Ask anyone about Bitcoins or the broader cryptocurrency market, and they are likely to call it thin air, manipulative, or even rat poison.

But recent events in the U.S. equities and futures market are showing stocks are not protected from sudden market downside, seemingly moving up and down with political tweets being the only market catalyst.

Making the above possible is U.S. President Donald Trump — moving the markets in 280 characters or less.

“Deal is dead”

In the late hours of June 22, White House trade adviser Peter Navarro said the China trade deal “is over” because of how China informed the U.S. about coronavirus.

UPDATE: Stock futures rebound from 430+ point drop after Peter Navarro says his comments about the China trade deal being “over” were about “the lack of trust” with China. Navarro added: “Phase one remains in place.” https://t.co/32oxbWlmpq pic.twitter.com/5kPRsGuLnP

— CNBC Now (@CNBCnow) June 23, 2020

The U.S-China trade deal is a long-ongoing standoff between the two superpowers. It started back in 2018, after Trump said he would increase tariffs and implement new cross-border regulations on imports and exports originating from China. The latter answered with its own set of policies and growth-stifling measures.

Aside from the macro-economic implications of the above, the U.S. stock market, in particular, the SP-500 and other popular futures products have fluctuated widely in the past year. This has, in turn, led to previously unseen levels of volatility.

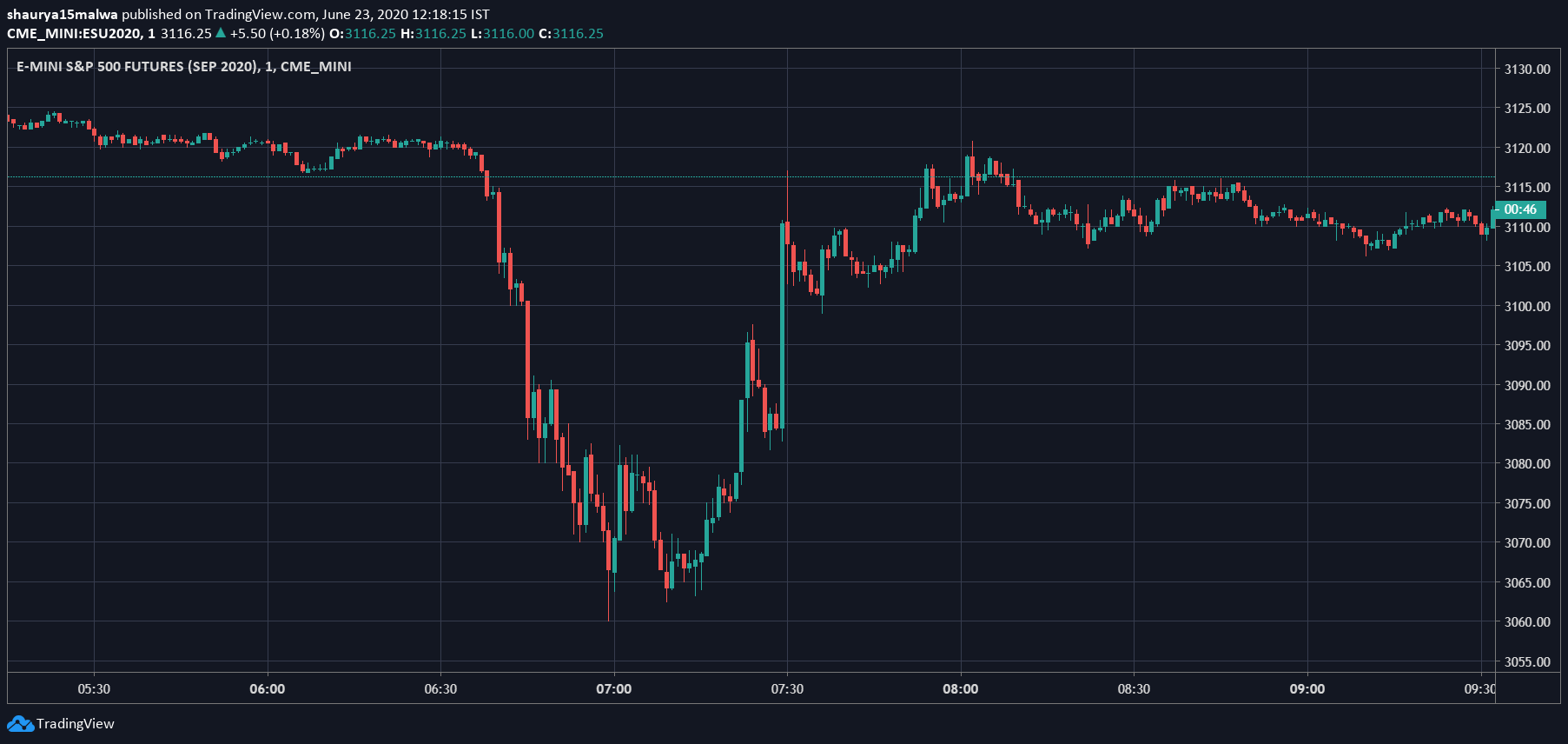

After Navarro’s statements in the morning, the SP-500 tracking e-mini ES futures dropped over 54 points in just 30 minutes. Each point is worth about $50, meaning a trader could have netted over $2700 using a single ES contract.

But Trump’s tweet came in right after the drop, similar to previous drop occasions:

The China Trade Deal is fully intact. Hopefully they will continue to live up to the terms of the Agreement!

— Donald J. Trump (@realDonaldTrump) June 23, 2020

The tweet immediately pumped the market upwards, sending it to prior-drop levels. In just one hour, the futures market both created and took away billions of dollars in notional value — all with just two tweets.

The below chart shows the market activity in the ES e-mini product:

Needless to say, people were not amused with the proceedings, with many taking to Twitter and calling the market a “big manipulation,” among other slurs.

Crypto markets = financial markets

Bitcoin, and most other large-cap tokens, have remained stable for the most part since April and is emerging as a global hedge as financial turmoil and political instability ensues.

The traditional market’s volatile activity, as mentioned-above, catalyzed with mere tweets instead of official White House releases have led managers like Paul Tudor Jones and Paul Britton to consider Bitcoin and gold ahead of bonds and other traditional products.

Raoul Pal of Real Vision expressed a similar sentiment earlier this month:

Bond yields are about to sound the fire alarm for The Insolvency phase and the end of The Hope phase. Bond yields are the truth. Keep an eye on this… pic.twitter.com/LuQKVZgwPP

— Raoul Pal (@RaoulGMI) June 12, 2020

Britton, as CryptoSlate reported earlier, manages over $22 billion of client assets. He said in May that bonds were no longer an attractive proposition for investors, and the decentralized nature of cryptocurrencies made them an attractive choice.

The stability in the crypto market has not gone unnoticed. Ethereum co-founder Vitalik Buterin was forthcoming in this regard, tweeting earlier in June:

What we expected: cryptocurrency would normalize and become more like the stock market

What happened: the outside world went crazy and the stock market became more like cryptocurrency— vitalik.eth (@VitalikButerin) June 12, 2020

Overall, Trump’s tweets, the market reaction, and subsequent public reaction might lead more participants to the cryptocurrency industry. Perhaps even helping the latter to shed its widespread manipulative image.