The University of Cambridge recently launched an index for tracking the electricity consumption from Bitcoin mining. The data provides interesting insights into the profitability and environmental impact of cryptocurrency mining.

Tracking Bitcoin electricity consumption in real time

Cryptocurrencies have been around for more than a decade, but the environmental impact of the industry is still hard to calculate. Nonetheless, Bitcoin has attracted the ire of the environmentally conscious.

Bloomberg ran a headline saying “Bitcoin Could Theoretically Put Paris Climate Goals Out of Reach,” The Guardian said Bitcoin mining is “killing the planet,” and CNN said Bitcoin is a “disaster” for the environment. Meanwhile, Bitcoin advocates hold that the energy that goes into maintaining the fiat money supply or mining for gold is greater than what is used for the Bitcoin network.

While both sides of the debate go to extremes, finding reliable data is near impossible. This is exactly why the University of Cambridge launched a new tool that aims to combat the misconceptions and false data regarding Bitcoin’s energy consumption.

Developed by the Cambridge Centre for Alternative Finance (CCAF), the Cambridge Bitcoin Electricity Consumption Index (CBECI) tracks the estimated annual electricity usage of the Bitcoin network in real time.

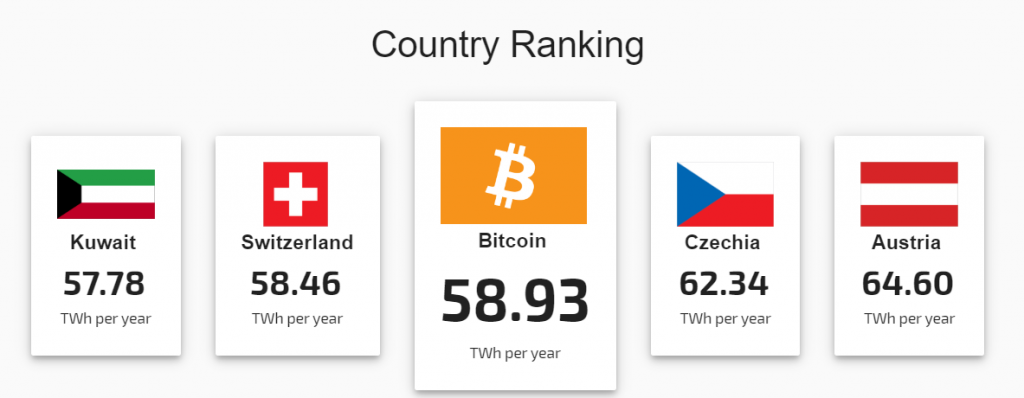

Annualized electricity consumption by Bitcoin network as of is 58.93 TWh—which roughly equals 0.24 percent of the total electricity consumption in the world.

Michel Rauchs, a researcher at CCAF, announced the news on Twitter, saying that CBECI was developed in order to present both sides of the Bitcoin sustainability debate.

8) We would like to provide an unbiased and objective ground for comparisons that presents the two sides of the debate so that visitors can independently assess the situation and make up their own mind. https://t.co/pZZggOrQwY

— Michel Rauchs (@mrauchs) July 2, 2019

According to the Index’s official website, the model was based on a bottom-up approach. Developed by Marc Bevand in 2017, the model uses various types of mining hardware as the starting point and provides an estimate of the network’s electricity consumption.

Ultimately useful data

Cambridge University noted that, while more accurate than most sources online, data from CBECI is still limited. As it’s impossible to determine the exact energy consumption of the Bitcoin network, the CBECI provides a range of possibilities. This range consists of lower bound and upper bound estimates, as well as a best-guess prediction.

The lower bound estimates assume that miners are using the most-efficient mining equipment to mine bitcoins, while the upper bound estimates assume that miners are using least-efficient mining equipment possible–as long as mining remains profitable in terms of electricity cost. The best guess estimates assume that miners are using a mixture of new and old mining equipment, instead of a single hardware model.

These estimates rely on very specific assumptions, listed in the Index’s methodology page. Any one of those assumptions can vary significantly depending on multiple factors. For example, the model is extremely dependant on a broad estimate of the cost of electricity.

It is also evident that Bitcoin mining equipment has become more efficient over the years. Miners are now 15-20 times more efficient than they were just five years ago. While the Bitcoin mining equipment efficiency was ~0.8 Joules/Gigahash in 2014, it stands near 0.04 Joules/Gigahash (from the Antminer S17 pro) in 2019.

The profitability threshold has also decreased with the introduction of new and more efficient mining equipment. While one could remain profitable with mining efficiency of 2.0 J/Gh in 2015, 0.34 J/Gh efficiency is needed in July 2019 to remain profitable if electricity cost is 5 cents/kWh.

However, electricity efficiency alone is not sufficient to decide which mining hardware to acquire since the model adopted by Cambridge does not factor in various associated costs in mining like equipment cost, labor, maintenance, and cooling costs. Yet, as experts familiar with the industry have asserted, electricity is by far the largest cost driver, followed by equipment depreciation.

CBECI also didn’t take into account significant variations in electricity costs in different countries and regions, or in different seasons while it assumed a standard electrical cost of $0.05/kWh.

But, despite its shortcomings, such a tool could prove to be incredibly useful as more and more traditional media outlets focus on crypto. Misconceptions about Bitcoin mining and energy consumption are frequently used to chastise the cryptocurrency. Now, the media has a source for a reasonable estimate of Bitcoin’s environmental impact.