Banking giant Goldman Sachs held its highly anticipated client call today, in which the topic of cryptocurrency was floated. Unsurprisingly, they offered a scathing critique of the nascent market, echoing age-old anti-Bitcoin talking points.

Their analysis of Bitcoin – and reasoning for why it should not be considered a viable investment – is highly flawed, however, and has even led some industry executives to point out the hypocrisy of some of their claims.

Goldman Sachs peddles anti-Bitcoin narrative in latest client call

In a recent call with clients, Goldman Sachs brought up Bitcoin in what was likely a response to recent comments from billionaire investor Paul Tudor Jones regarding why he believes the cryptocurrency has significant potential.

Unsurprisingly, their comments were quite negative, as they echoed the standard anti-Bitcoin talking points that critics have been leaning on for the past decade.

They specifically state that they do not recommend either Bitcoin or gold as strategic investments.

“We don’t recommend gold on a strategic or tactical basis for clients’ investment portfolios. We don’t recommend bitcoin on a strategic or tactical basis … even though its volatility might lend itself to momentum-oriented traders.”

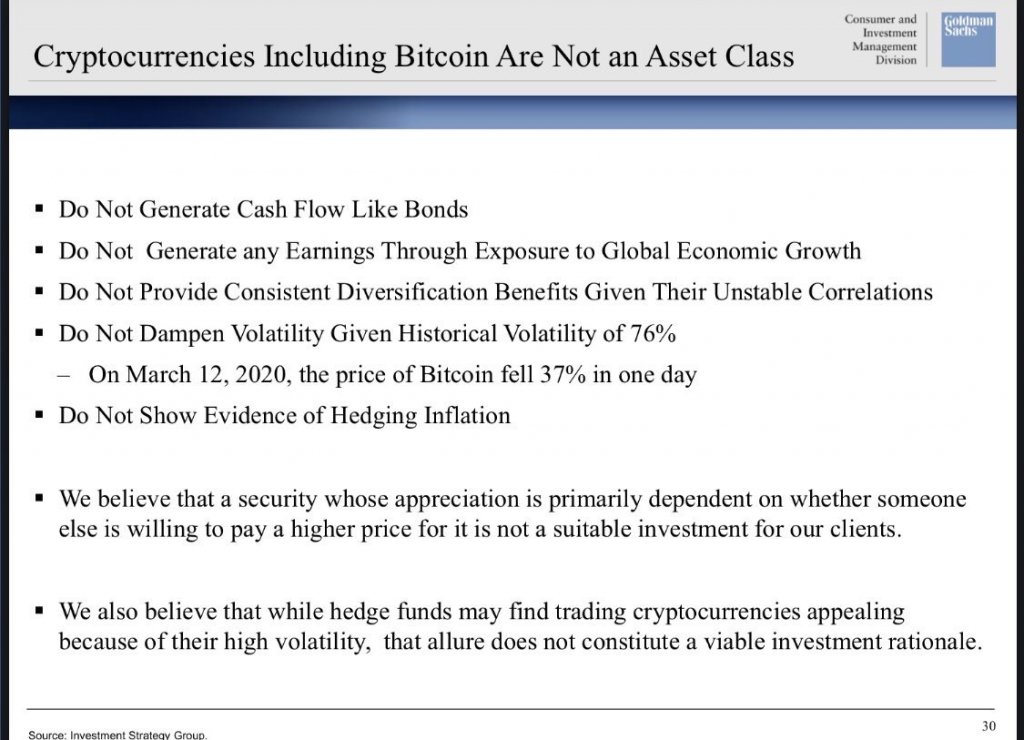

To justify this sentiment, the bank put forth a slide titled “Cryptocurrencies Including Bitcoin Are Not an Asset Class,” which contained a plethora of bullet points on why investors shouldn’t add BTC exposure to their portfolios.

Among other things, they point to the crypto’s high volatility, lack of underlying value, and its ability to see massive single-day declines like the one seen on March 12th as reasons why it is not a “viable investment.”

This slide led Cameron Winklevoss – the co-founder of cryptocurrency exchange Gemini – to note that these talking points are straight out of 2014.

“Hey Goldman Sachs, 2014 just called and asked for their talking points back…”

Goldman’s BTC critique highlights the double standard

Among the points listed above, Goldman also referenced Bitcoin’s use in criminal activities as a reason why it should be avoided.

Tyler Winklevoss – Cameron’s twin brother and the other Gemini co-founder – pointed out that this critique in particular highlights a blatant double standard.

“Goldman Sachs: In 2019, $2.8 billion in Bitcoin was sent to currency exchanges from criminal entities. Fun Fact: Goldman Sachs facilitated $6 billion in money laundering via 1MDB scandal between 2012-13. Double standard much?”

Because Bitcoin is the antithesis of big banks, it is highly unlikely that they will apt to embrace it anytime soon.