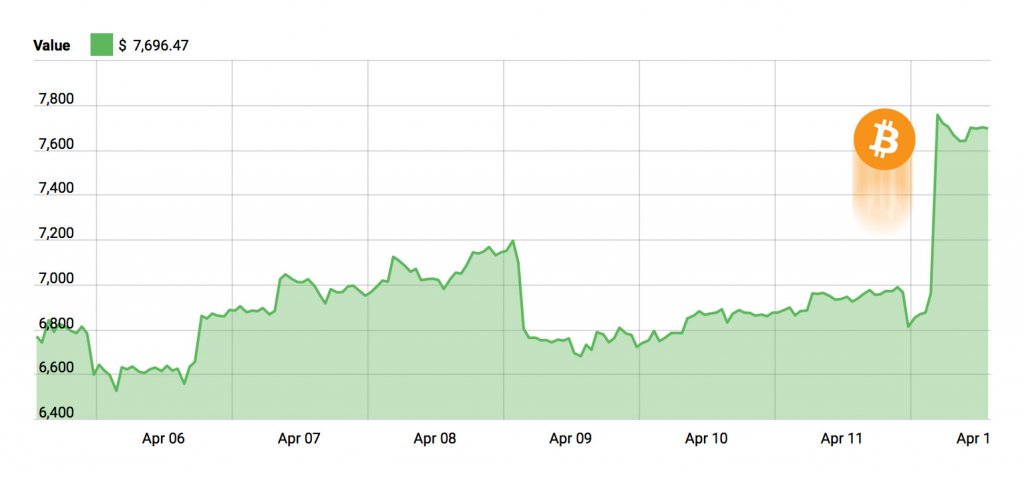

Cryptocurrency investors received an incredible shock today after seeing a double-digit spike in less than an hour.

After being on a downward trend since the start of the year, many are hoping for the end of the four-month-long bear market for Bitcoin and other cryptocurrencies.

https://twitter.com/iamjosephyoung/status/984396877201195008

Those keeping a close eye on BTC will have noticed the highly unusual, almost vertical swings in the market during the previous week. On April 7th, a 4.5% rise occurred over a period of three hours, followed two days later with the price plummeting 7% in just two hours.

While cryptocurrency markets are known for their high volatility and erratic behavior, this type of rapid price fluctuations are usually isolated to coins with smaller trading volumes.

Keeping in mind the current market cap of BTC is estimated at $130 billion, these kinds of shifts in Bitcoin’s value equate to millions of dollars worth of trades being bought and sold.

In fact, according to a tweet by @CryptoRae, Bitcoin had the highest one-hour trading volume in its history – $1.2 billion in a single hour.

Ready to have your mind blown? More Bitcoin traded hands in that one hour than *any other time in history*.

BTCUSD volume: ~$550M

XBTUSD volume: ~$635MThat’s $1.2 billion trading volume in one hour! pic.twitter.com/abnthbOq5n

— CryptoRae (@cryptorae) April 12, 2018

Institutional Investors Seeing New Value in Crypto Assets

Such a massive influx of capital is usually indicative of institutions entering the cryptocurrency market. Of course, this coincides with recent news of a wave institutional investment from George Soros and Venrock Venture Capital, a Rockefeller-based investment group.

It remains to be seen whether this truly is the end of the bear market for cryptocurrencies. However, with the recent OTC (over-the-counter) exchanges seeing “multi-billion dollar” volumes and P2P exchange portals across the globe seeing similarly large volumes, interest in the crypto markets remains strong.