Decred, a progressive cryptocurrency focused on governance, seems to have a natural connection to Bitcoin, as everything from its coin supply to price has followed Bitcoin’s ups and downs since 2014.

Decred has a deep relationship with Bitcoin

Bitcoin, the world’s first and largest cryptocurrency, has inspired thousands of digital assets, all of which were created to solve a particular set of problems.

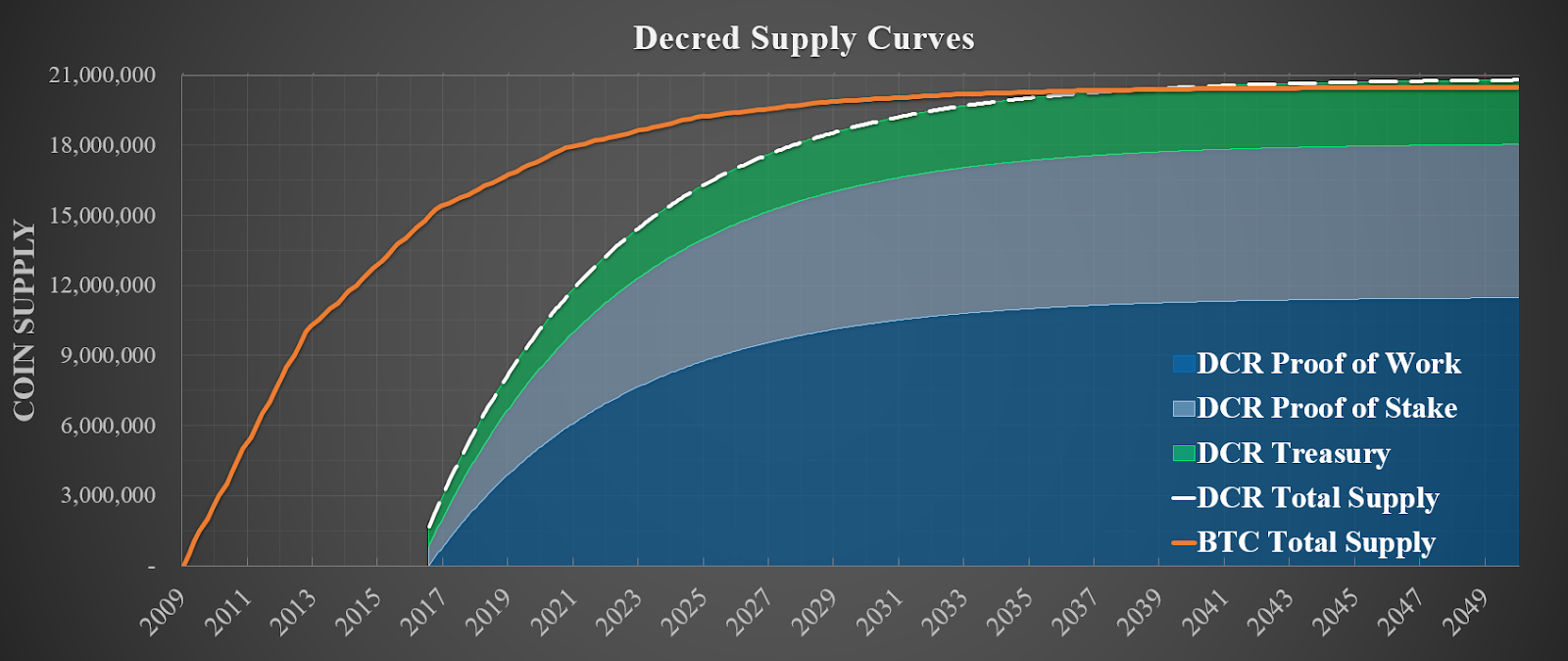

An abbreviation for “Decentralized Credit,” Decred is a hybrid system utilizing both a Proof-of-Work and Proof-of-Stake protocol. It was designed to solve the two largest issues Bitcoin has—scalability and governance. The main value proposition Decred brings is almost identical to that of Bitcoin—a maximum supply of 21 million coins and a deterministic supply schedule set by block height.

And while the coin was created to mirror Bitcoin in theory, data has shown that it also has a real-life relationship with Bitcoin. Checkmate, an on-chain analyst for Decred and ReadySetCrypto, pointed out that Decred has a Power Law relationship with Bitcoin.

The Power Law, sometimes referred to as the scaling law, is a term used to describe the functional relationship between two quantities. The law states that a relative change in one quantity results in the proportional relative change in the other quantity.

Where Bitcoin goes Decred follows

Previous research by Checkmate illustrated various other similarities between Decred and Bitcoin. With a deterministic supply schedule and the same maximum coin supply, Decred’s overall supply curve looks a lot like that of Bitcoin.

The data shows that the two coins should reach the same circulating supply in Q1 2038.

Apart from that, Decred’s stock-to-flow ratio follows the same set of values Bitcoin does. The ratio is traditionally used to measure the abundance of traditional commodities such as gold or silver and represents the amount of the commodity held in inventories divided by the amount of produced annually.

When applied to fixed-supply coins such as Bitcoin and Decred, the ratio is used as a measure of scarcity and value. The higher the ratio is the scarcer the asset is, and the more consistent the ratio is, the more resistant the asset is to inflation.

According to Checkmate, Decred has shown a statistically significant relationship between Stock-to-Flow and a market valuation that traverses the same set of stock-to-flow ratio as Bitcoin does.

But, despite the rock-solid data, market sentiment is still the strongest force driving the crypto market. Bitcoin is slowly becoming a household name, while Decred is the 38th cryptocurrency by market cap. Increased awareness and improved education are the push Decred needs to get into the big league.

Decred Market Data

At the time of press 2:51 am UTC on Nov. 7, 2019, Decred is ranked #39 by market cap and the price is down 0.88% over the past 24 hours. Decred has a market capitalization of $150.53 million with a 24-hour trading volume of $6.69 million. Learn more about Decred ›

Crypto Market Summary

At the time of press 2:51 am UTC on Nov. 7, 2019, the total crypto market is valued at at $217.29 billion with a 24-hour volume of $50.24 billion. Bitcoin dominance is currently at 66.20%. Learn more about the crypto market ›