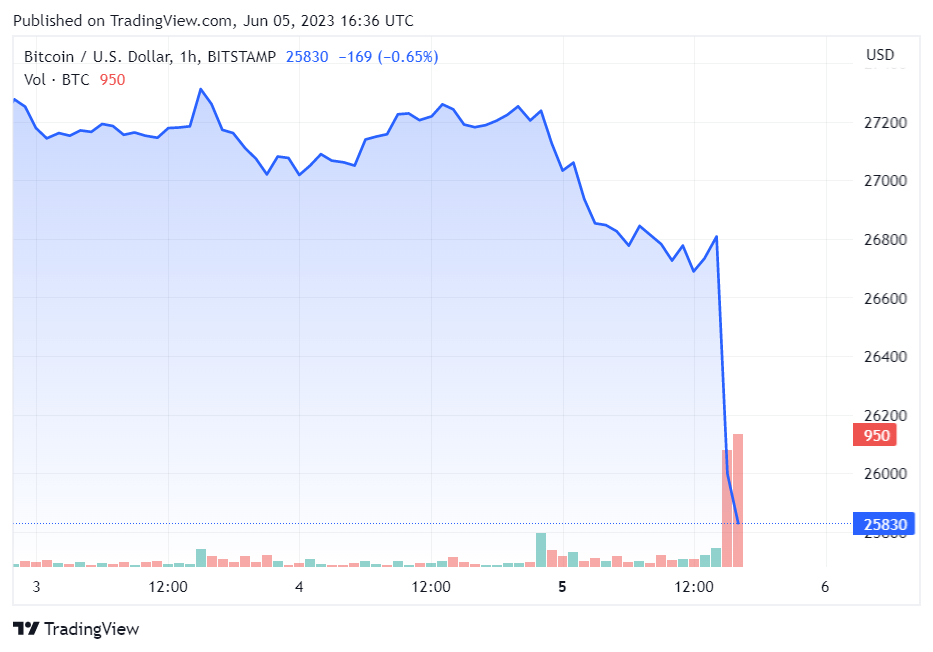

The U.S. Securities and Exchange’s (SEC) lawsuit against Binance wiped off over $200 million within one hour from crypto traders who held positions on the market.

Following the news, CryptoSlate’s data showed that the total market cap of digital assets declined 2.87% to $1.12 trillion.

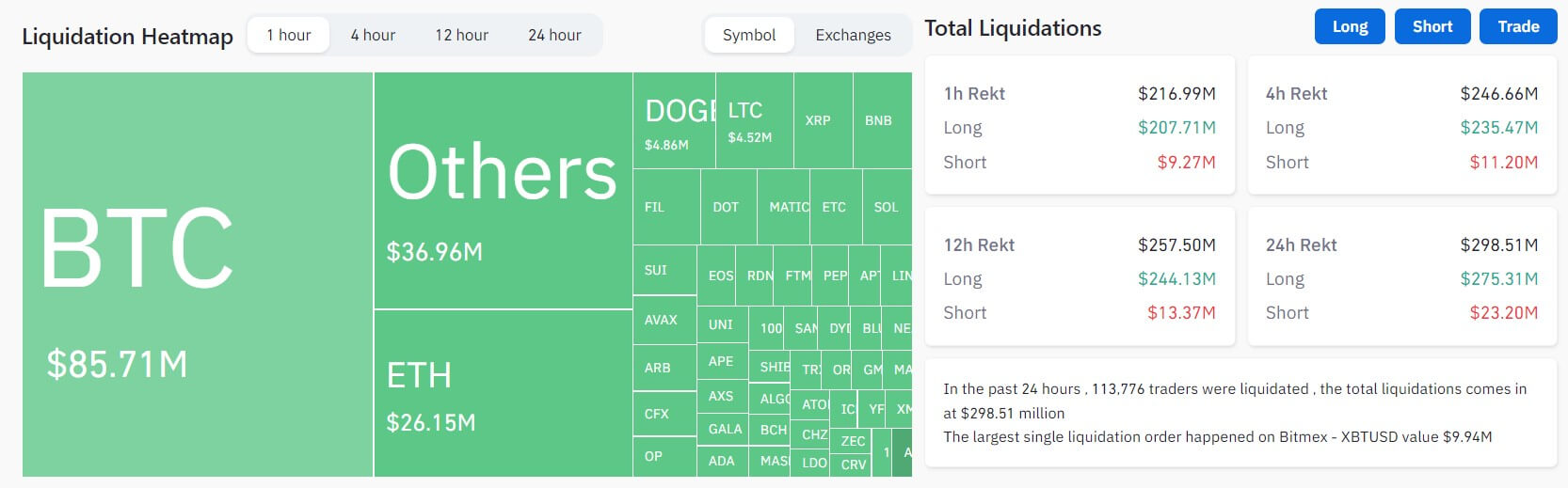

Nearly $300M in the last 24 hours

The crypto market saw $298.51 million liquidated in the past 24 hours, with more than 110,000 traders affected.

Data from Coinglass showed that long traders lost $275.31 million, with Bitcoin and Ethereum accounting for $130.46 million of these losses.

Meanwhile, short traders experienced $23.2 million in liquidations. The top two digital assets were responsible for around 49.5% of these losses.

Other assets such as BNB, Chainlink, XRP, Litecoin, and Solana experienced less than $2 million in liquidations, respectively.

Across exchanges, most of the liquidations occurred on OKX, Binance, and ByBit. These three exchanges accounted for 75% of the overall liquidations, with 92% being long positions. Other exchanges like Huobi, Deribit, and Bitmex also recorded a sizeable amount of the total liquidations.

The most significant liquidation occurred on Bitmex – XBTUSD, valued at $9.94 million.

Red market

Bitcoin dipped from over $27,000 to below $26,000 within one hour and was trading at $25,859 as of 16:36 UTC

The price of Bitcoin is down overall by almost 5% over the past 24 hours.

Binance-related BNB saw the highest loss, plunging by nearly 10% to $281, while Ethereum (ETH) fell 3%. Other top digital assets like XRP, Cardano (ADA), Dogecoin (DOGE), and others also reported significant losses during the reporting period.