Bitcoin-pegged ETH tokens remain a topic of a divide in the cryptocurrency community. While such projects have attracted institutional investments and widespread adoption, some observers aren’t pleased with their overall consensus mechanism.

Trust models under scrutiny

Take Wrapped Bitcoin (WBTC), launched in 2018, with BitGo serving as a Proof-of-Reserve custodian for example. WBTC is an ERC20 token that derives its value from Bitcoin, making cross-exchange transfers faster and simpler.

The project was primarily adopted by DEX projects like Dharma and Compound, and available for transfers via “atomic swaps” on Khyber Network and Ren.

Reminiscent of the traditional “fractional reserve banking” system, BitGo is “in charge” of holding all Bitcoin that back all minted WBTC tokens in circulation on Ethereum. All such tokens can be tracked and traced on the latter’s blockchain, with all other benefits of ERC20 tokens.

BitGo security officer Benedict Chan notes users can simply access a webpage showing all custodied Bitcoin addresses, and comparing with the actual WBTC amounts on the Ethereum blockchain. Swaps help in this regard, users can transact two-way cryptocurrency exchanges while mitigating the risk of a payment default.

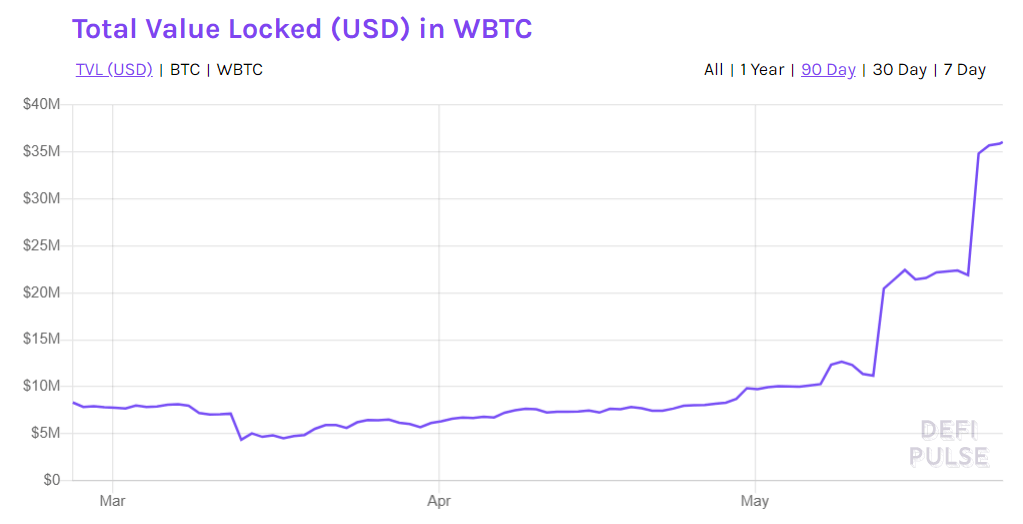

The popularity of such tokens is astonishing. WBTC outgrew the lighting network in 2018, as reports show. Defi firms like MakerDAO have accelerated the trend, with a 1,000 WBTC issuance earlier this month superseding the entire amount of Bitcoin locked on the Lightning network.

But Ethereum’s Vitalik Buterin remains skeptical of similar arrangements. The 26-year-old tweeted his concern on a reply to a post mentioning “2.5x more Bitcoin on Ethereum than Blockstream:”

I’m worried about the trust models of some of these tokens. It would be sad if there ends up being $5b of BTC on ethereum and the keys are held by a single institution.

— vitalik.eth (@VitalikButerin) May 21, 2020

Buterin did not single out BitGo, WBTC, or any of the companies mentioned earlier in the post. But the popularity of such projects could serve as an inspiration for similar, albeit badly designed, projects.

WBTC’s trust models are fully verifiable. However, a project could, in theory, claim to have more asset backing its (hypothetically) issued token. This could potentially give rise to centralization, as Buterin puts it:

“It would be sad if there ends up being $5b of BTC on ethereum and the keys are held by a single institution.”

Furthermore, BTC-pegged ETH tokens, or other asset-backed stablecoins like USDC, rely heavily on third-party custodians to hold the underlying assets. This creates “counterparty risk,” in case such custodians are served a legal notice or hacked.

Maker just added USDC as DAI collateral

Trusted collateral was part of multi-collateral DAI, so not a surprise

“Maker is no longer trustless!”

Not quite, but it’s less trustless than before

Trustless exists on a spectrum

DAI moved from the top right toward the bottom left pic.twitter.com/e98j00v5cT

— Ryan Sean Adams – rsa.eth ? (@RyanSAdams) March 17, 2020

Another concern, as Forbes notes, is “the ability of these entities to censor and rollback transactions, which is anathema to the ethos of the DeFi space.”

DeFi projects remain in their early stages, with loads of development and ironing out of critical points occurring each week, meaning trust concerns may be stamped out for good in the years to come.