Bitcoin’s recent price rise is attributed to the much-awaited halving event on May 12, but one metric suggests a sell-off is due if past samples are considered.

Metric close to previous levels but not “holy grail”

On-chain analytics provider Skew noted Bitcoin’s implied volatility indicator neared previous “sell-off” zones — specific instances where certain levels on the proprietary indicator were followed by a decrease in Bitcoin prices early this year.

Six weeks later, bitcoin implied vol is nearly back to its pre sell-off level pic.twitter.com/IaBHd9yWZC

— skew (@skewdotcom) April 27, 2020

The mentioned levels were previously seen in early-February, 2020, when Bitcoin briefly touched the $10,000 level but began a drastic 50 percent decline — from 18 February – 22 March — soon after. The indicator’s parameters led to sell-offs in October and November 2019, when Bitcoin went from approximately $10,000 to $8,000 and $8,800 to $7,000 respectively.

Interestingly, the same volatility levels in April 2019 were followed by an increase in Bitcoin prices, meaning the metric is not a singular indicator of drastic sell-offs.

However, Skew Analytics noted in a follow-up tweet:

However, skew remains positive. Will this be a structural parameter change? pic.twitter.com/5qvKo10Gxf

— skew (@skewdotcom) April 27, 2020

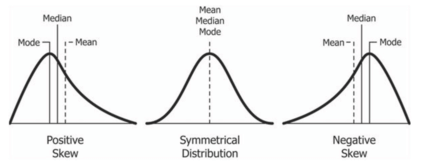

For the uninitiated, a “positive skew” in traditional finance is a statistical metric of outsized return with a low chance of huge risk for investors. Financial models, in theory, assume an asset’s distributions are centered around a particular “mean” value for that asset. Returns and risk remain conservative in such instances.

When “skew” is positive, an asset’s mean value shifts largely towards the “right” side of returns, as visualized in the chart below:

If Skew’s indicators are considered, the above implies Bitcoin remains in “positive” territory for investors; meaning a small chance — but significant in monetary value — of risk currently exists.

As an illustrative example, the aforementioned means there might be a 99 percent chance to gain $100, but a 1 percent chance to lose $10,000 (values not indicative of real figures).

Bitcoin whale becomes 5-year-holder

Despite the crypto market’s infamous volatility and various sell-off cycles, one “whale” has established themselves as a “HODLer,” if Fidelity Investments-backed CoinMetrics data is considered.

The Boston-based company tweeted on April 27:

A large #Bitcoin whale just graduated to a 5yr HODLer. Last week 68k BTC moved out of the 5yr active supply band, indicating that the last time they moved on-chain was in April 2015. pic.twitter.com/Jorx5TnlVn

— CoinMetrics.io (@coinmetrics) April 27, 2020

Data shows over 68,000 Bitcoin in an address tracked by CoinMetrics. At current market prices as per data on CryptoSlate, the digital holding is worth over $520 million – a mammoth figure. However, it is likely the Bitcoins could be held by a venture fund, miner, exchange, and not a single individual/s.

CoinMetrics did not respond to a mail requesting more insight on the above tweet at the time of writing.