Bitcoin’s recent uptrend has come about largely at the expense of smaller digital assets, as many altcoins have posted a severe underperformance of BTC as investors grow increasingly keen on finding assets that can perform well given the current global economic situation.

Some major cryptocurrencies are even trading at price levels not seen since 2014 while looking towards their BTC trading pairs.

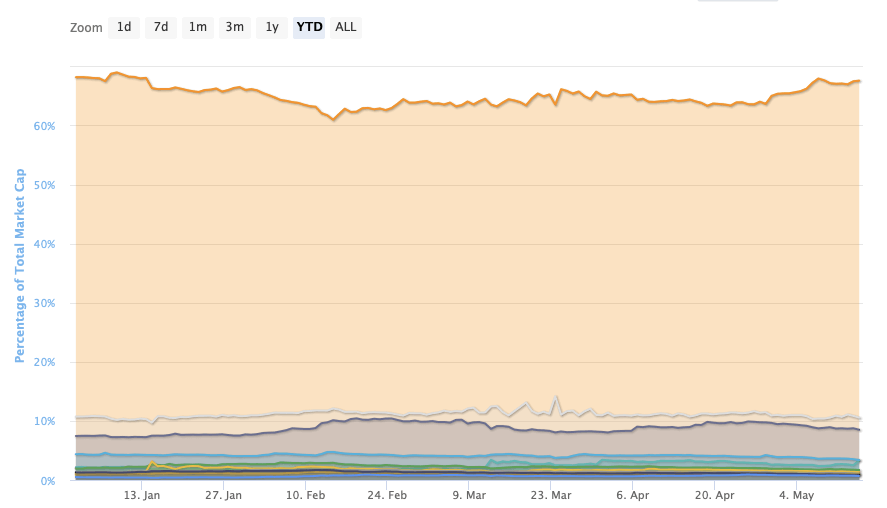

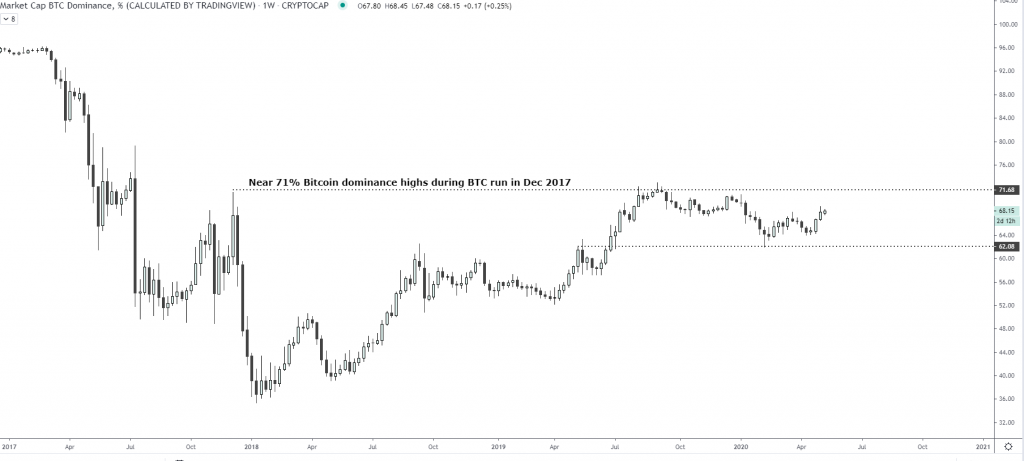

This has in turn led Bitcoin’s dominance over the crypto market to rise sharply in recent times, and one analyst is now noting that it may have to decline by 8 percent in order for altcoins to begin garnering upwards momentum.

Altcoins severely underperform Bitcoin as traders flock to liquidity

The ongoing economic crises seen across the globe has led investors within all markets to flock towards quality and liquidity.

In the case of the crypto markets, this has led to an exodus away from altcoins and towards Bitcoin.

Many major cryptocurrencies – including Ethereum and XRP – have gravely underperformed the benchmark digital asset throughout the past several weeks.

This trend is elucidated while looking towards Bitcoin’s dominance over the market, which currently sits at 67.4 percent. This marks a notable climb from mid-February lows of just under 60 percent that came about at the peak of the market.

Ever since then, this trend has firmly reversed, and Bitcoin now has the highest dominance over the crypto market seen since 2019.

One pseudonymous trader on Twitter named “Pentoshi” spoke about the poor performance altcoins have seen against BTC in recent times, noting that many are trading at levels not seen since 2014.

“ETH heading for levels not seen since 2016. LTC trading below 2014-2016 prices. XRP heading for levels from 2014, 2016, and 2017. The alt market looks like it could capitulate soon.”

Here’s how low BTC’s dominance needs to decline for altcoins to rally

Josh Rager – another well-respected cryptocurrency analyst on Twitter – explained that he believes Bitcoin’s dominance needs to decline towards 60 percent before altcoins can rally.

“BTC dominance has remained between 62% to 72% since June 2019. Before the next altcoin rally, would like to see a sharp move back down to low 60%. But if Bitcoin can get a close above $10,500 – would likely cause money to flow into BTC leading to increase in dominance.”

Whether or not investors continue treating Bitcoin as a safe haven asset could also play a role in where its dominance over the market trends, as this could perpetuate the ongoing exodus away from altcoins.