The introduction of Bitcoin futures to the CME has given professional traders, leveraged funds, and institutional investors a great gateway to gain exposure to the benchmark crypto.

Prominent investors like Paul Tudor Jones have already admitted to using futures to gain long-term exposure to the benchmark digital asset, and watching the trends seem surrounding volume and open interest on the platform can offer valuable insights.

Newly released research now suggests that there is actually a myriad of large investors who are getting involved within the crypto market, with this trend gaining steam in the time following Bitcoin’s recent crash to $3,800.

CME gains greater share of crypto market’s open interest

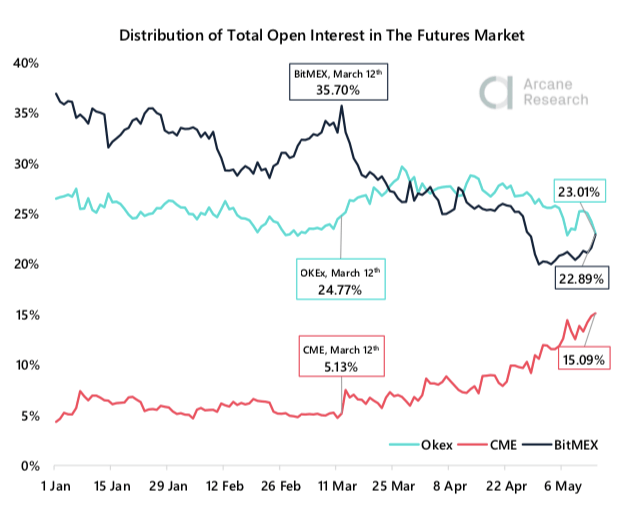

According to a recently released report from Arcane Research, the CME has been gaining increasing market share over the aggregated crypto market’s open interest.

Currently, the CME accounts for 15 percent of the market’s total open interest.

This number has grown significantly in the time following the mid-March meltdown, as open interest on the regulated platform previously only accounted for roughly between 4 and 8 percent of the crypto market’s total OI.

“CME currently accounts for 15% ($499 million in real terms) of the total open interest. The CME OI fluctuated between 4 -8% prior to the March crash, but the crash marked a visible trend shift as CME has been gaining market shares ever since.”

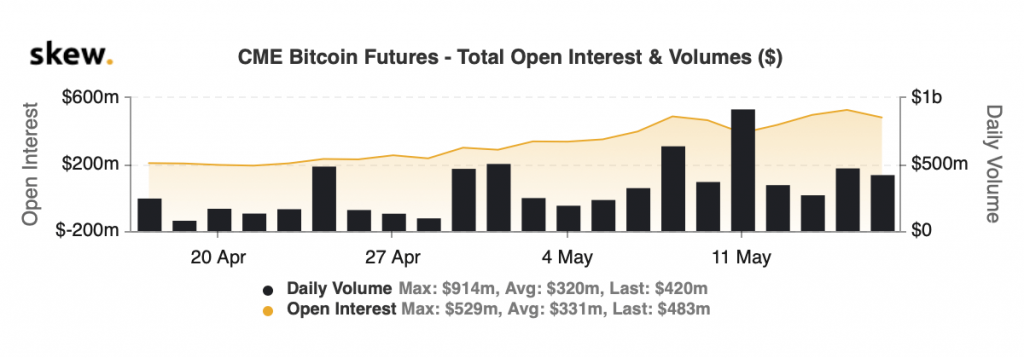

It also appears that the majority of those speculating on Bitcoin on the CME are taking long-term positions, as seen by the divergence between open interest and trading volume on the platform – per data from the research platform Skew.

This CME trend points to heavy institutional involvement

Arcane Research concludes that this growth indicates that professional traders – as well as individuals like Paul Tudor Jones – took the recent price crash as an opportunity to gain low-cost exposure to Bitcoin.

“This growth may indicate that professional money managers have loaded up on bitcoin following the market crash, seeking to allocate cash into a provably scarce asset class.”

It also comes as many crypto traders flee platforms like BitMEX – with the recent cascade of liquidations sparking immense distrust of centralized trading platforms.

The report notes that after deducting the estimated $75 million worth of Bitcoin futures that Paul Tudor Jones holds, there is still $400 million in open interest on the CME, showing that other institutions and large players are heavily involved in the crypto market.

“This still leaves more than $400 million worth of open interest held by other investors, indicating that Paul is not the only investor dipping their toes into this inflation hedge.”