The crypto market has been subjected to immense volatility throughout 2020, with Bitcoin plummeting to lows of $3,800 in mid-March before incurring an intense rebound that has since led it all the way up to highs of $9,500.

It appears that this immense volatility — and especially that seen throughout the past couple of days – has sent crypto traders into hiding, as the benchmark cryptocurrency’s open interest has been diving while traders flee BitMEX.

This occurrence is likely to favor bulls in the near-term, as the majority of spot traders tend to lean towards taking more passive positions, meaning that the crypto’s volatility may soon subside as it enters a stable mid-term uptrend.

Bitcoin open interest craters as traders flee crypto market

Active margin traders have been subjected to multiple unprecedented movements in recent times that have cost the majority of them large sums of capital.

The meltdown in mid-March created a cascade of liquidations on BitMEX, leading traders in long positions to rapidly be liquidated as buying pressure all but evaporated.

Trading on the popular platform was then shut down temporarily due to a reported “hardware flaw” – although some have speculated that the liquidations would have continued pushing Bitcoin lower had BitMEX not halted trading.

Although there are many other platforms besides BitMEX, the effects this occurrence sent shockwaves across all exchanges, even leading Bitcoin’s spot price to drop towards $4,000 for a short amount of time.

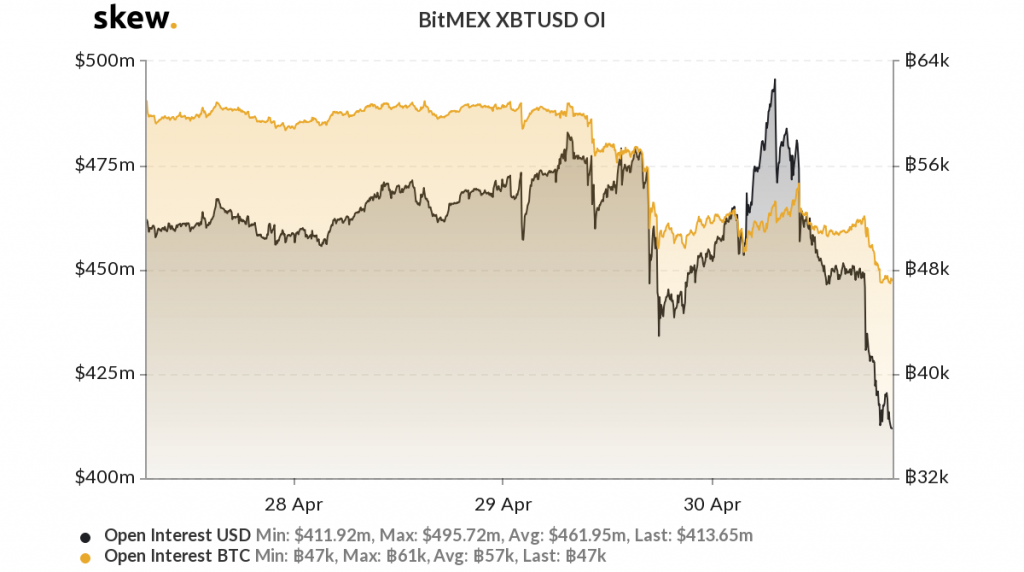

In the time following this movement, the cryptocurrency’s open interest dived before stabilizing around the $500 million level until yesterday, when Bitcoin’s rapid rise to highs of $9,500 liquidated another over $100 million in short positions.

This led BTC’s open interest to decline towards $400 million, a sign that traders are fleeing the crypto market for the time being.

Recent liquidation imbroglio sparks exodus away from BitMEX

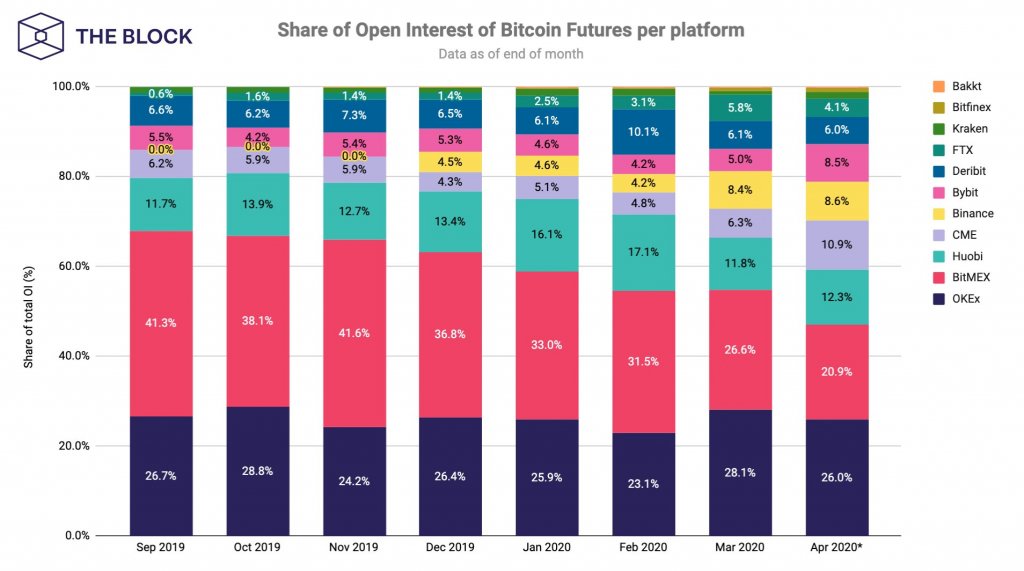

Part of the reason why Bitcoin’s OI on BitMEX has been declining is because the platform is seeing large BTC outflows as it loses its market share.

Larry Cermak – the director of research at The Block – spoke about this trend in a recent tweet, explaining that the crypto trading platform lost 50 percent of its market share in the time since November of 2019.

“BitMEX has been drastically losing market share in the last 6 months. By the end of November, BitMEX had 41.6% of the total open interest and now only less than 21%. So they lost ~50% of their market share now. Eventually if you don’t innovate, you will be overtaken.”

If the crypto market’s mid-term trend is governed more by retail investors than by margin traders, this could lessen the volatility and help increase the sustainability of its future uptrends.

Bitcoin Market Data

At the time of press 10:36 pm UTC on Apr. 30, 2020, Bitcoin is ranked #1 by market cap and the price is up 1.1% over the past 24 hours. Bitcoin has a market capitalization of $163.01 billion with a 24-hour trading volume of $68.55 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 10:36 pm UTC on Apr. 30, 2020, the total crypto market is valued at at $247.85 billion with a 24-hour volume of $233 billion. Bitcoin dominance is currently at 65.61%. Learn more about the crypto market ›