Fear surrounding the lethal Coronavirus (COVID-19) has plagued the global markets, sending shockwaves across multiple asset classes that has led commodities, crypto, and equities to all post sizeable losses over the past several weeks.

New data from a prominent analytics firm elucidates an interesting trend when it comes to the correlation between the crypto market and discussion rates regarding COVID-19, with the inverse correlation between the two is a bearish sign for Bitcoin and other cryptocurrencies.

Despite this, one top analyst is noting that he believes the chaos caused by the virus will ultimately be bullish for the crypto market, as digital assets will provide investors with a way to escape the problems associated with the traditional financial system.

Crypto market performance inversely correlated with discussions surrounding Coronavirus

It has been a rough past several weeks for Bitcoin and the aggregated market, with the benchmark cryptocurrency plummeting from highs of $10,500 to lows of $7,700 earlier this morning.

This intense downtrend has come about in tandem with that seen by the global equities markets, which has posted some of its largest losses seen since the 2008 financial crisis over the past couple of weeks.

It is unclear as to whether or not the crypto market’s poor performance is directly correlated with that of the U.S. stock market, but it is clear that the Coronavirus is the primary suspect behind this turbulence.

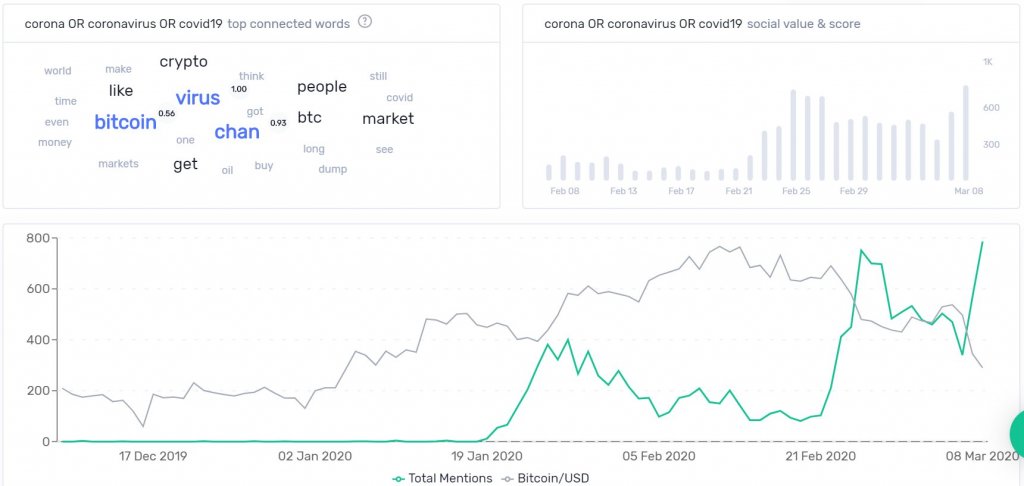

Recent data from blockchain analytics firm Santiment elucidates an inverse correlation between the crypto market’s performance and mentions of the Coronavirus on multiple social platforms – including Reddit, Telegram, Discord, and others.

“We brought up last week that our Emerging Trends platform is showing that there is a continued inverse correlation between the discussion rates of Coronavirus and COVID19, compared to the price of Bitcoin.”

Could a Coronavirus-induced recession ultimately be positive for BTC?

Although Bitcoin and most other cryptocurrencies have been firmly acting as risk-on assets over the past several weeks, it is imperative to keep in mind that one top analyst believes that the potential recession that is caused by the ongoing selloff will ultimately be a good thing for Bitcoin and crypto in general.

Crypto Michaël – a former full-time trader at the Amsterdam Stock Exchange – mused this possibility in a recent tweet, noting that the years ahead will be favorable to the nascent technologies.

“I’m starting to believe that the coronavirus is a scapegoat for the upcoming recession caused by the financial system’s irresponsible policies and boundaries. We might have some short-term sell-off on crypto markets, but I think it’s the years of commodities & Bitcoin.”

As hype and fear surrounding the Coronavirus continue spreading, the aforementioned data seems to suggest Bitcoin will see some continued downwards pressure in the near-term.

Bitcoin Market Data

At the time of press 9:29 am UTC on Apr. 25, 2020, Bitcoin is ranked #1 by market cap and the price is up 0.14% over the past 24 hours. Bitcoin has a market capitalization of $145.1 billion with a 24-hour trading volume of $44.14 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 9:29 am UTC on Apr. 25, 2020, the total crypto market is valued at at $227.16 billion with a 24-hour volume of $159.16 billion. Bitcoin dominance is currently at 63.89%. Learn more about the crypto market ›