Bitcoin’s intense uptrend seen in the time following its mid-March meltdown has allowed it to put some significant distance between its current price and its recent lows, nearly erasing all of the losses that were incurred in the time following its late-February downturn.

The latest push higher has allowed BTC to reclaim its position within a key logarithmic growth scale that it had previously dropped below, with this opening the gates for it to see significant further upside.

This comes as data shows that the cryptocurrency’s recent uptrend was driven primarily by retail investors, a sign that it may prove to be highly sustainable.

Retail buyers step up and propel Bitcoin past $9,000 as bullishness grows

Bitcoin is currently trading up just up 3.5 percent at its current price of $9,122 – marking a notable climb from daily lows of $8,700 and only a slight decline from highs of $9,200.

One trend to be aware of that could bolster the crypto’s price action in the near-term is that its recent uptrend has been driven primarily by spot buying pressure.

This is in stark contrast to previous uptrends that have been driven by traders employing high leverage to open long positions, with the cryptocurrency reeling lower once these positions are closed.

Mohit Sorout – a partner at Bitazu Capital – explained in a recent tweet that the decline seen in Bitcoin’s open interest on platforms like BitMEX shows that margin traders are largely fleeing the market.

“Bitmex OI hits a new All Time Low. This btc rally was purely a spot dominated ripper. Incredible.”

BTC recaptures key growth curve; signaling cycle highs of $23,000 could be imminent

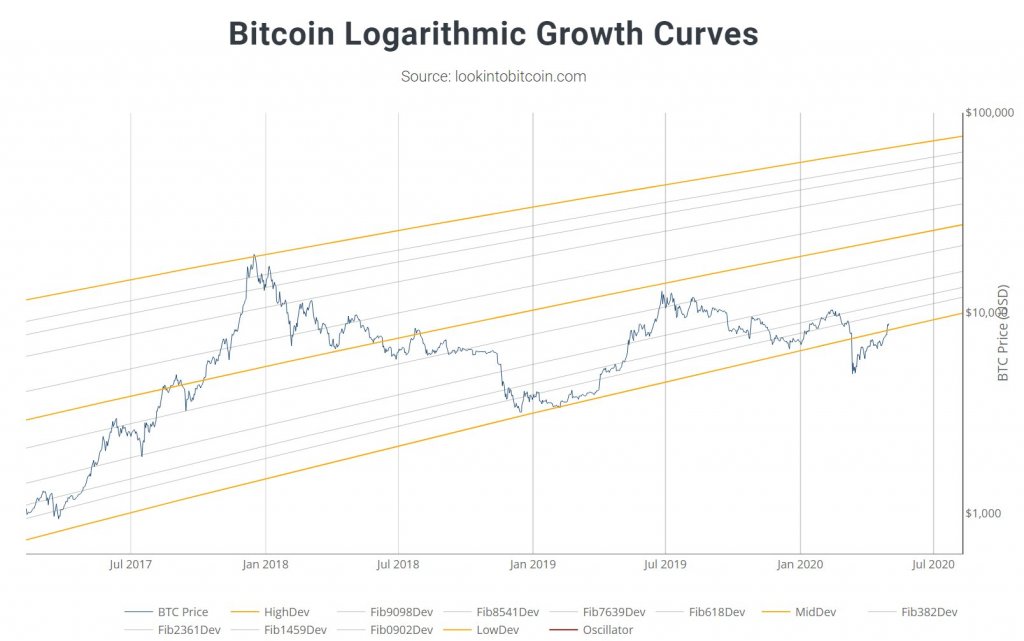

This latest leg up has allowed the benchmark crypto to move back into a long-established logarithmic growth curve.

The median of this curve sits at $23,000, which means that this could be the level that Bitcoin’s bulls will target next.

Josh Olszewicz pointed to BTC’s recapturing of this level in a recent tweet, offering a chart showing that the median of this curve rests at $23,000 while its upper boundary sits at just under $100,000.

“BTC back in the log growth curves. median = $23k.”

The combination of recapturing this key range coupled with the potential sustainability of this rally seems to suggest that the crypto could be poised for a notable upside in the weeks and months ahead.

Bitcoin Market Data

At the time of press 6:38 am UTC on May. 3, 2020, Bitcoin is ranked #1 by market cap and the price is up 2.5% over the past 24 hours. Bitcoin has a market capitalization of $167.04 billion with a 24-hour trading volume of $44.44 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 6:38 am UTC on May. 3, 2020, the total crypto market is valued at at $254.6 billion with a 24-hour volume of $150.46 billion. Bitcoin dominance is currently at 65.64%. Learn more about the crypto market ›