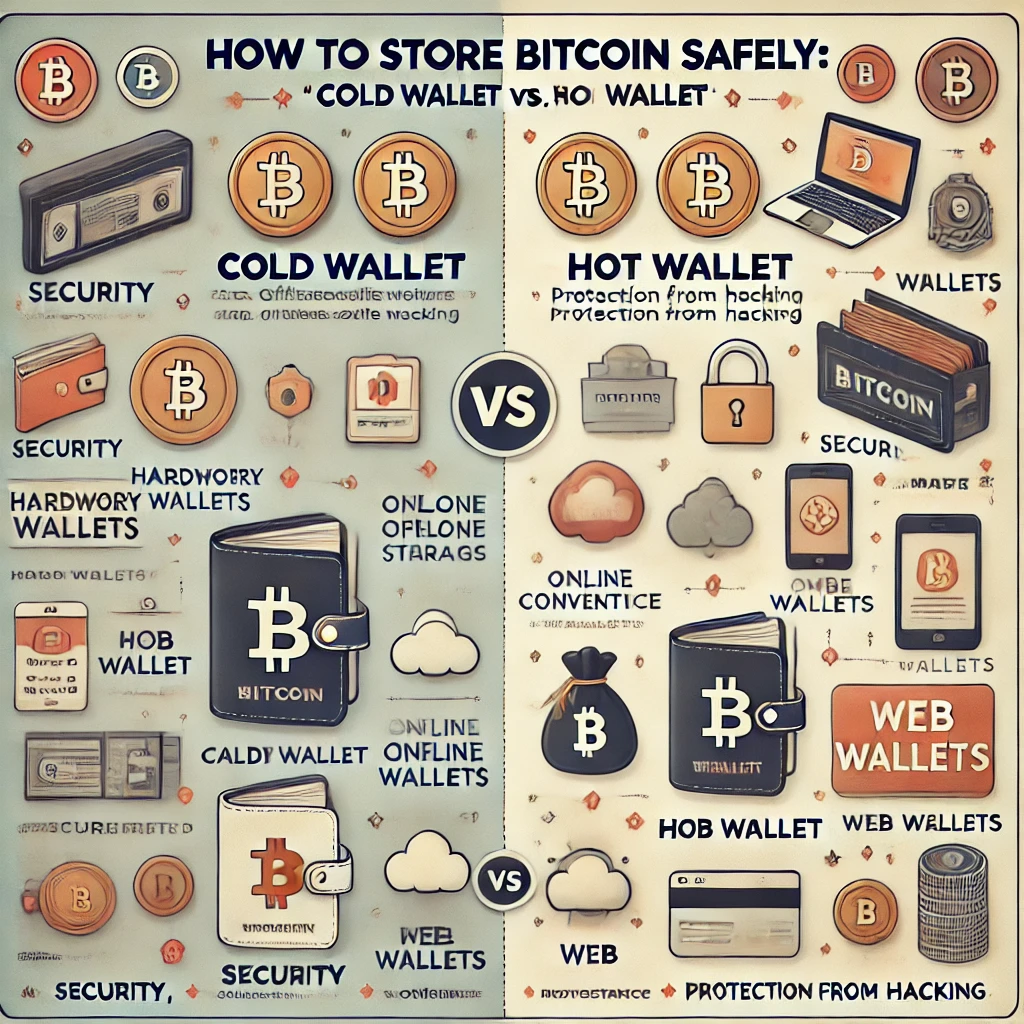

As Bitcoin and other cryptocurrencies gain popularity, protecting your digital assets becomes a top priority. Understanding the different ways to store Bitcoin is essential for every crypto investor. In this guide, we’ll explore the differences between cold wallets and hot wallets and provide tips on how to keep your Bitcoin secure.

What is a Bitcoin Wallet?

A Bitcoin wallet is a digital tool that allows you to store, send, and receive Bitcoin. It doesn’t hold the physical coins but keeps track of your private keys—the cryptographic keys that give you access to your Bitcoin on the blockchain. Wallets come in two main types: hot wallets and cold wallets, and each has its own advantages and risks.

What is a Hot Wallet?

A hot wallet is a type of Bitcoin wallet that is connected to the internet. These wallets are convenient because they allow for quick transactions and easy access to your Bitcoin. Hot wallets include mobile apps, desktop software, and even exchange-based wallets like those provided by Binance or Coinbase.

Pros of Hot Wallets:

- Easy to set up and use

- Quick access to funds for transactions or trading

- Ideal for smaller amounts or frequent use

Cons of Hot Wallets:

- More vulnerable to hacking or phishing attacks

- Dependence on third-party services (for exchange wallets)

What is a Cold Wallet?

A cold wallet is a Bitcoin wallet that is stored offline, disconnected from the internet. Cold wallets are often hardware devices or paper wallets. They provide enhanced security by keeping your private keys offline, making it harder for hackers to access your funds.

Pros of Cold Wallets:

- Extremely secure from online threats

- Ideal for storing large amounts of Bitcoin long-term

- You fully control your private keys

Cons of Cold Wallets:

- Less convenient for frequent transactions

- Can be lost or damaged if not properly stored

How to Choose Between a Hot Wallet and a Cold Wallet

Deciding between a hot wallet and a cold wallet depends on your Bitcoin usage and the amount you plan to store.

- Use a hot wallet if you need quick access to your Bitcoin for day-to-day transactions or active trading.

- Use a cold wallet if you’re holding a significant amount of Bitcoin for the long term and prioritize security over convenience.

For most users, a combination of both (using a hot wallet for small amounts and a cold wallet for savings) offers a balanced approach to convenience and security.

Best Practices for Storing Bitcoin Safely

Regardless of the type of wallet you choose, follow these best practices to ensure your Bitcoin stays safe:

- Enable two-factor authentication (2FA) on your accounts and wallets.

- Regularly back up your wallet and store recovery phrases securely.

- Use strong, unique passwords for all crypto-related accounts.

- Never share your private keys with anyone.

- Stay vigilant for phishing scams and fake websites or apps.

Conclusion

Storing Bitcoin safely requires a balance between convenience and security. Hot wallets offer ease of access for frequent transactions, while cold wallets provide peace of mind for long-term storage. By understanding the strengths and weaknesses of each, you can better protect your Bitcoin from potential risks. Always follow best practices for securing your crypto assets, and consider a mix of both wallet types to safeguard your holdings.