Bitcoin, and the cryptocurrency market, has largely traded in a tight price band since an initial rise in early-2020.

Fund managers have taken note and are actively considering BTC as a hedge against global markets. In fact, the traditional markets are, as Ethereum’s Vitalik Buterin puts it, turning into what the world thought crypto-markets would be.

What we expected: cryptocurrency would normalize and become more like the stock market

What happened: the outside world went crazy and the stock market became more like cryptocurrency— vitalik.eth (@VitalikButerin) June 12, 2020

But the stability will soon disappear as profit-seeking retail traders set their eyes on Bitcoin, bringing with them a surge in price volatility, a fund strategist believes.

Profit hunters to prop Bitcoin price

Matt Maley, the chief strategist at Miller Tabak + Co, says Robinhood traders will soon seek opportunities in the Bitcoin market, once their infatuation with traditional stocks and options wanes off.

Traditional markets have seen unprecedented volatility in recent times across products like futures and equities. Many say, retail traders—perhaps some even spending their stimulus checks—are fuelling a surge in U.S. markets, one that does not mirror real-world concerns like unemployment or economic contraction.

? 14.7 million Americans are still out of work. Coronavirus infections are rising at an unprecedented rate. ?

Until this crisis is over, we must:

?Provide $2,000 a month per person

?Ensure medical care without cost

?♀️Guarantee workers’ wages

?Extend unemployment benefits— Bernie Sanders (@SenSanders) July 2, 2020

But their boredom could eventually drive Bitcoin up. Quick profits are unlike long-term investing, and retailers are likely to rush in when BTC shows signs of an upwards trend.

Speaking of the retail mindset, Maley adds:

“They’re playing in another sandbox right now, but they’re keeping their eyes on all the other sandboxes because they know that something like Bitcoin can make them a big profit very quickly.”

Talking to Bloomberg, Maley said Bitcoin’s Relative Strength Index (RSI)—a mathematical measure of overbought or underbought conditions—is at a neutral point of 48.5.

Bitcoin is known for its sudden moves, even if not all end in ecstasy. In March 2020, the pioneering digital asset fell over 45 percent in two trading sessions for no fundamental reason.

Some funds were liquidated and faced legal notices from clients, as CryptoSlate reported at the time.

Reviving bankruptcies and Bitcoin

Maley’s thoughts come after Robinhood traders were quoted by mainstream media outlets in the past month for piling into bankrupt companies like Hertz—driving it’s stock price up by 30 percent in under a week.

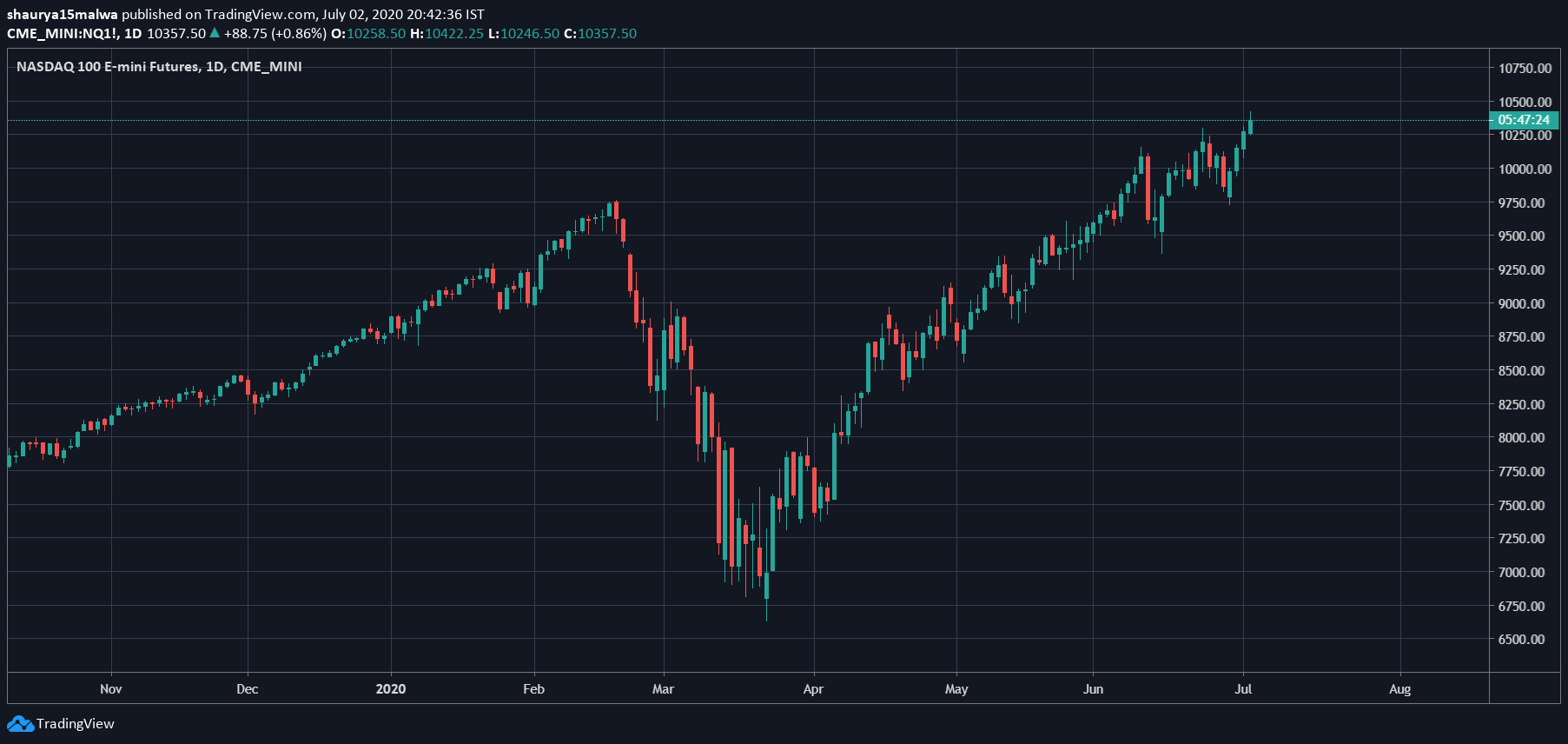

Their actions may have led to the revival of indices like the SP-500 and Nasdaq-100 as well, with the latter posting all-time highs even as the long term outlook remains grim.

Bitcoin is up over 30 percent for the year. Other relatively unknown tokens like Compound’s COMP are up almost 300 percent, driven by a recent boom in DeFi protocols.

For option trading subreddits like r/wallstreetbets, the above is a boon. The forum almost exclusively trades options on Robinhood—and while speaking about crypto is “forbidden” in the sub’s rules—the traders might check out BTC options if a profit opportunity presents.

Why is there so much outrage with Hertz? For the first time in a long time, it is using the market as it is meant to: to raise capital.

Because it’s selling garbage stock? WeWork almost pulled it off.

— WallStreetBets (@wallstreetbets) June 13, 2020

Benn Eifert, the managing partner of QVR Advisors, believes there’s an overlap between the “Robinhood types” piling into shares of bankrupt companies and those who purchased crypto in 2017.

“It’s a social media-like dynamic,” he told Bloomberg, adding that “influencers” point out some pretty-looking charts and give out a market call causing “many people [to] pile in.”