Institutional investors are still aggressively investing in Bitcoin in the third quarter of 2020, data from Grayscale shows. It follows six months of consistent capital inflow from institutions into the cryptocurrency market.

The lead of billionaire fund manager Paul Tudor Jones is seemingly encouraging institutions to invest in Bitcoin as an alternative store of value.

Is it really the historic birthing of a new store of value in Bitcoin?

In May 2020, Tudor Jones surprised the cryptocurrency community by publicly expressing his enthusiasm towards Bitcoin.

The billionaire investor said Wall Street is observing a historic “birthing of a store of value,” adding that he has 1 percent of his assets in Bitcoin.

He said:

“Every day that goes by that bitcoin survives, the trust in it will go up.”

Market data shows institutional investors agree with the stance of Tudor Jones.

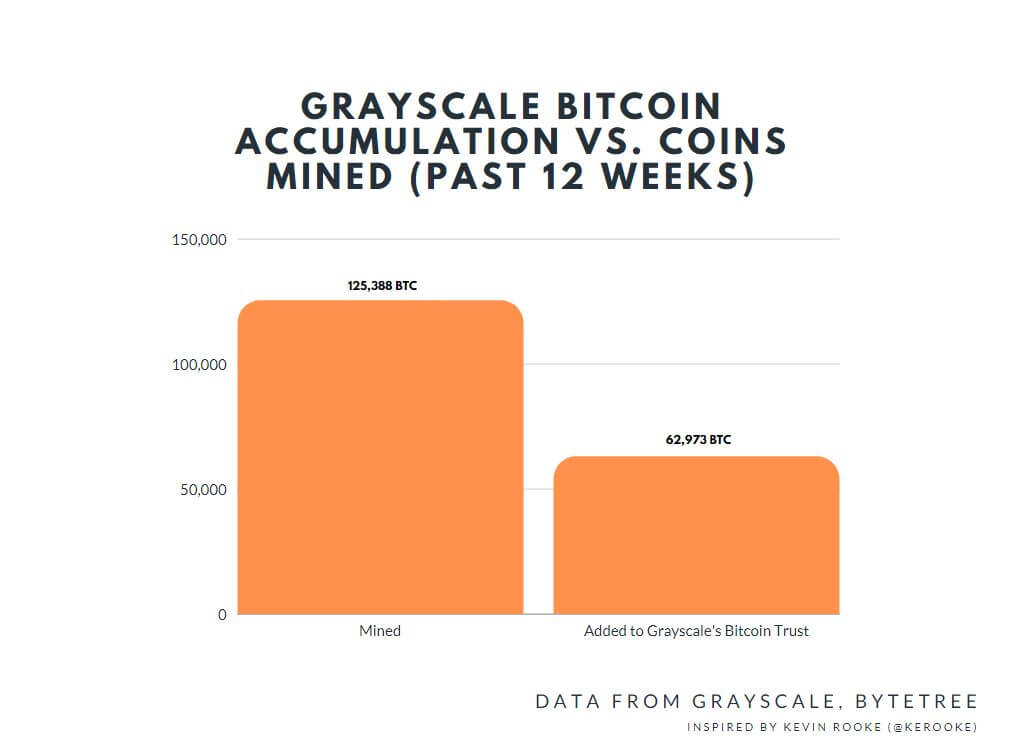

In the past 12 weeks, Grayscale Bitcoin Trust added 62,972 BTC. In the same period, 125,368 BTC was mined.

Grayscale Bitcoin Trust is a publicly tradable investment vehicle operated by Grayscale that allows institutional investors to invest in BTC in the same way they would buy stocks.

It simplifies the process for institutions to increase their exposure to the cryptocurrency market in a strictly regulated ecosystem.

Institutional investors accumulating more than half of BTC mined in the last three months indicates the institutional market is gradually expanding on a day-to-day basis.

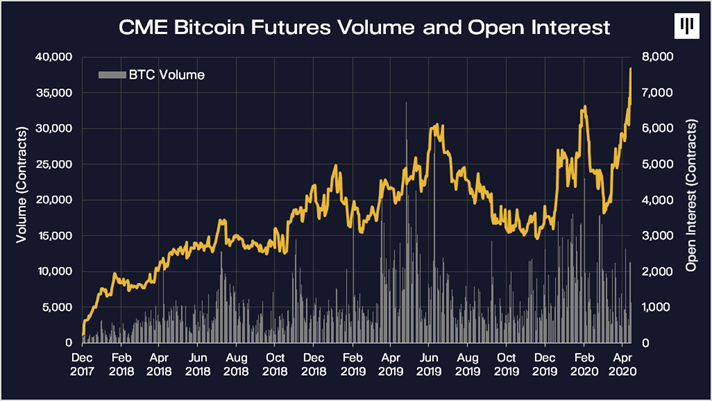

In previous market cycles, the uptrend of Bitcoin was dominated by the futures market and on some occasions, the spot market.

Futures market refers to exchanges like BitMEX, OKEx, and Binance Futures where traders can use additional leverage to trade with more capital than they have.

Spot market refers to exchanges like Coinbase, Binance, and Gemini that allow users to purchase or sell cryptocurrencies with fiat currencies or stablecoins without any leverage.

If the institutional market becomes as big as spot and futures markets in the medium to long-term, it would provide a stronger foundation for future BTC rallies.

Pantera Capital CEO Dan Morehead said:

“CME bitcoin futures provide a real-time proxy for the increase in institutional investment. Open interest recently surged to a record high. In this new era of Unlimited Quantitative Easing it might be imprudent to not have some exposure to Bitcoin.”

What’s key in the coming months?

Earlier this week, CryptoSlate reported that $2 trillion asset manager Fidelity said crypto will continue to gain institutional adoption.

A study done by Fidelity found that the interest of institutional investors towards Bitcoin is likely to be sustained.

Fidelity Digital Assets said:

“The results suggest that digital assets continue to gain adoption and interest by a variety of institutional investors.”

In the longer term, the key to facilitating increasing institutional demand would be to see an emergence of well-regulated custodian solutions, over-the-counter (OTC) desks, and investment firms to assist institutions into the cryptocurrency market.