Bitcoin’s intense strength seen throughout the past several days and weeks showed some signs of degrading today. This comes after BTC shed over $20 billion off of its market capitalization during its sharp $2,000 decline seen yesterday evening.

The benchmark cryptocurrency is now flashing some signs of immense short-term bearishness, as indicated by a few key technical indicators.

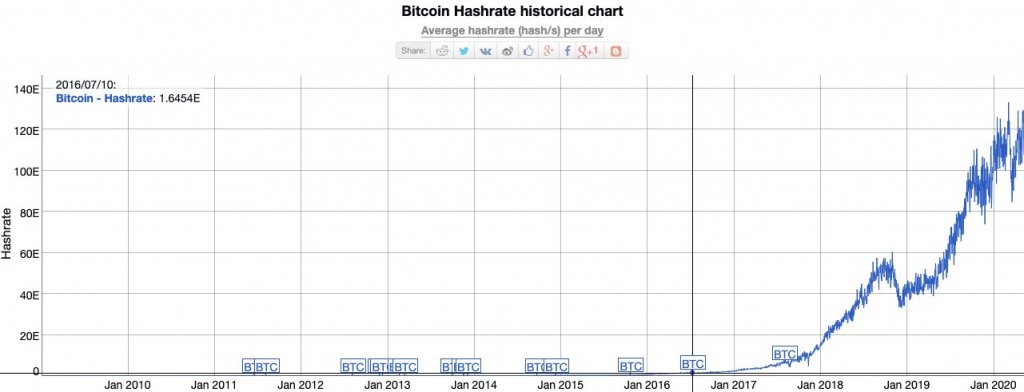

The long-term outlook for the cryptocurrency remains incredibly bright, however, and its development from a fundamental perspective in the time since its last halving event in 2016 is clearly elucidated by its hash rate’s parabolic growth.

Fundamental analysis shows Bitcoin could see further weakness in the near-term

Bitcoin’s price action seen throughout the past 24-hours has been overtly bearish, as the cryptocurrency cratered by nearly $2,000 yesterday after multiple failed attempts to break above the $10,000 level.

This overnight movement was quite surprising, as BTC was previously showing signs of stability and strength as it methodically pushed higher each day.

It now appears that $8,400 has become a key short-term support level, as BTC has posted a notable reaction to this level on a few occasions throughout the past day.

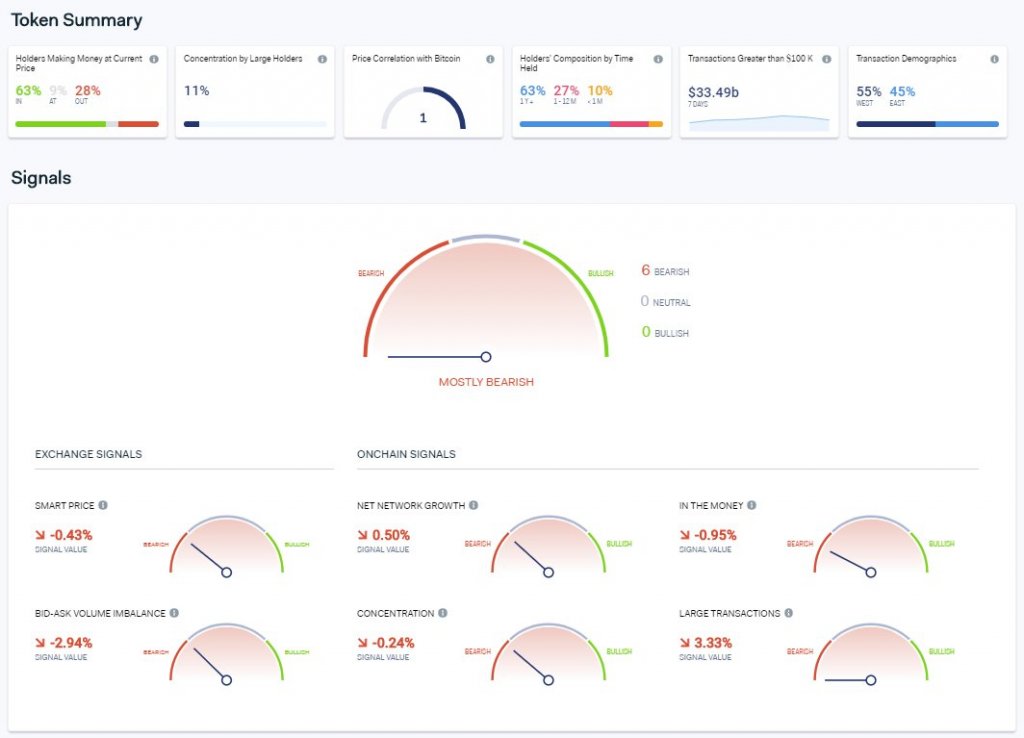

Degrading short-term fundamental strength may be enough to push the crypto below this level, however, as data from the blockchain data visualization tool IntoTheBlock indicates that a few key factors are elucidating some underlying weakness.

“With just two days left for the Bitcoin Halving, our actionable signals indicate a Bearish Momentum. Why? – The Network is not growing as fast as before – Less accumulation by large holders – Less % of addresses in the money – Large transactions (>$100k) were also decreasing.”

As the crypto’s weekly candle close fast approaches, how Bitcoin trends in the coming several hours should offer investors with insight into where it will trend in the time surrounding its imminent halving event.

BTC’s long-term fundamental outlook is incredibly bright

Despite showing some short-term signs of weakness, it is imperative to note that the cryptocurrency’s long-term fundamental outlook is incredibly bright.

This can be seen while looking towards Bitcoin’s surging hash rate, which just recently hit fresh all-time highs – marking and 8,100 percent increase in the time since the prior BTC halving in 2016.

Samson Mow, the CSO of Blockstream and the CEO of Pixelmatic, explained in a recent tweet that this massive hash rate growth signals that miners are “very bullish.”

“Bitcoin’s hashrate has increased over 8100% since the 2016 halving. We were at ~1.56 Exahash at the 2016 halving. Today we are at ~127 Exahash. Miners are very bullish on BTC.”

This macro fundamental strength is likely to give Bitcoin a serious boost in the years ahead.