Fundstrat Global managing partner and notorious Bitcoin bull Tom Lee has reaffirmed his prediction of a $25,000 Bitcoin end-of-year price despite underwhelming post-Consensus cryptocurrency market performance.

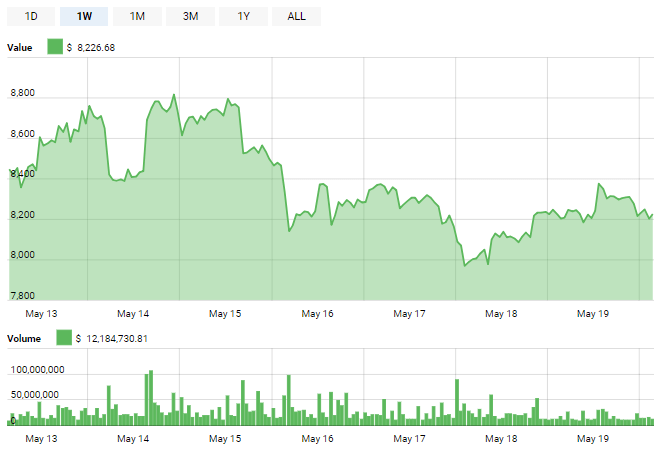

The Consensus conference, which ran in New York from May 14-16, is widely considered the most important event on the blockchain calendar. Historically, cryptocurrency prices have rallied after the event on a wave of positive investor sentiment — a pattern that has not been repeated this year.

Consensus Rally Fails to Ignite

Prior to the conference, Lee predicted significant market gains between 10 and 70 percent, stating that the highest-ever attendance rate at the event would see Bitcoin once again test the all-time high of $20,000:

“Already one of the largest crypto conferences in the world, attendance this year is up dramatically and coming at a time when Bitcoin/Crypto is down YTD. Hence, we expect the Consensus rally to be even larger than past years.”

Consensus rallies in previous years have seen Bitcoin prices skyrocket — optimistic projections of a potential 2018 Consensus rally would have seen the cryptocurrency climb back to the $15,000 level. Consensus 2018, however, came and went without any positive market action at all.

Bitcoin prices fell nearly 10% over the course of the conference week, dropping below $8,000 on the final day of the event until hitting a low of $7,931. Fundstrat digital currency analyst Alex Kern highlighted the changing nature of Consensus as a catalyst for the price drop:

“Many repeat attendees commented that the panels felt more like commercials than substantive discussions, which was not the case last year”

In an interview with CNBC’s Fast Money, Lee stated that while he admits that he was perhaps “overly optimistic” about a potential Consensus price rally, he’s now even more bullish on Bitcoin:

“While there was not a Consensus bump, our conviction on crypto-currencies strengthened during the conference … It’s the people that you know are important to this industry coming together.”

Crypto Industry “Needs Trifecta of Progress”

The Consensus 2018 rally failed to launch, according to Lee, due to three key points of failure. Months of regulatory uncertainty led many market participants to look forward to the conference as a precursor to a market confidence surge, but a failure to provide clarity on the issue of regulation delivered only disappointment.

CRYPTO: #Consensus2018 rally did not happen, very disappointing. What we needed was a trifecta of progress: (i) institutional custody/tools; (ii) buy-in by banks/investment managers; (iii) regulatory clarity (3 of 3 needed), but we got progress on (i) and (ii). Full text below pic.twitter.com/XcqNhgYgK7

— Thomas Lee (@fundstrat) May 18, 2018

Lee focuses on a lack of regulatory opacity as a key driver of the Consensus 2018 sell-off, stating that consensus on a regulatory framework around crypto from the SEC is critical in order to catalyze “broad cultural buy-in by institutional investors.”

The entry of institutional capital into the cryptocurrency market is promoted as one of the primary causes of a potential 2018 bull run. Institutional investors are tentatively entering the market, states Lee, but institutional custodial tools for crypto are essential to accelerating institutional adoption.

The recent launch of Coinbase Custody announced over the course of Blockchain Week, is set to provide institutional investors with the financial architecture necessary to enter the market en masse.

If investment managers are to buy into cryptocurrency, according to Lee, widespread acceptance must be promoted by addressing several factors:

“In our many conversations, with institutional investors/banks, we find that specific teamas may be quite enthusiastically committed, but widespread internal acceptance of crypto/blockchain faces hurdles of indifference/inertia, legacy bias/protectionism, and career risk.”

Lee: ‘Bitcoin on Track to 25K’

Regardless of poor post-Consensus market performance, Lee has maintained his bullish stance on Bitcoin, sticking to his $25,000 end-of-year prediction and emphasizing the importance of holding BTC at the right time:

“Bitcoin doesn’t have to go up every day to move from $8,000 to $25,000. The ten best days account for all the return of bitcoin in a year. If you didn’t own bitcoin for ten days each year, you lost 25 percent each year.”