With the crypto industry struggling through a record bear market situation, one asset that has polarized analysts is Coinbase stock which has fallen to new lows.

Bitwise Invest Chief investment officer Matt Hougan thinks Coinbase stock is undervalued despite falling significantly in 2022.

According to Hougan, Coinbase raised money at a valuation of $8 billion in 2018. At the time, it had 22 million users, generated $520 million in revenue, and had $11 billion in assets on the platform.

Fast forward to 2022, the revenue is $3.3 billion, it has 101 million users, and the platform’s assets are now $101 billion. Despite these clear indications of growth, the company is trading at a valuation of $9 billion.

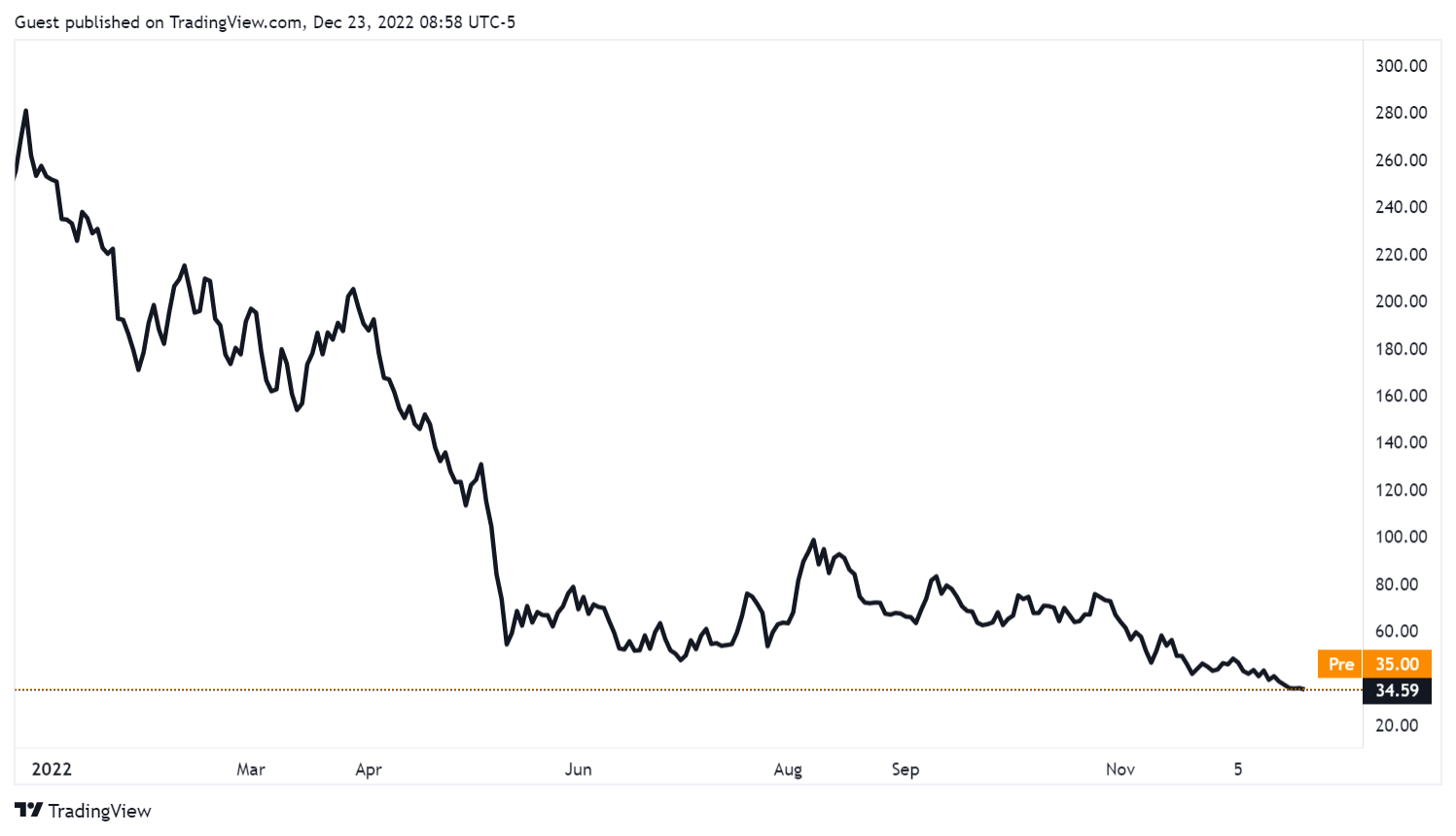

Coinbase stock is at an all-time low

Coinbase stocks have fallen since the start of the year, trading around $35 as of press time. This represents a more than 86% drop in the year-to-date metric.

Following its stock value decline, the exchange’s market cap dropped to around $8 billion, while even Dogecoin’s market cap surpassed it at $10 billion. While this does not reflect the exchange’s intrinsic value, it shows how the current market conditions have affected it.

Analysts have tied its stock decline to several factors, which included the current crypto winter and the fact that the exchange has been burning through cash at a record pace. During the first three quarters of 2022, the exchange recorded over $2 billion in losses.

Coinbase’s primary revenue source is from trading fees, and the current market has impacted that. While it has more customers, trading fees are lower because crypto asset values are down. Rivals like Binance.US have also tried to entice traders with new features like zero-trading fees for assets like Bitcoin (BTC).

CEO Brian Armstrong told Bloomberg that he expects the exchange’s revenue to drop by as much as 50% in the current year.

Industry perspectives

Some think Coinbase is overvalued, pointing to its cash burn, lack of significant improvements over the years, and employee stock compensation. Several market analysts have downgraded the stock. Mizuho recently downgraded the stock to underperform, setting a $30 price target.

Before then, the Bank of America had downgraded the stock from Buy to Neutral, setting a $50 price target. It noted that while the exchange is nothing like FTX, the material decline in the value of Bitcoin will affect its stocks.

Many in the crypto community also share this view, noting that Coinbase was overvalued in 2018. Lazar Wolf tweeted that E*Trade sold for 2.5% of its assets under management, while JP Morgan is valued at around 10% of its AUM.

Wolf added that he was a series C investor in the exchange and dumped all his stocks last year at $340.

Bullish views remain

Meanwhile, despite the pessimism shared by some analysts, others share Hougan views.

21.co CEO Hany Rashwan expressed the belief that Coinbase stocks are undervalued. According to him, although Coinbase has lost a lot of money this year, it has doubled its share of the fiat exchange market since September.

Rashwan said that anyone who believes in crypto’s long-term potential and values Coinbase’s recent growth rates and market share would see the one or two years of poor market conditions as an aberration. He added:

“They’re losing a lot of money, yes. They should obviously reduce these losses, but I still see a fundamentally good business underneath.”

Meanwhile, Coinbase CEO Brian Armstrong insists that the company will still exist in the next two decades and believes investors should buy COIN stock just as they buy crypto assets. Armstrong said:

“We’ll also be a beneficiary of increased regulation and diversifying our revenue stream away from trading fees.”