According to data from Glassnode, Bitcoin‘s Over-The-Counter (OTC) holdings, an often-overlooked aspect of cryptocurrency trading, have surged to their highest level in the past year, with inflows consistently outpacing outflows since May 2023.

Over-The-Counter (OTC) trading denotes the direct exchange of assets like Bitcoin between two parties, bypassing the traditional exchange. This off-exchange trading happens via a decentralized dealer network and often involves substantial amounts of Bitcoin.

This is done through a decentralized dealer network. In the context of Bitcoin, OTC trades are often used by whales who want to buy or sell Bitcoin without impacting the market price too much. This can be important as large trades on public exchanges can cause significant price fluctuations.

OTC holdings refer to the amount of Bitcoin held by these OTC desks. These holdings can offer insights into the behavior of large investors. For instance, an increase in OTC holdings could suggest that more whales buy Bitcoin through OTC trades, potentially indicating bullish market sentiment. Conversely, a decrease in OTC holdings could mean the opposite.

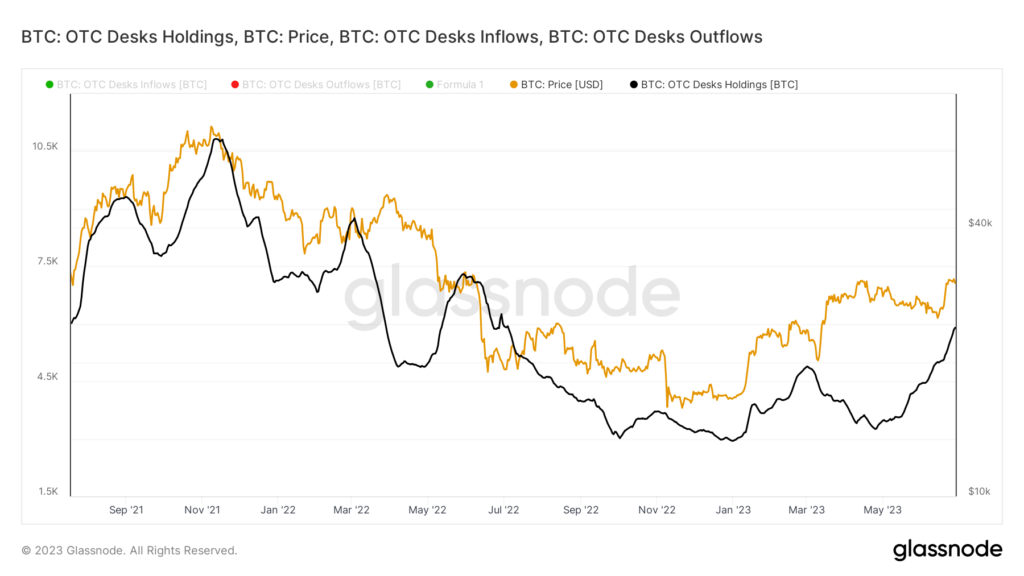

Bitcoin OTC holdings

Beginning the year with a local low of roughly 2,969 BTC, OTC holdings have bounced back, hitting 6,285 BTC on June 28, 2023, the highest level witnessed since May 2022.

Despite this recent surge, Bitcoin OTC holdings are yet to surpass their all-time high of 11,928 BTC, established on Aug. 17, 2020. This record was set amidst Bitcoin’s peak price of $68,692 on Nov. 10, 2021.

Interestingly, the price of Bitcoin and the OTC holdings appear loosely correlated, with OTC holdings lagging slightly behind BTC prices. For example, as Bitcoin has traded relatively flat since June 21, OTC holdings have experienced an increase of 12.45%, climbing to 5,899 BTC from 5,244 BTC using a 30-day EMA. This increment happened while Bitcoin’s price remained around the $30k mark.

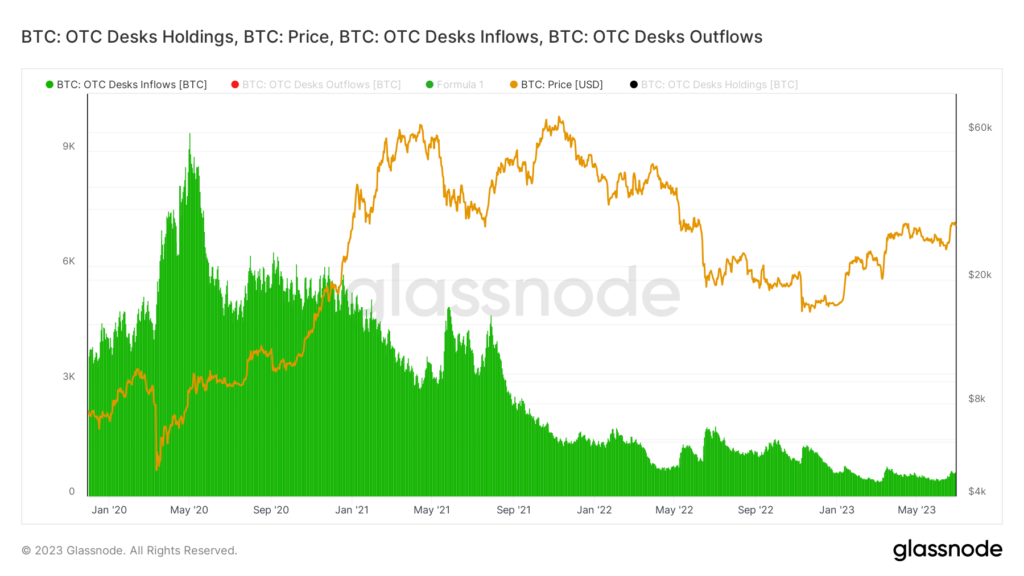

Bitcoin OTC inflows

Concurrently, Bitcoin OTC inflows have continuously declined since their peak around the last Bitcoin halving in May 2020. At that time, OTC desks regularly saw inflows well above 6,000 BTC. However, as evident from the reduction in holdings, 2023 has been less favorable, with inflows plunging to a 30-day EMA low of 394 BTC.

However, June appears to have reversed the trend, with inflows rising to approximately 645 BTC, a significant drop from pre-pandemic levels.

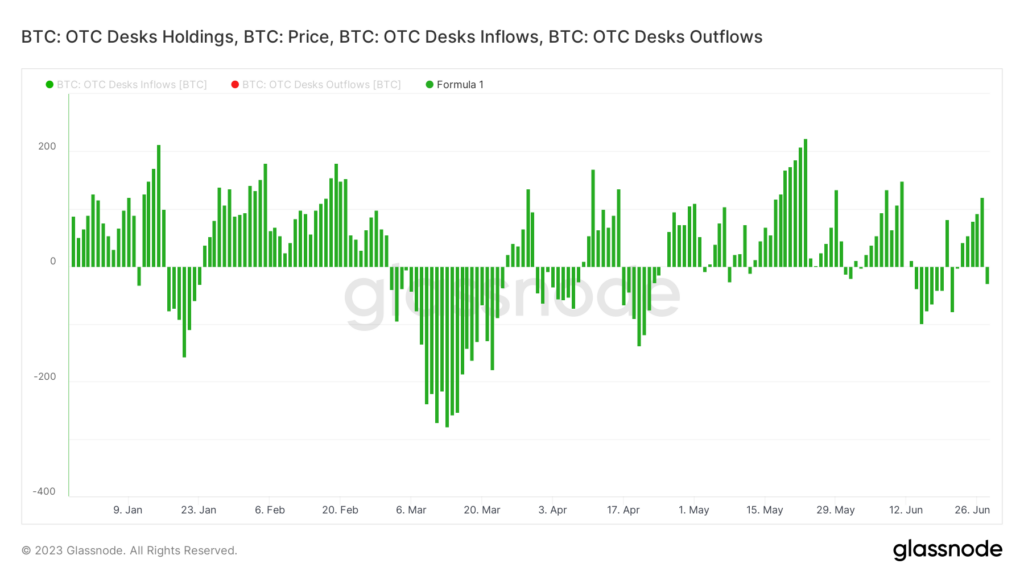

As per Glassnode data, a comparison of OTC inflows and outflows reveals a consistent surplus of inflows since May 2023. This is particularly notable because the last period of excess outflows was observed in March 2023.

While recent trends in OTC holdings and inflows hint at renewed market confidence in Bitcoin, the overall decline in inflows since 2020, along with OTC holdings still being significantly below their all-time high, indicates that the market has substantial room for growth.

These trends and metrics are worth watching for investors and enthusiasts, serving as critical indicators of whale sentiment and potential investment opportunities. Further, given the myriad of bankruptcies, lawsuits, and other regulatory issues that have plagued the crypto industry over the past 12 months, OTC desk trades are expected to see continued activity as reserves are reorganized, or creditors are repaid.