Weeks after the Bitcoin halving in mid-May, miners are seemingly moving out of China and into Europe — with one prominent mining pool stating geopolitical tensions between the U.S. and China are a major catalyst.

Losing “inertia”

F2Pool, one of the world’s largest Bitcoin mining pool as per data on BTC.com, said in a tweet this week that “inertia” is keeping the most of the Chinese hashrate still intact, but the country will “eventually lose its grip on the industry.”

The inertia keeping the majority of hashrate in China could eventually lose its grip on the industry. It’s likely the development of farms outside of China will increase pace in 2020 ?

—@hodlbug coming to similar conclusions as the excellent thread from @elindinga at @21Shares_ https://t.co/Tlz07mC7TF

— f2pool (@f2pool_official) June 29, 2020

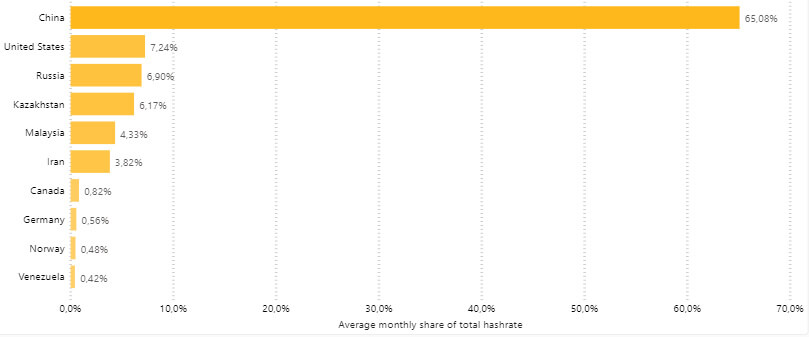

China commands over 65 percent of the global Bitcoin hash rate, as per reports. F2Pool, AntPool, Pooling, and BTC.com are the major players, with smaller ones like Lubian and ViaBTC also making their mark.

China is no newcomer to mining. Such businesses have thrived there for years, with F2Pool itself active since 2013. Low labor costs, cheap electricity, and technical know-how have each played their part in catapulting China’s rise in the mining industry.

However, the podium is likely to see change. F2Pool believes mining farms outside of China will “increase [their] pace” this year.

A 21 Shares analyst echoes the thoughts. Going by @elidinga on Twitter, he said earlier this week that “three important geopolitical” patterns could explain China’s sharp mining decline in recent times.

China has often been deemed as a major concern due to its striking lion’s share in #Bitcoin mining. There are three important geopolitical patterns explaining the sharp decline in China’s dominance over time. Thread⬇️https://t.co/CzE5gfz8AU

— Eli (@elindinga) June 29, 2020

Three political factors

First is the ongoing U.S-China trade war, presumably coupled with the latter’s political behavior with India, Hong Kong, and Taiwan. Capital outflows have seen a record level in the country since 2010. Western investors, hedge funds, and even some East Asian VCs are running for the exit.

The above has, by extension, caused funds spent on Bitcoin mining and farm setups to steadily decline. Mining, by nature, is an expensive affair, oft requiring millions in upfront investments to building a mid-sized mining outlet.

Next is the “de-dollarisation of various financial systems, specifically in emerging economies.” The latter are increasingly turning to crypto-assets ahead of traditional financial instruments. Eli adds:

“Since accessing cryptoassets from crypto exchanges is undoubtedly impossible for users in countries like Iran, setting up mining operations to earn Bitcoin presents [a] viable option.”

11/ In the same vein, Russia started to dedollarise parts of its financial system. Since 2013, it has cut the dollar share of its foreign exchange reserves down to 24% from 45%. Interestingly, Russia has almost a 7% market share in Bitcoin mining. https://t.co/Q5EFQycFFt

— Eli (@elindinga) June 29, 2020

Last, is Bitcoin mining businesses getting institutionalized in the U.S.

U.S Prominence and rising difficulty

Just last week, a relatively new mining firm, Core Scientific, led by ex-Microsoft COO Kevin Turner said it would purchase over 17,595 units of mining rigs from Bitmain. Another firm in Canada, Hut 8 Mining, also raised $8 million from investors to build mining capabilities.

As such, U.S. investors interested in such avenues are family offices, traders, and accredited investors, notes Eli. He added this trend was likely to shift to professional traders in the short term.

Data shows the U.S. is already catching on — commanding 7 percent of the global mining hash rate:

Meanwhile, Eli said retail mining still remains active in the Bitcoin market, presumably using old GPUs to earn their bread. However, they are likely to be stamped out in the near-term as Bitcoin’s difficult changes and corporate miners invest in better equipment.