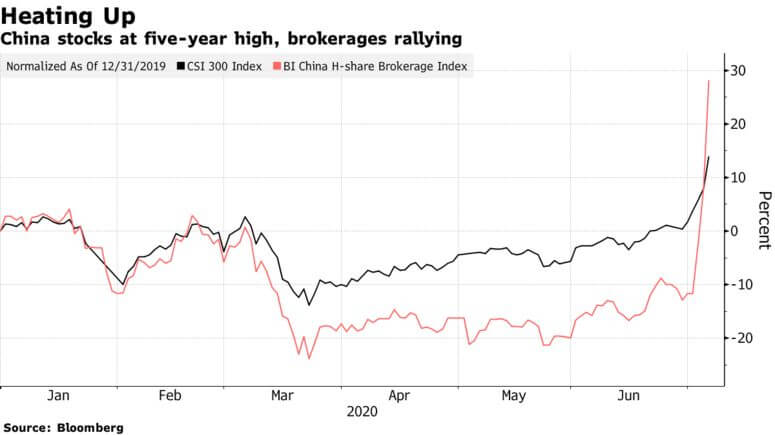

Dramatic moves in Chinese stocks over the past week are causing analysts to draw comparisons with 2015’s bubble.

Reports state retail traders across China are actively searching for high-risk, high-returns in traditional assets. As a consequence, however, this may cause upward movement in the crypto markets, say observers.

A “healthy bull market”

Driving the action in Chinese equities is low-interest rates and Robinhood-like investment products. SCMP noted Monday the government is also pushing for a “healthy bull market” as scrips see green.

Chinese stocks increased 5 percent on aggregate this morning; with tech, healthcare, and other dominant large-caps leading gains.

The revered China Securities Journal even posted a full-page ad stating stocks are more important than ever in a post-pandemic environment. Sources add the term “open a stock account” is trending on both WeChat and Baidu.

Leverage offered by Shanghai and Shenzhen bourses is now half of its pre-bubble multiples. Chinese banks, the report suggests, are also withdrawing funds from the broader financial system to prevent a bank run and an eventual yuan deflation.

This is to prevent a $5 trillion bust-repeat of 2014-2015. At the time, Chinese stocks were at record levels, with several billion-dollar IPOs attracting widespread media attention.

As CryptoSlate reported last week, China is already touting checking large financial transactions as part of its digital yuan program. The latter is set for a 2022 launch closer to the Beijing Winter Olympics.

“Bode well for crypto”

China’s a major part of the global digital currency and blockchain ecosystem, even as the country shuns Bitcoin and the broader altcoin market.

Its digital yuan project is among the largest CBDC rollouts in the world, while the BSN— which recently onboarded Chainlink—and Hainan’s “blockchain hub” initiatives remain the more prominent government-backed blockchain initiatives.

Seeing the recent rise in a Chinese Index product, crypto quant fund Amber Group tweeted on June 6:

FTSE China A50 Index at new ATHs, surpassing 2015 mania levels. As a proxy for risk sentiment in China, this could bode well for crypto. pic.twitter.com/eESrwITAGo

— Amber Group (@ambergroup_io) July 6, 2020

Three Arrows Capital CEO Su Zhu echoed the thoughts, stating:

“If you think Chinese A-shares breaking all-time highs is bearish for anything in crypto aside from bears’ ability to pay rent next month, phew.”

Ex-Messari product lead Qiao Wang tweeted in a similar vein:

This is a major development. China just shilled its stock market in front of 1.4B people on national television. The risk-on sentiment might spill over to crypto. I’m reducing my shitcoin shorts and adding Defi longs. https://t.co/6uddvRp3Sb

— Qiao Wang (@QWQiao) July 6, 2020

However, not everyone is on board with a bullish sentiment.

Primitive Ventures’ Dovey Wan, known for her detailed takes on the Asian crypto markets, said the market cap of Chinese A-shares surpassed a staggering $10 trillion USD for the first time since 2015.

Last month, Wan suggested dull crypto markets might cause retail traders (generally speaking) to seek volatility in traditional assets. And considering today’s surge in China, cryptocurrencies may end up “even more dull:”

Chinese A shares rallies so hard and total mark cap surpasses 10 trillion USD first time since 2015 today, absolutely printing

This will further suck in retail capital into equity market (both are 80% or more retail in China) so makes crypto market even more dull https://t.co/7s4MPWVJR1

— Dovey 以德服人 Wan ?? (@DoveyWan) July 6, 2020

Regulated or not, Bitcoin (and the broader crypto sector) remains heavily dominated by Chinese entrepreneurs and investments. More than 60 percent of the Bitcoin’s hash rate originates from the country, with one ex-regulator even calling it a “commercial success.”