A crypto wallet belonging to a defunct Russian crypto exchange BTC-e moved 10,000 Bitcoin (BTC) ($165 million) on Nov. 23 to two unidentified wallets.

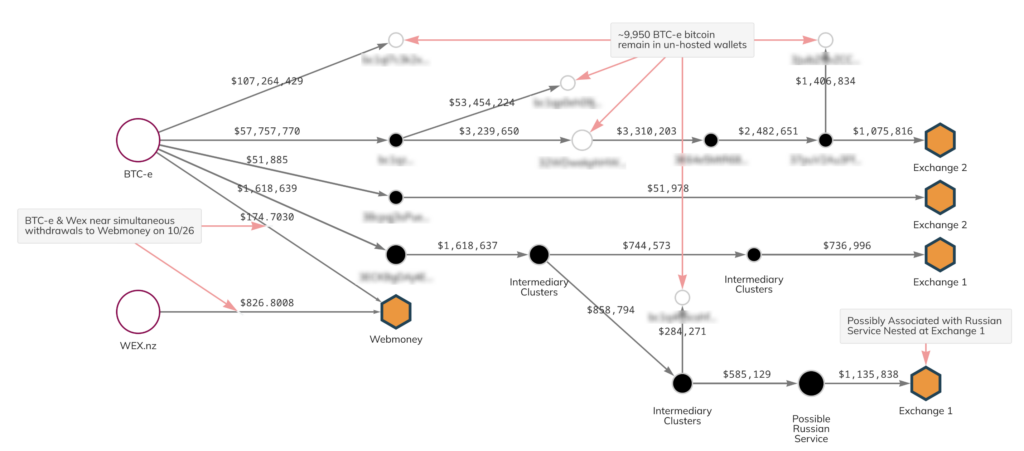

Chainalysis reported on Nov. 23 that BTC-e had begun withdrawal from its wallet nearly a month ago. On Oct. 26, successors of the defunct exchange sent small amounts of Bitcoin to a Russian electronic payments service, Webmoney.

The blockchain analytics firm added that BTC-e made a test payment on Nov. 11 before a further transfer of 100 Bitcoin to an exchange on Nov. 21.

“Of the total sent in the last several days, approximately 9,950 Bitcoin remain in personal wallets, while the rest was moved through a series of intermediaries to four deposit addresses at two large exchanges.”

Peckshield reported that the address involved in the transaction had received the 10,000 BTC in February 2014.

#PeckShieldAlert The address received 10k BTC on 6 Feb 2014https://t.co/wtAIcecWJx pic.twitter.com/81smfZglZh

— PeckShieldAlert (@PeckShieldAlert) November 24, 2022

Meanwhile, CryptoQuant founder Ki Young Ju noted that 65 BTC was transferred to HitBTC and called on the exchange to suspend the account.

Criminals profit over 5000%

While one Twitter user wondered why the criminals did not attempt to sell the BTC when it traded at record highs during the bull run, Young Ju pointed out that they still made a 55-times profit from the trade.

Well, they don’t care. It’s 55x profit for them anyway.

They got these Bitcoins when the price was $297 in Jan 2015, and the BTC price is $16,617 now, so approx. PnL is 5,594%.

— Ki Young Ju (@ki_young_ju) November 24, 2022

According to Young Ju, the criminals got the Bitcoin when it traded for $297 in Jan 2015, but the asset is now trading for around $16,617, meaning their profit is nearly 5,594%.

Old Bitcoin movement increases sell pressure

The movement of this old Bitcoin could increase the selling pressure on an industry that has already reached a two-year low.

According to Young Ju, old Bitcoin movement is bearish in most cases because they are BTC minted in the lawless era and owned by individuals who can’t use KYC-compliant custodian services.

Old #Bitcoin is a bearish thing in most cases.

Think about $BTC being:

1/ minted in the lawless era

2/ owned by individuals who can’t use KYC’d custodian services.

3/ distributed through multiple exchanges in tens of thousands of small deposits, which don’t require KYC. https://t.co/hZN3vFGJ8M pic.twitter.com/DKntRAj7N1

— Ki Young Ju (@ki_young_ju) August 22, 2022

Meanwhile, CryptoQuant tweeted that BTC spent output between the 7 to 10 years old band has reached 10,000 –an 8-month high.

Breaking News$BTC spent output of 7 years to 10 years UTxO age bands just hits an 8-month high with 10K BTC.

Live Chart 👇https://t.co/v2UAOyJXeT pic.twitter.com/dV1FSfD1KP

— CryptoQuant.com (@cryptoquant_com) November 23, 2022