Bitcoin is on the decline after an explosive two months. After seeing a drop of $61 billion, the crypto market may face years of a bear market, warns a Bitfinex whale.

Why is the sentiment around crypto bearish again?

After failing to test a major resistance level for Bitcoin at $10,500, the crypto market saw a significant pullback in a short time frame.

It lost $10,500, $9,550, and $9,000 in quick succession, three heavy multi-year support levels.

Whales like Joe007, one of the biggest Bitcoin traders on Bitfinex, have long warned traders against such a reaction to the downside, given the lack of organic demand and fiat inflow to support the Bitcoin upsurge in February.

Last week, the whale said:

“Would 2-3 years delay reaching new ATH be such a big thing, really?”

Long-term holders of Bitcoin are anticipating the crypto market to enter a correctional phase before another extended rally because it would provide the market with a stronger foundation to recover from.

A long accumulation phase, which the crypto market did not get with the recent rally, allows both retail traders and institutions to drive a stable fiat inflow into the market.

It allows for the creation of a strong foundation for a proper bull market, as seen in 2016.

Long-term fundamentals for BTC

While the block reward halving is not necessarily an optimistic short-term factor for Bitcoin, in the long-term, it will act as a driving factor for extended rallies.

Bitcoin depends on the supply and demand in the market primarily for its value. Hence, an argument can be made that events that impose a direct impact on the supply of BTC have the biggest effect on its price.

Eventually, as the Bitcoin price recovers with a solid foundation, it will lead to the outflow of BTC to alternative cryptocurrencies, leading a comprehensive crypto market upsurge.

Another key fundamental factor for BTC and the crypto market as a whole is the emergence of strictly-regulated trading platforms and custodians.

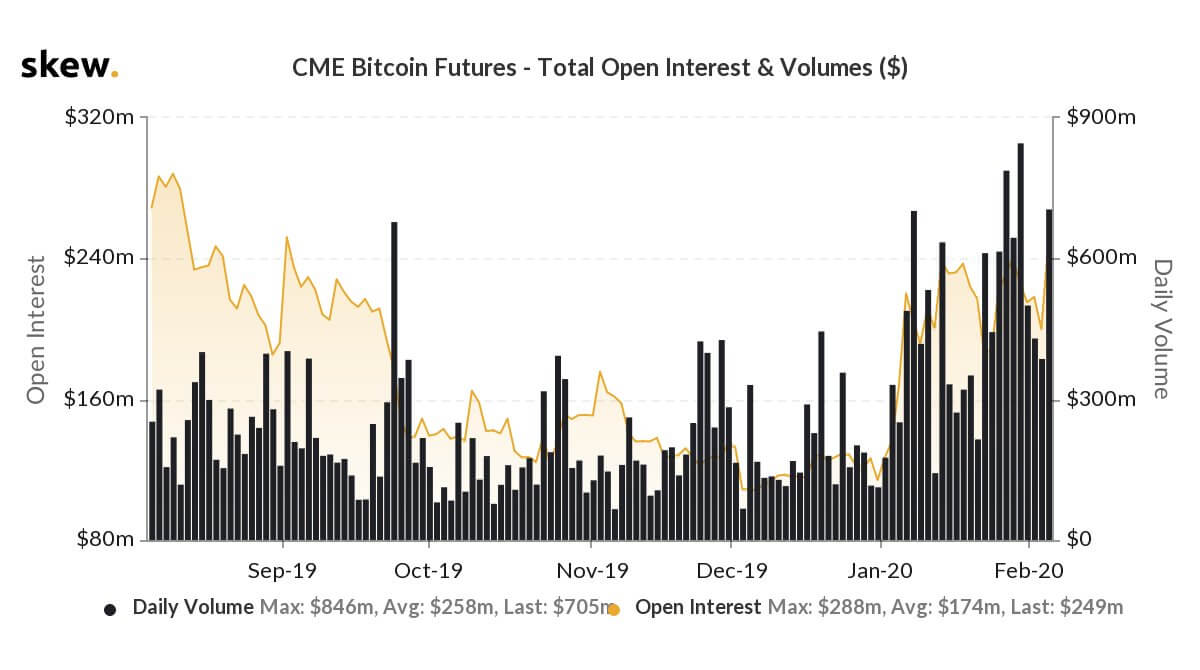

In the U.S., in particular, both accredited and retail investors a wide range of selections for exchanges and custodians, such as Coinbase, Gemini, CME, Bakkt, and LedgerX.

The diversity of trading platforms provide more competition in the crypto market, and encourage companies within the market to improve to provide an edge over its competitors.

In previous bull markets, one of the major issues was the lack of reputable and trusted liquidity providers.

In the last 18 months, the quality of custodians and exchanges has increased significantly with the entrance of key players.

Other factors such as hash rate remain as a consistent positive factor for Bitcoin.

“Despite BTC’s recent price drop, its hashrate has hit ATH and continues to climb,” said the Binance Research team.