-Generation Applications In The Avalanche Ecosystem

- Kudo Money Raises $4M in a Strategic Round to Bring Identity Passports to Crypto

Public Chain:

- Ethereum Launches First Public Testnet for Full Upgrade to Pos

- Binance implement Bruno upgrade and BEP-95 real-time token burning

- Kava 9 Test Network Line, Has Integrated IBC and Supports Cosmos Ecological Asset Cross Chain

- Layer 2 Ethereum Protocol Optimism Officially Removes Whitelist, Will Allow Devs to Deploy Directly on Its Mainnet

- Web3 Content Delivery Network AIOZ Network is Now Live on the Mainnet

DeFi:

- The Sandbox Game Are Planning to Migrate to Polygon and Launch DAO in 2022

- Anyswap Officially Changes Its Name to Multichain

- GameFi project Tap Monster changes name to PunkMonster

- ConstitutionDAO Permanently Waved Multi-signature Access

- Crypto artist Pak’s work surpasses Beeple in total value at #1

NFT:

- Mintable NFT Platform Integrates Immutable X Layer 2 Scaling Solution

- NFT marketplace OpenSea transaction total exceeds $12 B, a record high

- OpenSea Daily Trading Volume Tops $150M, Record High Since Sept. 16

- Sotheby’s Makes $100 Million in NFT Sales with Younger Audience

- BAYC NFT Transaction Totals Surpass $800 Million Over NBA Top Shot

Stablecoins:

- Coinbase Users Can Earn Yield with DeFi on DAI

- The Supply of USD Stablecoins Has Increased by 388% This Year, Driven by Defi and Derivatives

- USDC issuance exceeds 40 B U.S. dollars and hits a record high

- Tether Issues an Additional 1B USDT on the Wavefield Blockchain

- USDC Total Circulating Supply Reaches $38.44 Billion, USDT’s Supply at $73.12 Billion

Security Events:

- NFT Project Monkey Kingdom Hacked for Nearly US$1.3 Million in SOL

- $3.2 Million ETH Stolen Via MetaDAO DeFi Protocol Rugpull

- $8.2M Lost as Visor Finance Suffers Latest DeFi Hack

- Grim Finance Suffered a Lightning Loan Attack, Lost More Than $30M

- Hackers steal $120 million from Badger DeFi platform

Description: With the crypto market slowing down and competition from public chains fierce, Terra is looking to replace Binance.

Footprint Analytics Analyst: [email protected]

Date: Jan 11th, 2022

Data Source: Footprint Analytics Dec. Report Dashboard

What is Footprint

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.